Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

North American renewable natural gas market could expand tenfold by 2050 to reach 4 bcfd

The RNG market grew 20% in 2022; number of RNG projects doubles in last five years

1 minute read

Driven by new government incentives for the transportation sector, renewable natural gas (RNG), or biomethane, saw tremendous growth in 2022, with 60 million cubic feet per day (mmcfd) of new production capacity added, according to a new report from Wood Mackenzie.

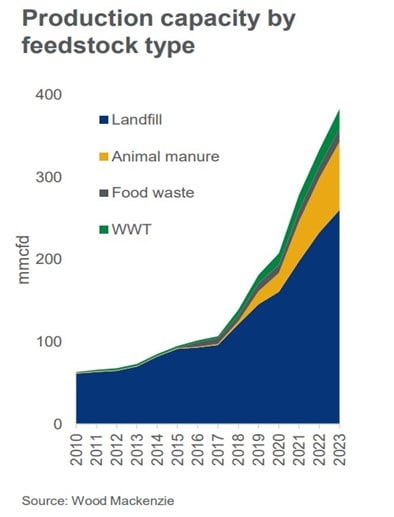

According to the report “North American renewable natural gas state of the market” the number of RNG projects has doubled in the last five years and 66 future projects were announced in 2022. In total, the North American market size sits at 385 mmcfd, with states such as Texas (62 mmcfd), California (33 mmcfd), Pennsylvania (33 mmcfd), leading the way.

Activity has been spurred by recent mandates and incentives aimed at lowering greenhouse gas emissions, most notably through investment tax credits (ITC) in the Inflation Reduction Act for RNG development and low-carbon fuel programs in the EPA’s Renewable Fuel Standard program.

“RNG has become more popular as it can have five times lower carbon intensity than natural gas projects and helps reduce emissions considerably when used for transportation fuel,” said Natalia Patterson, senior research analyst with Wood Mackenzie. “More than half of RNG production is estimated to be consumed as fuel for natural gas vehicles.”

Landfills make up the largest portion of the capacity by feedstock through methane emissions, but animal waste projects are on the rise, followed by food waste and wastewater treatment projects.

Despite the recent growth, the RNG market currently only makes up 0.5% of the North American natural gas market. Yet with continued policy support and technology development, Wood Mackenzie projects it will growth to 3% of the market by 2050, for a total of 4 billion cubic feet per day.

“There are opportunities for new policy framework to drive more activity in the sector, but we will also need to see voluntary efforts as well, particularly from the industrial sector as more firms commit to low carbon initiatives,” said Patterson. “The growth in the industrial sector would have the potential to dwarf traditional RNG demand in the transportation sector.”