Register for the webinar

Permian investments have been scaled-back aggressively. But there are still 135 active rigs concentrated in certain geographies. Are the tight oil wells still being drilled generating returns at today’s prices?

Join our Upstream veteran analysts, Rob Clarke and Brandon Myers, on Tuesday, June 30, as they analyze ultra-core inventory and discuss who is sitting on the best acreage. Defensive strategies could turn into opportunities if some of this acreage hits the market.

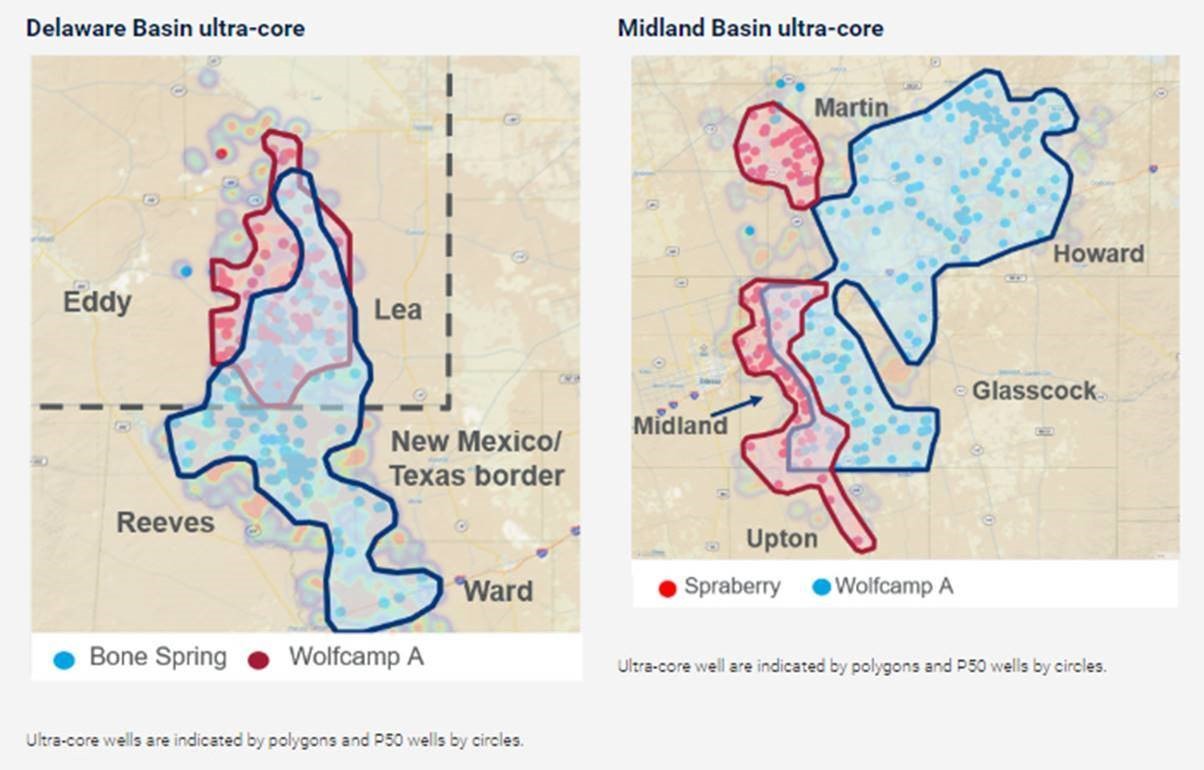

The live-presentation will walk you through our latest valuations work focused on the Delaware and Midland basin in these three simple steps:

- High-grade undrilled acreage by recovery rates and geologic properties

- Develop type curve distributions to highlight the best undrilled locations

- Test price scenarios and timing to find the optimal drilling schedule against various price outlooks