Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

President Tinubu’s radical reforms signal new economic era in Nigeria

Changes to petrol subsidy and exchange rate will transform Africa’s largest economy

2 minute read

The new president of Nigeria, Bola Tinubu, has started to roll out radical reforms in a move that could turbo-charge investment in the West African state according to Gail Anderson, Director of Research for Upstream Sub-Saharan Africa at Wood Mackenzie, a global insight business for renewables, energy and natural resources.

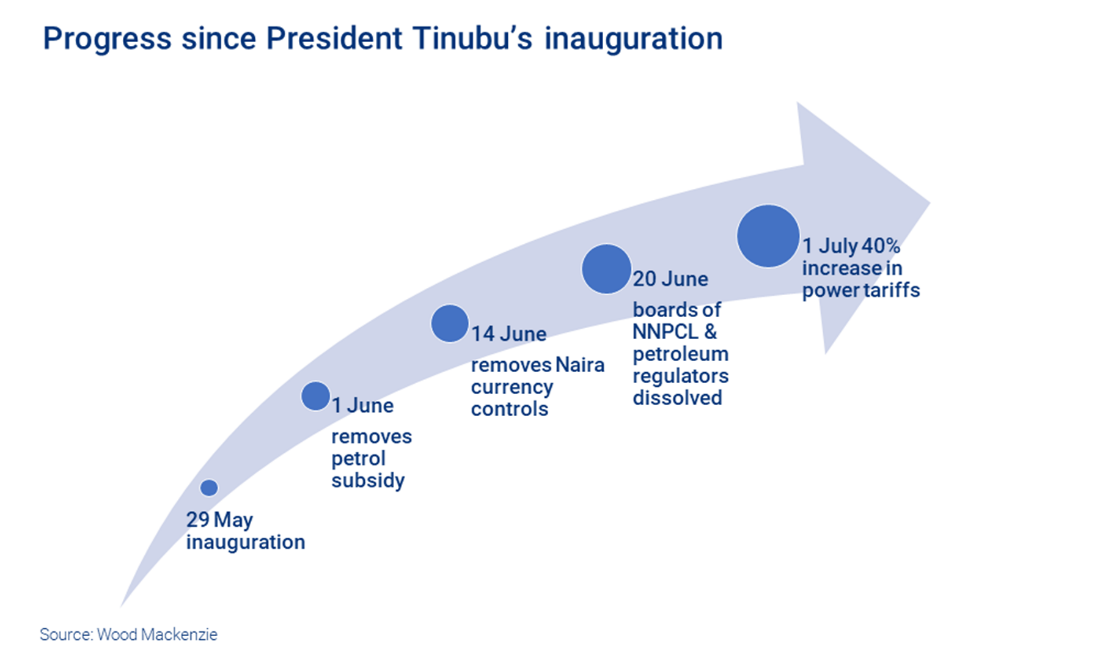

In his inauguration address on 29 May, President Tinubu promised to review the current taxation policies to make Nigeria more investment friendly, unify the exchange rate for the Naira - the country’s currency - and phase out petrol subsidies.

Subsidies on petrol were removed on 1 June. A litre is now selling for 500-600 Naira (US$1.00-US$1.30) compared to 180-200 Naira (US$0.38 to US$0.43). This will save the Federal government over US$10 billion this year.

“Ending petrol subsidies, used extensively in distributed generation, will arguably do more than any other measure to help Nigeria transition to a low-carbon economy,” Anderson said. “This will encourage consumers to source cleaner, cheaper alternatives such as gas or solar, or even use the electricity grid more often.”

The new president’s next move was to remove state controls on the Naira in a move aimed at ending the practice of operating multiple exchange rates, acute dollar shortages and back market trading.

Domestic gas prices are quoted in US dollars but paid in Naira, at official Central Bank of Nigeria rates. This meant producers were operating with hefty currency losses in addition to the volume and payment risks from the power sector.

“The change is highly significant for gas producers. Full removal of currency controls should eliminate this problem, although it is unclear how and when it will be implemented,” Anderson said.

Wood Mackenzie predicts the increase in gas prices that the new reforms will usher in will ripple out across the power sector. Tariffs along the gas-to-power value chain are regulated at below the cost of supply. If the Naira cost of gas increases for generators, then Nigeria’s power sector regulator would need to pass these costs down to end users. On cue, electricity tariffs have increased by 40% in July and Anderson believes that government intervention would be needed for Nigerians already struggling with soaring food prices:

“Despite the high risks of Tinubu’s economic shock therapy, his demonstrated willingness to make the big calls on the economy will immediately improve the Federation’s finances and make Nigeria more attractive to foreign capital and more competitive for inward investment,” Anderson said.