Kazakhstan's new Tax and Subsoil Use Codes: a brighter future?

*Please note that this report only includes an Excel data file if this is indicated in "What's included" below

Report summary

Table of contents

-

What are the changes?

- Tax Code introduces new profit-based terms

- But some fiscal issues are largely unaddressed

- Subsoil Use Code optimises legislation

- Why did Kazakhstan need to improve its terms?

-

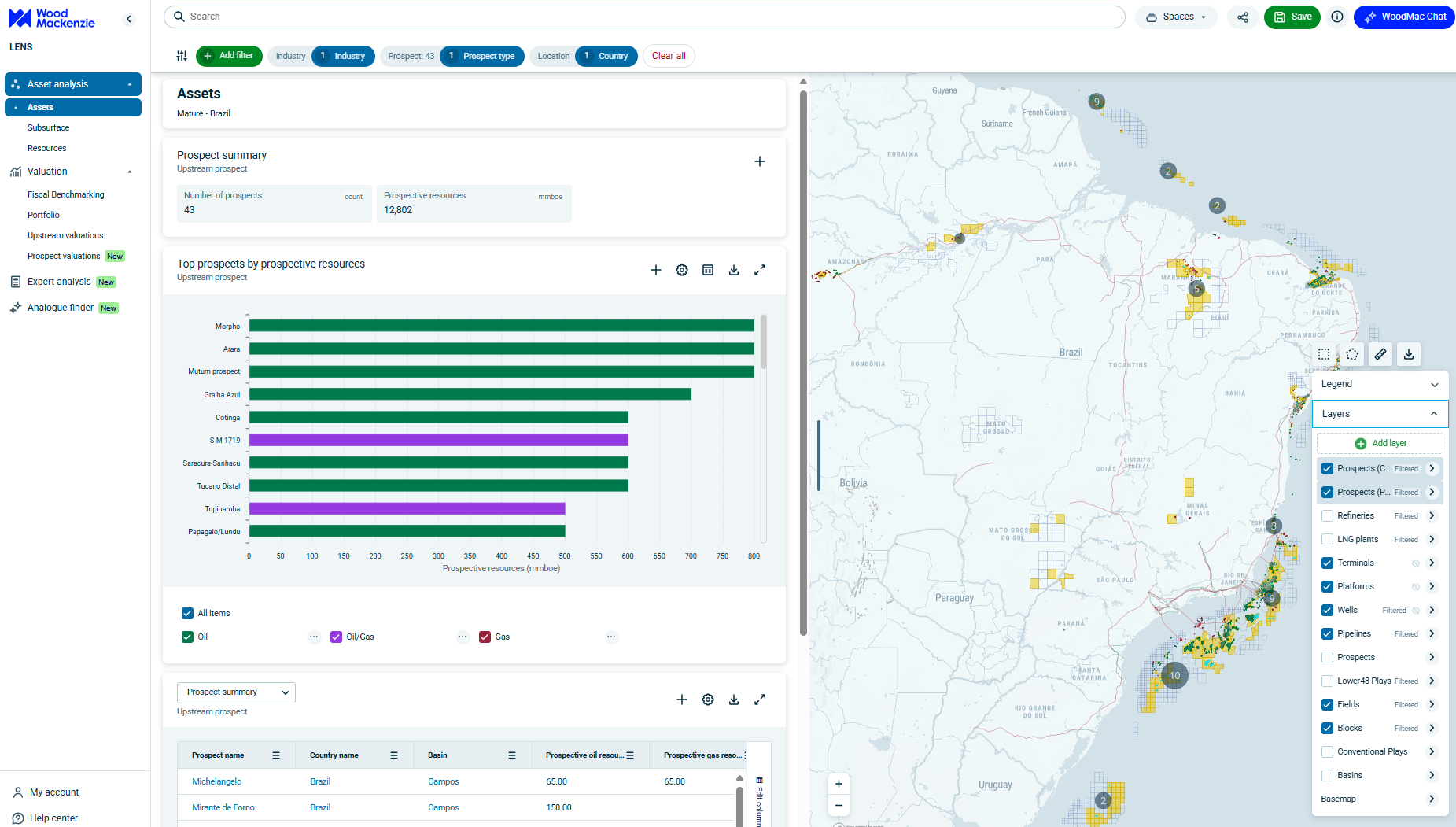

What is the economic impact of fiscal changes?

- Alternative subsoil tax improves the commercial proposition for offshore and deep onshore projects

-

How competitive can Kazakhstan become?

- Pre-tax economics must improve

- AST reduces government share to competitive level

- Kazakhstan joins debate on fiscal 'fair share'

- What else should Kazakhstan do?

- Appendix

Tables and charts

This report includes the following images and tables:

- Kazakhstan oil and condensate production, 2010-35

- Kazakhstan onshore E&A drilling, 2010-18

- Kazakhstan offshore E&A drilling, 2000-17

- Overview: alternative subsoil tax and standard concession terms

- Kazakhstan's new Tax Code: key changes for oil and gas

- Kazakhstan's new Subsoil Use Code: key changes for oil and gas

- Model field economics (NPV10): deep onshore

- Model field economics (NPV10): offshore (shelf)

- Model field economics (NPV15): deep onshore

- Model field economics (NPV15): offshore (shelf)

- Deep onshore field: standard terms

- Deep onshore field: AST terms

- 4 more item(s)...

What's included

This report contains:

Other reports you may be interested in

Russian Federation product markets long-term outlook H2 2019

In 2019, total products supply was in a position of surplus in the Russian Federation relative to demand.

$9,450Kazakhstan upstream summary

Three super-giant fields dominate a well-established upstream industry - The Tengizchevroil (TCO), Kashagan and Karachaganak ...

$6,480Turkmenistan upstream summary

Central Asia's largest gas producer - Turkmenistan's gas output is currently more than 7.5 bcfd, centred on the prolific ...

$6,480