What happens to returns when explorers move to gas?

This report is currently unavailable

*Please note that this report only includes an Excel data file if this is indicated in "What's included" below

What’s the key takeaway from this report?

Gas will be key for future exploration. But while it holds many attractions over oil, its returns are weaker.

We assess what will shape the adoption of gas, and what this will mean for full-cycle economics.

Why buy this report?

- Understand what the shift to gas means for exploration returns

- Get a detailed comparison of the numbers: how does gas stack up against oil?

- Explore our ideas on what strategies explorers can use to drive higher returns

This report explores the broader theme of what role the exploration industry will play as the energy transition takes long-term oil growth off the agenda. Get our thoughts on the industry issues that matter.

Report summary

Table of contents

-

Executive summary

- Explorers face growing reliance on gas

- Gas is cheaper to find and develop

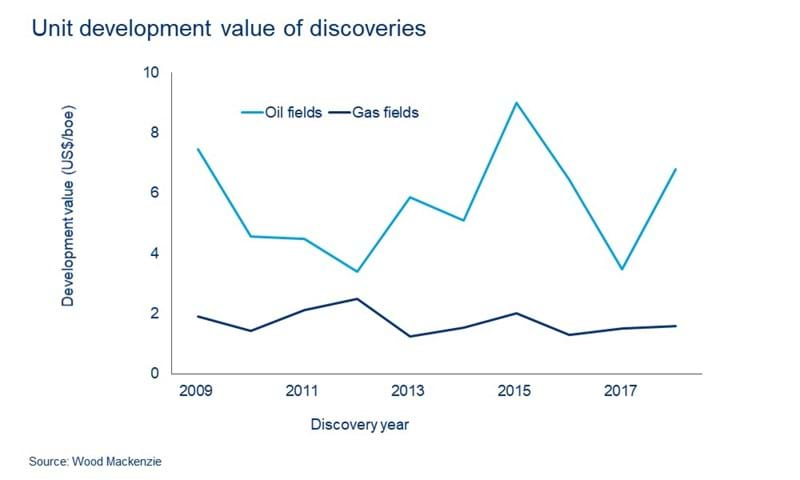

- But gas has much lower value

- Domestic gas is advantaged over export gas

- Exploration strategies will adapt for gas – sooner or later

Tables and charts

This report includes the following images and tables:

-

New field discovery volumes 2009-2018Commerciality of oil and gas discoveriesDevelopment value of discoveries 2009-2018

-

Unit development value of discoveriesUnit value of discoveries by market typeUnit value of discoveries by water depthLargest gas exploration countries by principal market type

What's included

This report contains: