Mexico's unconventional round tests the shale landscape, but can it change it?

*Please note that this report only includes an Excel data file if this is indicated in "What's included" below

Report summary

Table of contents

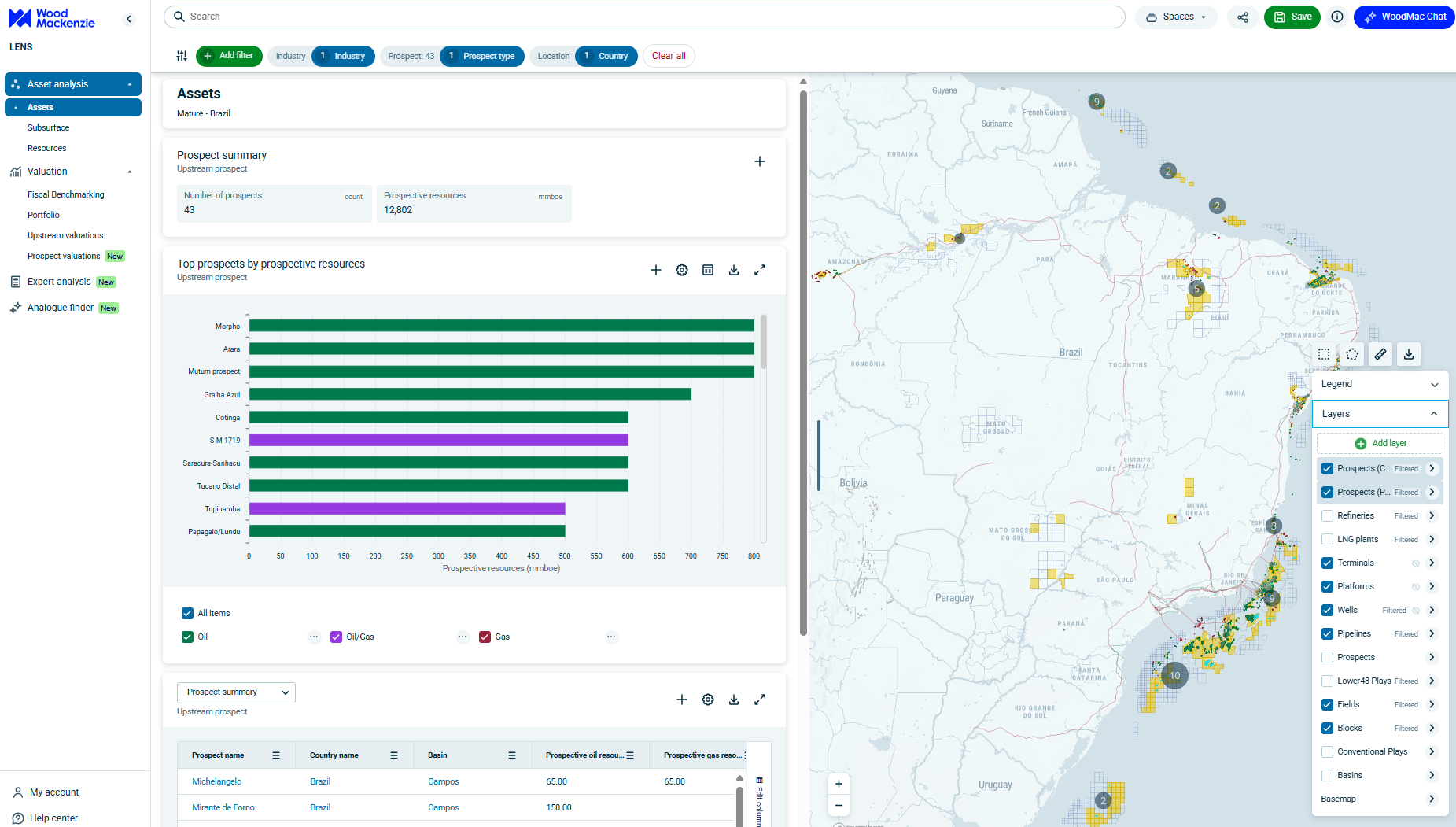

- Nine Burgos basin blocks on offer

- Early Pimienta wells confirm shale potential

-

Cost and commerciality: great unknowns

- US shale gas imports to Mexico are cheap and growing

- Can Mexico build a fit-for-purpose supply chain?

- Mexico's onshore faces heightened security risks near the border

- Round will have local appeal

- Fiscal terms introduce a new secondary rate

- Mexico's pilot unconventional phase - a positive step

Tables and charts

This report includes the following images and tables:

- Round Three unconventional onshore

- Unconventional shale characteristics

- Type curve comparison

- Fiscal timeline of taxes and fees for an unconventional development under new license terms

- L48 Cumulative undrilled gas resource remaining (1Q2018)

- L48 Cumulative undrilled liquids resource remaining (1Q2018)

- Mexico onshore net acreage by company for active licenses (excludes Pemex)

What's included

This report contains: