Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

US could see $100B of new LNG projects in the next five years

2 minute read

High prices and the demand for energy security will drive the US to be the leading exporter of LNG in 2023 and potentially pave the way for $100 billion in new developments to support long-term growth, according to a new report from Wood Mackenzie.

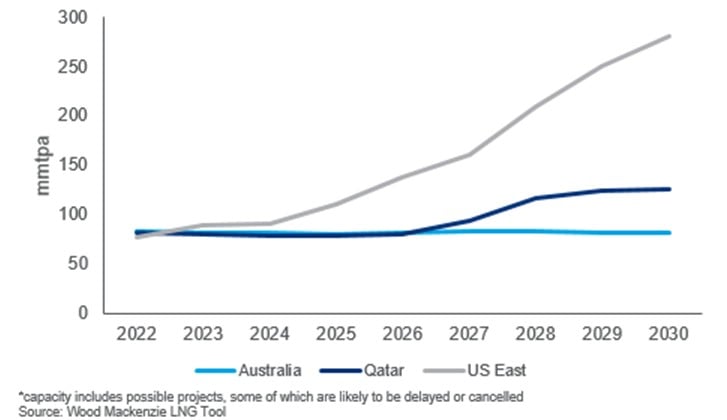

In 2022, the US was the third-largest exporter of LNG at 76.4 million metric tonnes per annum (mmtpa). With the resumption of the Freeport facility, the US will surpass Qatar and Australia this year to export 89 mmtpa. However, it won’t stop there. Wood Mackenzie predicts that based on the combination of projects already under construction and momentum of potential projects, US LNG capacity could grow between 70 mmtpa and 190 mmtpa before the end of the decade, potentially more than doubling current exports.

Liquefaction capacity* of current top three global LNG exporters

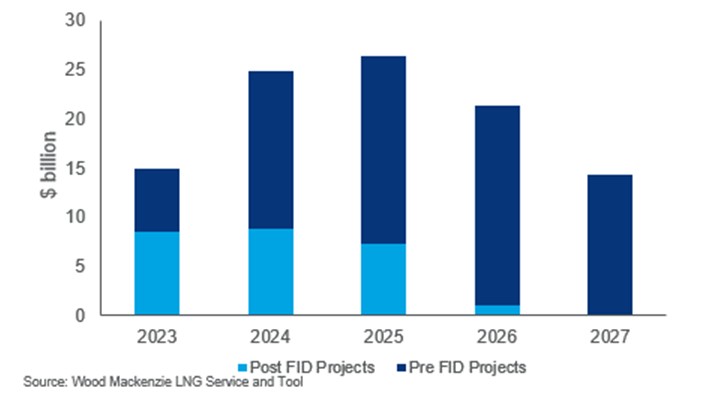

To achieve this, a slew of new projects will have to launch, which could lead to as much as $100 billion in new projects in the next five years.

“Record-high prices and the need for energy security drove buyers, which included portfolio players and US producers and infrastructure companies, to seek long-term US LNG deals in 2022 and created huge contracting momentum for projects,” said Giles Farrer, head of gas and LNG asset research for Wood Mackenzie. “Last year alone, 65 mmtpa of long-term US deals were signed, dwarfing the 18.5 mmtpa we saw in 2021. This activity has pushed a host of pre-final investment decision (FID) US projects forward and we could see a wave of FIDs this year and next.”

Next five-year investment into US LNG projects by FID status

According to Farrer, projects will be undertaken by both privately and publicly-owned developers and most pre FID projects are currently seeking external financing for this investment. “In most cases, project financing will support between 60-80% of the required capital, with the remainder either financed via equity raises and/or balance sheets.” he added.

Risks to capacity growth

The potential for cost increases is challenging developers as they move forward, particularly through supply-chain-triggered inflation and competition for resources.

“Our benchmarking analysis indicates we have already seen inflation of over 20% on the US Gulf Coast, compared to projects which were built in the last five years,” said Sean Harrison, research analyst, gas and LNG for Wood Mackenzie. “As developers continue to push more projects forward, competition for service contracts will rise, creating a squeeze on both work force and material prices. This could cause further cost inflation, along with delays to some projects.”

Harrison added that despite rising costs, competition for customers is keeping liquefaction fees low, potentially between $2-$2.5 per million British thermal unit for fixed price long-term agreements, challenging profitability.

“The combination of low fees and increasing costs mean we estimate unlevered internal rates of return (IRRs) as low as 5-6% for some projects. Based on these returns, some projects are finding it challenging to secure finance, particularly via equity raises,” said Harrison. “Projects are looking for ways to create additional value for developers and equity investors. Ways they might find upside include procuring feedgas efficiently, securing good prices for uncontracted LNG sales, debottlenecking and re-rating of trains and the sale of pre-commercial volumes. Charging customers for additional services to reduce project emissions could also deliver additional returns”