Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Low demand could see 20% European gas price fall in summer 2024 compared to current projections

Wood Mackenzie report also says markets could be tighter than expected in 2025

2 minute read

European gas prices are set to fall 20% by mid-2024, compared to the current forward price curve, despite the market recent tightening due to the extensions of gas field maintenance schedules in Norway and strikes at key Australian liquefied natural gas (LNG) fields according to a new report by Wood Mackenzie.

The report ‘Short-Term Outlook – Europe Gas’ states that despite the current market pressures, the European gas sector looks set to see a fall in gas demand that will have a knock-on effect for prices next year. Factors including storage reaching as high as 96% levels at the end of October as well as a softening of demand for gas in the power sector, could see prices falling 20%, or $4 per million British thermal units (MMBtu), by next summer, compared market expectations in the current forward price curve.

“The Norwegian maintenance schedule being extended could have had a serious impact if storage levels were not so high,” says Mauro Chavez, Research Director, European Gas and LNG markets at Wood Mackenzie. “And while the strikes in Australia will ripple across the global LNG market, it is more likely they will be short-lived, limiting the implications on Asian and European market balances.”

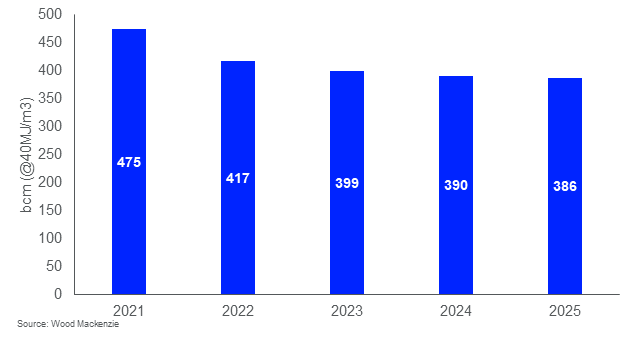

Europe Gas demand*

*excluding Turkey and Ukraine

The report forecasts a further reduction of 9 bcm in overall gas demand in 2024 (or 2.2% year-on-year), mainly materialising in the power sector. Gas in power is expected to decline by 12% year-on-year in 2024, a similar decline to that of 2023, caused by an increase renewable capacity, improved nuclear performance and still relatively weak electricity demand. The anticipated rebound in industrial and residential demand will also fail to fully materialise, given challenging economic factors.

The view of a well-balanced European markets and downside on prices for 2024 relies on a normal-weather assumption for winter 23/24 and summer next year. Weather will play a key part on how markets will balance, with the report warning that an extremely cold winter in Europe would witness additional demand of more than 20 billion cubic metres and see gas storage levels fall to 26% by March 2024, risking Europe to fail in achieving its 90% storage target, resulting in substantial upward pressure on prices. However, forecasts of an El-Niño year suggest there is now a higher change of a warmer-than-average winter across Asia and Europe, which risks putting further downward pressure on prices.

However, the report predicts that the market will tighten once again in 2025.

“In 2025, the European gas balance will get tighter due to Russian imports through Ukraine stopping as the transit agreement expires,” Chavez says. He added “the market anticipates a big drop in prices in 2025 on the expectations that more LNG supply will be available. However, we think this is overplayed as it will take time for supply to ramp up, while LNG demand in Asia will increase”. The report anticipates less LNG availability for Europe in 2025, compared to 2023/4, with storage levels reaching 90%, a lower level compared to previous year, putting pressure on prices.

Editor’s Notes

Wood Mackenzie’s new global conference Gas, LNG and the Future of Energy 2023 is where the industry comes together from 14-15 November in London to discuss the different market, investment and corporate dynamics shaping it, and the role of gas in supporting the energy transition.