Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Neptun Deep FID signals Romania’s arrival as major EU gas player

Offshore Black Sea project will make Romania EU’s largest gas producer

2 minute read

The final investment decision to approve the US$4.4 billion (EUR4 billion) Neptun Deep gas development in the Black Sea is a defining moment for Romania’s energy sector and will make it the EU’s largest gas producer according to a report by Wood Mackenzie, a global insight business for renewables, energy and natural resources.

The long-awaited decision to greenlight the giant offshore field development by the 50/50 partners in the scheme, OMV Petrom and the state-owned Romgaz, will now go to the National Agency for Mineral Resources (NAMR) for regulatory endorsement. It is the first deepwater project in Romania’s Black Sea sector and will be Europe’s largest upstream final investment decision (FID) of the year.

“Neptun Deep comes at a vital time as the EU looks for greater energy security due to Russia’s ongoing war against Ukraine,” Ross McGavin, Senior Upstream Research Analyst for Wood Mackenzie says. “However, the real breakthrough has come from Bucharest, after the Romanian government made some investor-friendly reforms to its controversial Offshore Law.”

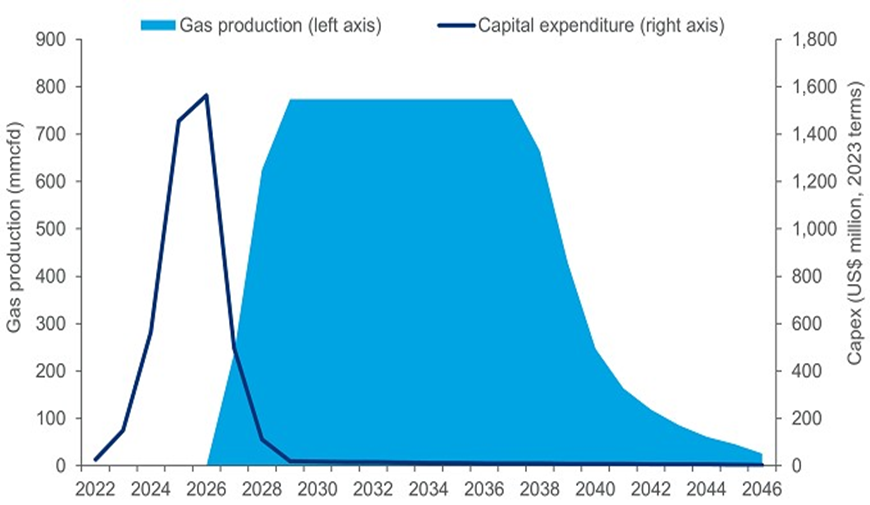

Neptun Deep production and capex

Source: Wood Mackenzie Upstream Service

“The reforms reintroduced tax stability for Romania’s Black Sea projects, but there is no guarantee that regulatory volatility will be avoided in future, as shown by Romania’s current producer gas price cap,” McGavin adds.

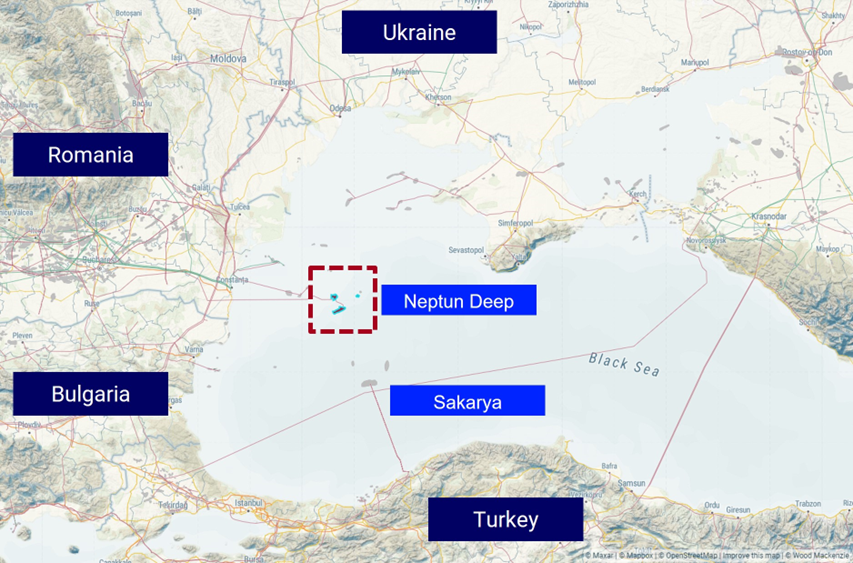

Neptun Deep involves the development of the Domino and Pelican Sud fields and is expected to start production in 2027. With 100 billion cubic metres (BCM) of reserves, the development will have 10 wells with a plateau gas output that is expected to deliver 8 billion cubic metres a year (775 million cubic feet/day) of gas for almost 10 years.

The report states that Neptun Deep underpins the strategic transition of OMV Petrom and OMV, its parent company, to a gas-weighted portfolio. At plateau, the gas output of 8 BCM will make a significant contribution towards OMV’s target of a 60% gas production mix by 2030.

Neptun Deep map

Source: Wood Mackenzie Lens

“The project is advantaged by low unit costs and an extremely low carbon intensity thanks to its optimised scope,” McGavin says. “Another surprising outcome is that the budget is also largely unchanged from past estimates of about EUR4 billion, despite global cost inflation and risk premiums in the Black Sea during the war in Ukraine.”

Romania as net gas exporter?

The report adds that such is the scale of the scheme Romania could become energy independent by the late 2020s and export any excess gas to markets in the EU. Transgaz, Romania’s transmission system operator, is already planning a pipeline that will link Neptun Deep’s onshore tie-in point near the Black Sea coast to the EU gas network at the BRUA interconnector (Bulgaria-Romania-Hungary-Austria).

There will be immense scrutiny on costs and schedule during Neptun Deep’s execution phase. After years of frustrating delays, the countdown now begins to a critical new gas supply for Romania and the EU.