Sign up today to get the best of our expert insight in your inbox.

Powering China’s data centres

Renewables and grid investments surge as the AI race hots up

4 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

War is once again reshaping gas and LNG

-

Opinion

Middle East conflict set to drive oil and LNG prices significantly higher

-

The Edge

Can natural hydrogen deliver its potential?

-

The Edge

The big themes on Big Oil’s mind

-

The Edge

India’s energy challenge

-

The Edge

Is there still life in decarbonising hard-to-abate sectors?

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin oversees our Europe, Middle East and Africa research.

View Gavin Thompson's full profileSharon Feng

Senior Analyst, China Power Market

Sharon Feng

Senior Analyst, China Power Market

Sharon leads Wood Mackenzie's research coverage for China power and renewables.

Latest articles by Sharon

-

The Edge

China renewables investment powers on

-

The Edge

Powering China’s data centres

-

Opinion

Gas & LNG in Asia: the next 10 years

Read the Chinese version (中文版)

China and the US are locked in a battle for global AI dominance, with President Donald Trump just this week unveiling “America’s AI Action Plan”. Success will, in large part, depend on delivering enormous amounts of power to meet soaring demand from data centres.

The world’s two superpowers have vastly different power markets, however. With US power demand barely growing over the past two decades, utilities have been left flatfooted as demand surges. Meanwhile, China’s electricity consumption has grown at an average of 8% a year over the same period, with investment in capacity and grid infrastructure never letting up.

Is China better prepared than the US to meet its data centre power demand? Could China face its own constraints as demand booms? Do Chinese data centres have a cost advantage over the US? Sharon Feng and Wanting Zhao from our China power team provide their views.

What’s happening with China’s data centre power demand?

As in the US, China’s data centres are just getting started. We expect data centre power demand to grow at around 17% annually to reach 479 TWh by 2030 in our base case, roughly equal to national power demand in France.

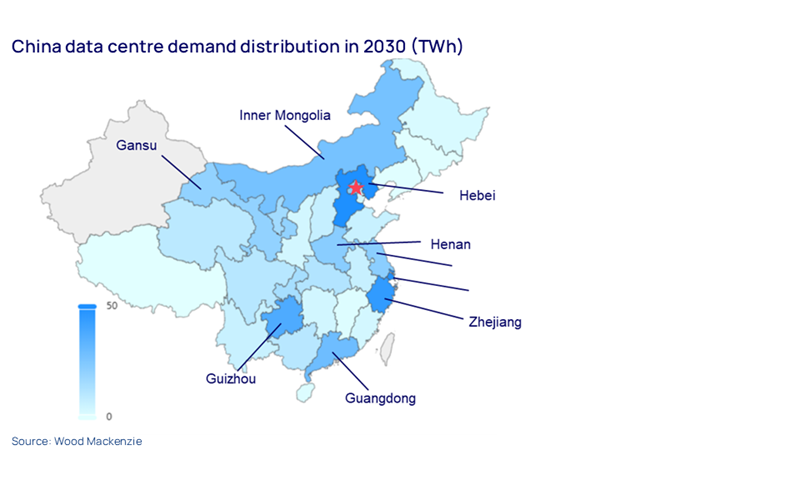

Just as in the US, Chinese data centres are concentrated in particular regions. Project development and power demand are focused on coastal cities, though build-out is expanding into northern and central regions as the need for low-cost green energy rises. Of the 20 Chinese provinces expected to have data centre power demand above 20 TWh by 2030, just three – Hebei, Shanghai and Zhejiang – will collectively account for 148 TWh, effectively China’s equivalent of the PJM market, centred around Pennsylvania in the US.

How is China meeting the demand growth?

Coal remains the bedrock of China’s power market, providing 24/7 baseload supply to data centres even as the country added more wind and solar capacity over the past five years than the rest of the world combined. But the Chinese renewables juggernaut is unrelenting: looking out to 2030, China’s wind capacity is set to double over current levels and solar will almost triple while battery storage grows more than sixfold. As a result, wind, solar and storage will supply 5,500 TWh of output by 2030, equal to 40% of total Chinese generation and overtaking coal for the first time.

Compare this to the US, where utilities are struggling to add capacity fast enough. Optimism around the Inflation Reduction Act (IRA) has given way to caution as renewable developers and utilities absorb the latest energy and trade policies of the Trump administration. Renewables will continue to grow quickly, but we estimate that the One Big Beautiful Bill Act (OBBBA) will lead to total installed wind and solar capacity increasing by 100 GW through to 2030, half the projected growth rate under the IRA framework.

This is putting a bigger call on gas in the US. But any projects proposed today are not likely to be online until 2030 and beyond, and will face ever-escalating costs, including potentially higher domestic gas prices.

Could China face the same capacity and grid constraints as the US?

Not so far, given its phenomenal commitment to power sector investment. Looking forward, strong government support and rapid capacity additions mean China’s renewables growth is outpacing power demand. Average development lead times for onshore wind come in at two years compared to five in the US, while utility solar is added in half the time.

Critical grid equipment lead times are also much shorter. Domestically produced transformers in China, for example, are available with 48-week lead times, compared to an average of 143 weeks in the US.

Do Chinese data centres have a cost advantage over the US?

The levelised cost of electricity (LCOE) of Chinese renewables has tumbled in recent years. Since 2020, the LCOE of Chinese solar PV has halved while onshore wind costs have fallen by almost two-thirds, though further cost reductions look minimal. Over the same period, the LCOE of US renewables has slightly increased as supply chains and manufacturing have been reshored while tariffs and the OBBBA now weigh heavily on the sector. The LCOE of US wind and solar remains competitive in many parts of the domestic power market but will be significantly higher than China’s over the next five years.

What does this mean for the US – and the rest of the world?

The US remains the global leader in AI, boasting the world’s largest tech companies. There’s also huge political support to push the sector forward, with Energy Secretary Christopher Wright last week calling the AI race the US’s “next Manhattan Project”.

It will not have been lost on Secretary Wright, however, that success depends on massive amounts of new power. A stark conclusion from his own department’s recent Resource Adequacy Report is that investment in power supply is not keeping pace with AI power demand. In the US – and in many other countries around the world – data centre demand is challenging the electricity market model. To succeed, countries must move quickly to boost cost-effective generation capacity, accelerate permitting reform, consider new large-load tariffs and push domestic technological innovation.

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world.