Renewable Asset Cost Modeling (RACM)

Make more informed decisions through CapEx and O&M cost estimates tailored to your assets' specific characteristics

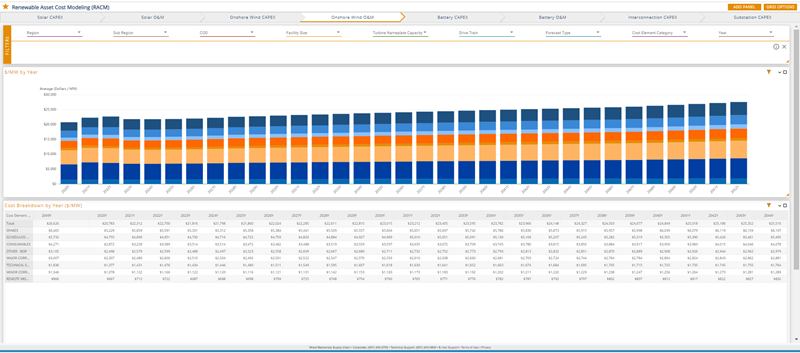

Monitor and understand your renewable asset project costs all in one view

Factors such as commodity volatility, geopolitics, supply and demand, and fluctuating grid-connection costs are causing uncertainty in the market, as a result it has become increasingly difficult to develop a good understanding for project cost. With our proprietary RACM product, you can streamline your cost estimating process and validate decision making through seamless generation of asset cost estimates using dynamic modeling and configuration capabilities.

RACM by the numbers

See how our model is making an impact on the energy transition.

$8.5T

Supply chain spend

120K+

Competitive bid events providing visibility into 1000+ renewable energy projects

30K+

Indices in our proprietary database that are available at your fingertips

25M+

Unique cost estimates provided

Features and workflows

Simplify your internal project approval process with executives or investment boards with our trusted benchmarking data which is informed by thousands of distinct renewables projects across the energy landscape.

Key features of Wood Mackenzie's Renewable Asset Cost Modeling:

- Compare EPC bid pricing with industry benchmarks.

- Identify natural negotiation opportunity areas to minimise costs.

- Generate cost buildups, forecasts, and impacts for any contemplated solar, onshore wind, or battery storage.

- View CapEx or OpEx project costs to stay ahead of market changes.

Wood Mackenzie's Renewable Asset Cost Modeling provides data on:

- High-quality, asset cost estimates built on proprietary inputs from thousands of global renewable energy projects and qualitative analysis from our team of expert energy researchers.

- Produce rapid project cost scenario tests to determine component- and project-level cost discrepancies to inform your asset investment decision-making.

- Forecast and monitor impacts of key project cost factors, such as supply-demand, commodity volatility, policy, technological advancements, and more.

Wood Mackenzie's Renewable Asset Cost Modeling enables a number of key workflows including:

Developers, utilities & IPPs

- Generating a project cost estimate can be very manual, time-consuming, and requires an understanding of a variety of factors impacting those costs. Our cost model provides component-by-component, $/Watt prices per renewable technology for optimal strategising, budgeting, and ROI calculations as new market perspectives are developed.

Category & procurement managers

- Forecasting how CapEx and OpEx costs are expected to trend going forward requires a full breadth of data and research to precisely predict. Our model reliably and accurately projects cost trends which provides assurance and confidence in negotiations to navigate various market perspectives and obtain optimal cost benchmarks all at your fingertips.

Financials

- Stay ahead of the increasing market complexity by scenario-testing projects to keep informed on cost and buildup discrepancies before they happen. Streamline the project cost estimating process, validate investment analysis, and assess renewable energy markets, assets, and future trends all in one place. With our model being fast and easy-to-use and filled with high-quality & accurate data, we help you offset the risk of market fluctuations for optimal price efficiencies.

Why choose WoodMac's Renewable Asset Cost Modeling?

Our project estimates are informed by our unrivaled data assets, including over $8 Trillion in industry spend across over 1 billion transactions, over 5,000 completed unit price benchmark analyses, and over 120,000 project bid event submissions.

Gain the ability to forecast project data informed by our proprietary WoodMac research and data surrounding renewables supply-demand factors, commodity trends, policy, technological advancements, and much more.

Get the latest estimates which are updated dynamically as new data is acquired and new market perspectives are developed.

Frequently asked questions

Here you’ll find answers to the most common questions you may have on Wood Mackenzie's Renewable Asset Cost Modeling. If you have any other questions, get in touch.

RACM works well coupled with our Cost Intelligence product which provides an unabridged view of EPC prices in the historical and current market landscape to understand what factors are driving the market and where to optimize on their strategies while keeping costs low.

-

Manage your enterprise spend and become more cost-effective in your business’s categories and vendors/suppliers.

-

Understand how the external market is impacting the costs of the equipment and services you buy.

-

Understand whether the price changes from your suppliers are in line with how the market has moved.

-

Efficiently buy required equipment and services from suppliers and ensure you’re getting the lowest price point.

-

Advance the energy transition by cost-effectively building, owning, and operating renewables assets.

CapEx:

Solar, wind, storage, interconnection, substation.

OpEx:

Solar, wind, storage.

Contact an expert

Advance your position in the energy transition by cost-effectively building, owning, and operating renewables assets.