Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980

US utilities have committed to 116 GW of large load capacity growth, equal to 15.5% of current US peak demand

While 91% of the 17 GW of disclosed capacity under construction is in regulated markets, future capacity shows notable shift toward deregulated markets

1 minute read

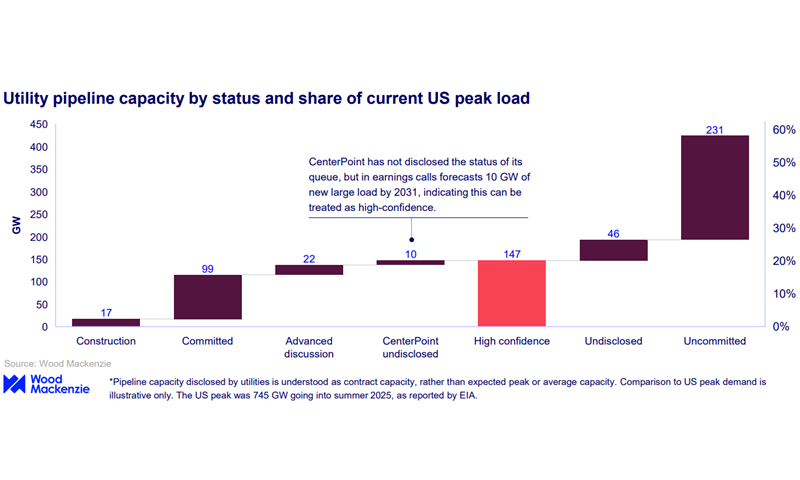

With 116 gigawatts (GW) of large load capacity committed or under construction, US utilities are planning for significant large load capacity growth—equivalent to 15.5% of current US peak demand—according to a new Wood Mackenzie study of major investor-owned utilities. Accounting projects in advanced discussion or a near-term forecast brings the total to 147 GW, or 20% of US peak demand.

The report, “No turning back, an analysis of utility large load pipelines,” shows a significant portion of this capacity will come online this decade, with 60 GW expected to be added through 2030, equal to 8% of current US peak demand. Utilities expect 93 GW to be operational by 2035, after which little pipeline capacity has been disclosed.

"Utilities are committing to large loads ramping rapidly this decade," said Ben Hertz-Shargel, global head of Grid Edge for Wood Mackenzie. "The market will be hard-pressed to supply this new load on that timeframe, which may prevent it from happening.”

Market shift toward deregulated areas

The report identifies a notable shift in where large load projects are sited. While 91% of the current 17 GW of disclosed capacity under construction is located in regulated markets, 54% of committed capacity not yet under construction and 65% of capacity in advanced discussion is planned for deregulated markets.

Nearly three-quarters of high-confidence load is concentrated in ERCOT and PJM regions.

"Committed capacity not under construction as well as advanced discussion capacity fall disproportionately in deregulated markets, primarily ERCOT," said Hertz-Shargel. "Deregulated markets pose risks of inadequate future supply and price increases to non-large load customers, which has prompted market interventions by Texas and PJM and will likely prompt more in the future."

Pipeline uncertainty increasing

Despite modest increases in high-confidence capacity at several utilities, its share of total pipeline capacity has decreased over the last few quarters as new requests outpace the advancement and withdrawal of existing requests.

"Rather than starting to see a trend toward pipeline certainty, we continue to observe the opposite," said Hertz-Shargel.

Data center ramp rates are augmenting this uncertainty. The time to reach contract capacity varies considerably for projects over 300 MW, often much longer than four years.

"The pace at which utilities connect data centers is just part of the story,” said Hertz-Shargel. “How soon the grid actually sees load will ultimately depend on data center developers.”