Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Rosebank oil field reaches FID

Government’s decision to approve will encourage other new projects in the UK North Sea

1 minute read

The announcement by Norway’s Equinor and the UK’s Ithaca Energy to go ahead with the Rosebank deepwater oilfield project in the West of Shetland basin could lead to more fields being approved according to a report by Wood Mackenzie.

The report states that the approval of the controversial project has led to the UK government facing accusations of back-sliding on climate goals.

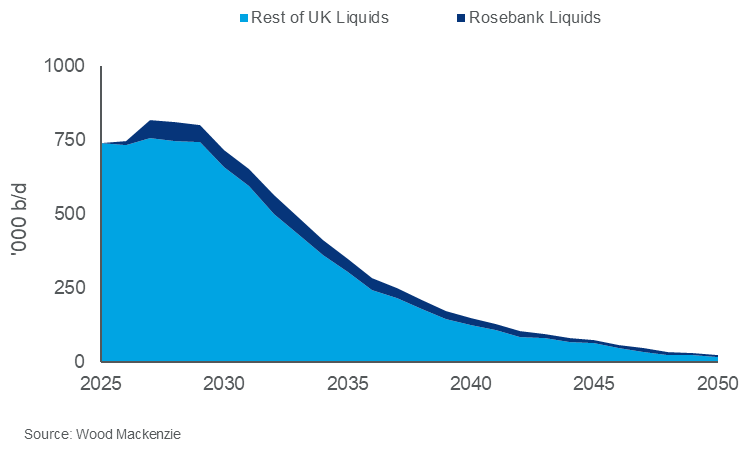

“As the biggest final investment decision (FID) in 20 years, Rosebank will account for 8% of UK liquids output at peak in 2027/28,” says Gail Anderson, Research Director for the North Sea. “Following this FID, there is more likelihood of other nearby fields such as Cambo progressing”.

The report also states that despite the decision to develop Rosebank, the project still faces future fiscal risks, especially around the UK government’s windfall tax for energy companies, the Energy Profits Levy (EPL). A change of government at the next election could result in the removal of the 29% Investment Tax Allowance under the EPL.

“The UK’s well-earned reputation for fiscal disruption means that Rosebank will face major risks whoever governs the country next year,” says Gail Anderson, Research Director for the North Sea, “any future toughening of the EPL, could make Rosebank’s economics marginal.”

Rosebank’s contribution to UK liquids production