Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Steel decarbonisation to redefine supply chains by 2050

Wood Mackenzie report says new metallic hubs will emerge as steel industry accelerates carbon abatement efforts

6 minute read

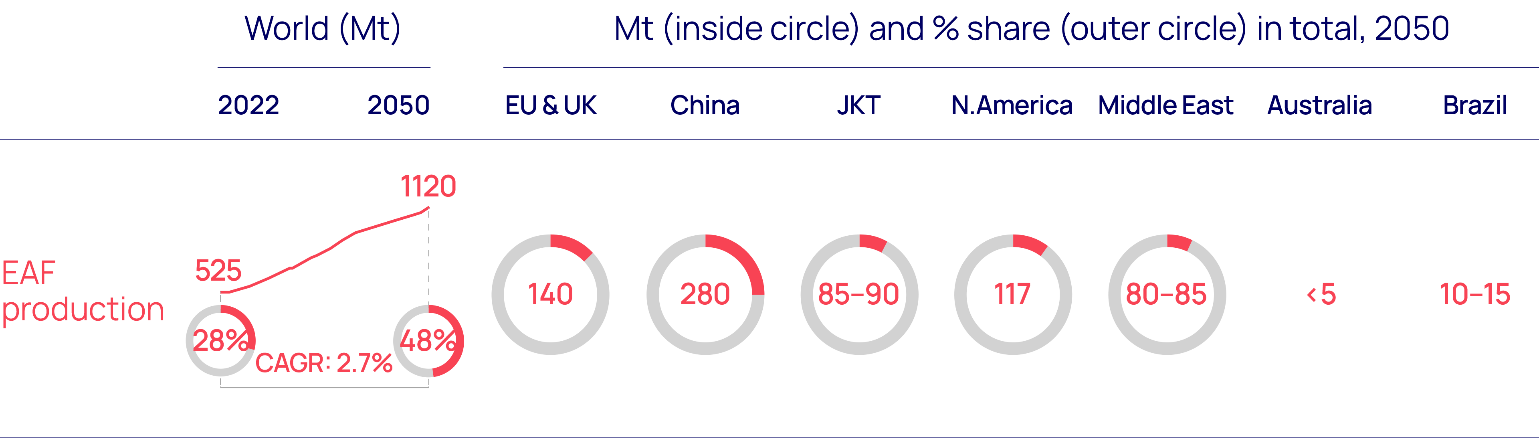

The rise of electric-arc furnace (EAF) technology, increased use of green feedstock and evolving carbon policies will reshape steel production and global trade patterns according to ‘Metalmorphosis: how decarbonisation is transforming the iron and steel industry’, the latest Horizons report from Wood Mackenzie.

Low-carbon intensive EAF production currently accounts for 28% of global steel output: In Wood Mackenzie’s new analysis, EAF production will rise to 50% by 2050. Investment of US$130 billion will be required to achieve this goal. This level of investment is based on Wood Mackenzie's base case outlook of 550 million tonnes (Mt) net-capacity additions by 2050.

Driven by demand for less carbon-intensive steel, this capacity growth will support an increase in the supply of greener feedstocks such as Direct Reduced Iron (DRI) and high-grade scrap. The share of these feedstocks in total metals demand is expected to increase from the current 36% to 54% by 2050. As a result, new production, processing, and trading hubs for low-carbon iron and scrap will emerge.

Source: Wood Mackenzie

The rise in DRI production and trade will create new investment and revenue generation opportunities for companies across the value chain. Malan Wu, Global Head of Assets, Metals and Mining Research at Wood Mackenzie and lead author of the report says, “Wood Mackenzie forecasts DRI capacity to double within 30 years, with an estimated US$80 billion investment required. This projection does not include potential investments in green hydrogen, smelters for low-grade DRI, pellet hubs, and shipping. As the cost of lower-carbon steel rises, quality will take precedence over quantity.”

“In markets with high and mature carbon prices, we expect to see a shift towards importing green DRI to manufacture low-carbon steel using EAFs, instead of importing finished steel from more emissions-intensive producers like China and India,” Wu said.

Wu also added that steel producers in China and India will need to keep up with this trend and invest in EAF capacity to remain competitive. “Using higher-quality scrap will also benefit most existing producers as it is sourced from demand centres,” Wu said.

Isha Chaudhary, Global Head of Steel and Raw Material Markets, at Wood Mackenzie, co-author of the report says “Iron and steel production accounts for approximately 8% of the world's carbon emissions and is a hard-to-abate industry. With the right levels of investment and policy support, decarbonising the industry is a realisable goal, bringing with it the potential to transform the industry outlook. As this transformation takes hold, the impact on trade patterns and the steel value chain will be substantial. The decarbonisation of iron and steel is already underway, and few industry players will be left untouched.”

Green DRI hubs will emerge, near clean energy sources

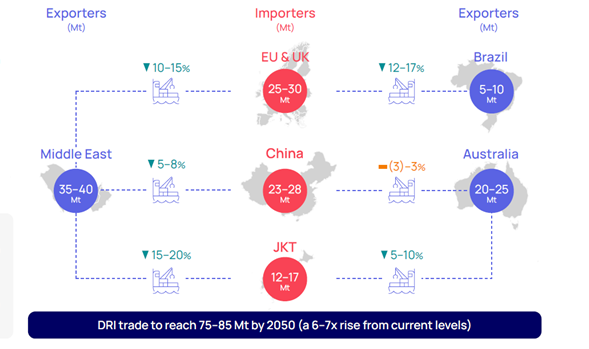

Wood Mackenzie predicts that the location of new green DRI hubs will be determined by their proximity to low-carbon hydrogen production, particularly given the uncertainties around how traded hydrogen will be transported and stored.

The Middle East and Australia are well positioned to capitalise on this opportunity and the project pipeline in both regions is growing fast. Global steelmakers, energy companies, miners and trading houses are leading the race to produce green DRI by taking advantage of multiple catalysts in both the Middle East and Australia.

For producers in the European Union (EU), it will be up to 15% more cost-effective to produce EAF steel by importing DRI from the Middle East than manufacturing it locally. Wood Mackenzie says by 2050, the EU will become the biggest global importer of DRI, accounting for more than a third of the total DRI trade.

China, the world's biggest steel producer, will likely look to a mix of imported and locally produced DRI. While imports from the Middle East will be more competitive, China is also likely to invest at home to support its massive domestic steel sector.

Source: Wood Mackenzie

Carbon policies transforming steel trading patterns

A further driver in the emergence of new hubs is carbon policies such as the Carbon Border Adjustment Mechanism (CBAM). The EU imported 23% of its finished steel in 2022 but imported 34% (equal to around 80-90 Mt) of its carbon emissions from finished and semi-finished steel. From 2026, an increasing share of these emissions must be paid for under the CBAM. Within nine years, 100% of the carbon content of steel imported into the EU will be taxed.

“The EU's CBAM will significantly rebalance the steel trade. By increasing the cost of imported finished steel by 20-25%, the CBAM will notably impact EU steel imports and domestic production. European countries now must weigh the options between importing finished steel, green DRI for steel production, or additional scrap,” Chaudhary added.

From quantity to quality: the rise of scrap

A key finding of the report is that increased use of scrap will be an essential step in the steel industry's decarbonisation efforts. Mihir Vora, Principal Analyst, Steel and Raw Materials Markets at Wood Mackenzie, co-author of the report says, “through recycling, steel mills can reduce their carbon footprint by up to 60% and save 1.5 tonnes of iron ore, 0.9 tonnes of metallurgical coal and 0.3 tonnes of other additives.”

“Driven by a push towards EAF steel production, we expect mature economies with the most ambitious net-zero targets to emerge as future scrap hubs and major markets for DRI imports. The outlook for China – the world's largest steel manufacturer – is less clear although recycling offers a huge potential advantage for local steelmakers. We anticipate a rise in the availability of scrap post 2035, as the construction boom - a key contributor to the supply of scrap from demolished buildings – only really began since the 2000s and has a lifespan of 30 to 50 years,” Vora added.

ENDS

Editor’s notes:

About Wood Mackenzie’s Horizons report: Metalmorphosis: how decarbonisation is transforming the iron and steel industry

Horizons is a monthly detailed analysis published by Wood Mackenzie. In this report, Wood Mackenzie concludes that decarbonisation will support the emergence of new production, processing and trading hubs for low-carbon iron and steel. Driven by rising demand for green steel, the industry’s push for net zero is set to transform the value chain of a commodity essential to the industrialised world.

These new hubs will centre on abundant, low-cost renewable electricity and competitive green hydrogen supply, both key to the production of green direct reduced iron (DRI), used as feedstock in steelmaking.

A copy of the report is available on request from Wood Mackenzie’s PR team.

How to read the chart:

- % change indicates the differential between the region’s domestic EAF steelmaking cost produced using domestic DRI vs imported DRI.

- Green arrows denote the differential in steelmaking cost using imported DRI vs domestically produced. For example – EU's EAF steelmaking cost will be 10-15% lower if it imports DRI from Middle East vs locally produced.

- The imported DRI cost includes FOB price (including margins at origin), freight costs and impact of destination carbon price.

- The steelmaking cost includes an assumption of carbon cost impact for domestic production and imports (based on the emission intensity in the respective regions).

- Our analysis excludes smelting cost (to reduce impurities) at the destination country

- JKT: Japan, Korea, Taiwan

About Wood Mackenzie’s Energy Transition Outlook

Wood Mackenzie’s Energy Transition Outlook report (part of its Energy Transition Service) maps three different routes through the energy transition with increasing levels of ambition – but also difficulty and investment. They are Wood Mackenzie’s independent assessment of what it would take to deliver on countries’ announced net zero pledges and potential outcomes for the planet. You can read more information here and a copy of the analysis is available on request.