Discuss your challenges with our solutions experts

Crushin' it: Hi-Crush acquires Permian Basin Sand Co.

55 million tons of sand reserves gained

1 minute read

Proppant producer and supplier Hi-Crush has diversified its portfolio by acquiring Permian Basin Sand Co. for US$275 million. This acquisition — the largest ever for Hi-Crush — is in direct response to increased drilling activity in West Texas. In our latest report, our analysts share their outlook for proppant use trends through 2018.

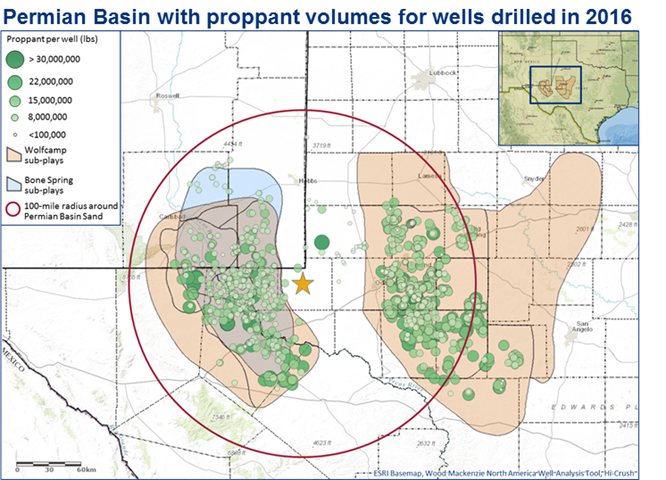

While frac sand producer and supplier Hi-Crush has historically exclusively developed Northern White sand from Wisconsin, the company is using the US$275 million Permian Basin Sand Co. acquisition to pivot to lower-cost regional Texas sand. Located in Winkler County, Permian Basin Sand's processing plant is in a high-demand ZIP code and able to service both the Midland and Delaware basins, where drilling activity is strong.

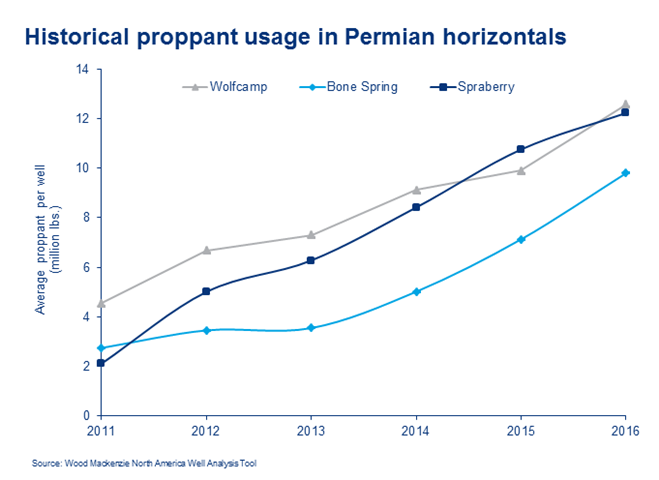

During the downturn, Lower 48 operators began switching from Northern White to cheaper regional sand and compensated for its lower crush strength by increasing volumes of proppant. We expect this trend to continue, with regional sand eventually surpassing Northern White demand.

Through the acquisition, Hi-Crush will gain 55 million tons of sand reserves, with the ability to process three million tons per year. Extrapolating 2016 trends in proppant loading, Hi-Crush has the capacity to service 500 Permian horizontal wells in 2017, or 17% of the projected Permian demand.

Is the sand market expected to tighten given the building momentum in drilling activity and companies' increasing production targets? Sand companies have admitted to order books bursting from the recent uptick in proppant demand this year, but as we look out to 2018, oversupply could be a downside risk to proppant pricing if activity levels don't hold up.

Introduced in 2015, the North America Well Analysis Tool continues to expand its coverage of permitting, completion, production, and cost data for onshore oil and gas wells in the United States. The tool now includes more than 3 million wells drilled by 90,000 different companies across 28 states. Data and interactive mapping capabilities provide users with insights on well production and performance, potential acquisitions and opportunity valuations, competitor benchmarking, future drilling activity, and more.