Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Top 10 solar PV inverter vendors account for 86% of global market share

2022 saw an increase in global PV inverter shipments to more than 330 GWac

2 minute read

The top 10 global solar photovoltaic (PV) inverter vendors accounted for 86% of market share in 2022, increasing by 4% year-over-year since 2021, according to latest analysis by Wood Mackenzie, a global insight business for renewables, energy and natural resources.

The global PV demand of 201 gigawatt alternating current (GWac) in 2022 contributed to 48% growth year-over-year for PV inverters. In terms of inverter shipments, strong growth in Europe, Asia Pacific, and the United States where government support bolstered to meet clean energy goals led to a total of 333 GWac of global shipments in 2022. The industry saw this renewed increase in shipments as the pandemic-related chip shortage and other supply chain challenges eased in 2022.

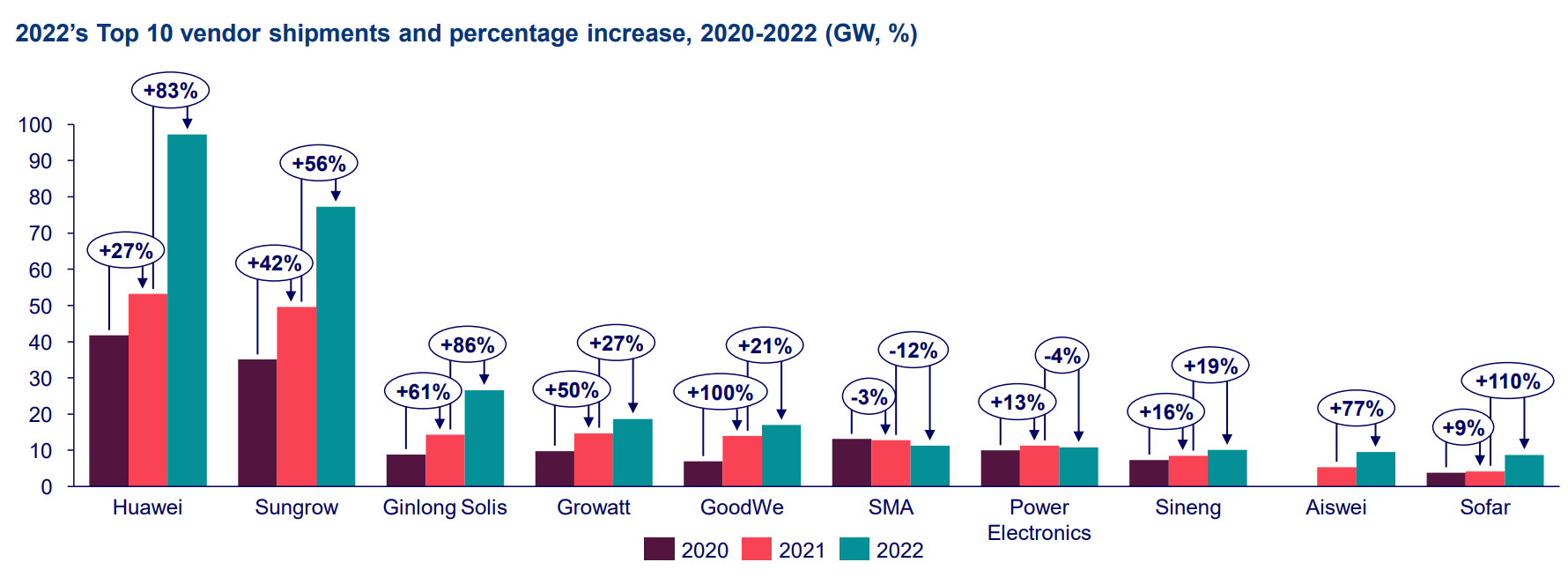

The top five vendors – Huawei, Sungrow, Ginlong Solis, Growatt, and GoodWe – shipped more than 200 GWac and accounted for 71% of total global PV inverter shipments in 2022, growing 8% from 2021. Huawei’s shipments saw a significant increase of 83% in 2022 compared to 2021, while Sungrow’s shipments expanded 56% in the same period.

(source: Wood Mackenzie)

Huawei and Sungrow maintain leadership

For the eighth consecutive year, Huawei and Sungrow continued to lead the market, taking the first and second positions, respectively. Together, the top two vendors covered more than 50% of the global market cumulatively in 2022, while continuing to lead the APAC region with a 55% market share, compared to 46% in 2021.

Huawei held the first position with a 29% market share in 2022. Second runner-up Sungrow increased its market share by 23% in 2022, compared to 21% in 2021. Ginlong Solis moved up to third place in 2022, driven by the company’s shipments in China.

The top eight vendors of 2021 held their ranks in 2022, with only Ginlong Solis and Growatt swapping third and fourth positions from 2021. Aiswei and Sofar jumped up three ranks to enter the top 10 ranking, holding the ninth and tenth positions respectively in 2022.

Asia Pacific leads inverter market

The Asia Pacific (APAC) region held 50% of the global market with a 44% year-over-year growth in shipments, with total shipments to the region reaching 167 GWac. China led the market with 78% of inverter shipments to APAC directed to the country as installations reach an all-time high. India retained its position as the second largest inverter market in APAC in 2022 but saw a 25% decrease in shipments year-over-year. While Japan overtook Australia as the third, with 7 GWac shipped to the country, seeing a 23% year-over-year growth.

Europe accounted for 28% of the global market with 92 GWac shipped to the region. Europe experienced the highest shipment growth with an 82% increase in 2022, following its 44% year-over-year growth in 2021, as the region strives for carbon neutrality by 2050 under the European Green Deal plan.

The US, however, consumed 13% of the global market, with only 42 GWac shipped to the country. PV-storage hybrid inverters made up 10% of the regional shipments as the US increases the integration of solar and storage.

ENDS

Reporting metrics:

WoodMac ranks vendors by quantity of shipments in megawatts-alternating current (MWac). Only shipments with revenue recognised in the reporting year are counted towards the market share.