Asia Pacific corporations hungry for green energy power up for energy transition

Corporate power purchase agreements for renewables are setting new records in 2023 as costs fall and green energy takes off

3 minute read

Kyeongho (Ken) Lee

Head of Asia Pacific Power Research

Kyeongho (Ken) Lee

Head of Asia Pacific Power Research

Ken is the Head of Asia Pacific Power research in our Power & Renewables group.

Latest articles by Kyeongho (Ken)

-

Opinion

The global power market outlook: can global power generation keep up with the energy transition?

-

Opinion

Asia Pacific corporations hungry for green energy power up for energy transition

-

Opinion

The power of the PPA: corporate renewable procurement sets a new record in Asia Pacific

Corporate power purchase agreements (PPAs) for renewables in Asia Pacific are booming in 2023, with contracted capacity expected to be up 35% year-on-year. But can corporations go green while saving money? And which form of clean energy is the most competitive for companies to source through a PPA?

We recently offered an insight into the APAC PPA market as part of our Asia Pacific Power Service. The report, entitled Route to green energy: Asia Pacific's corporate renewable procurement, provides an analysis of recent corporate renewable PPA contract growth and an overview of the PPA market in the region. Fill in the form to download a complimentary extract, or read on for a quick summary of the key themes covered.

A new record in contracted PPAs for renewables in Asia Pacific

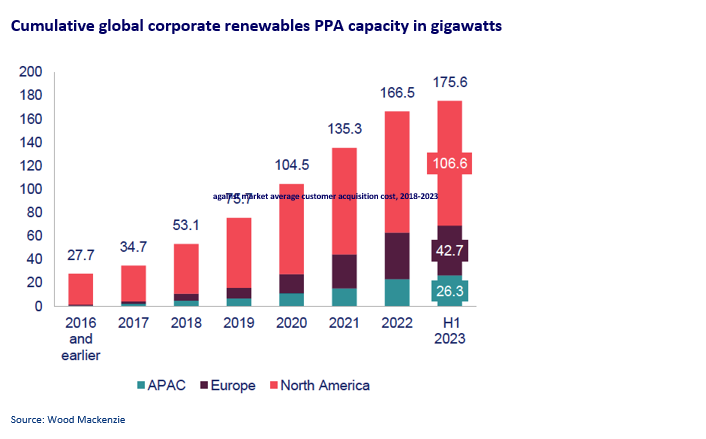

The Asia Pacific corporate PPA market should amount to 31.4 gigawatts (GW) of contracted power this year – a big jump up from 23.2 GW in 2022. Momentum is strong, with incremental contract volumes on pace to break records for the second year in a row. Yet, with corporate PPAs for renewables in the region making up only 15% of the global market, there is still plenty of room for growth (see chart below).

What are the main benefits of the PPA model for corporate buyers?

The corporate PPA model enables commercial and industrial buyers to more directly achieve their emission reduction targets buy purchasing renewable power directly from clean sources. Instead of purchasing their power requirements with distribution utilities where the source of power may not always be purely green, companies can directly to procure renewable power through an agreement with project developers. In addition to power procured, end users can obtain guarantees of origin certificates to certify the energy they are consuming comes from renewable sources. For obvious reasons, corporate PPAs for renewables are more common in deregulated electricity markets, as opposed to markets where state-owned utilities dominate the power supply chain.

What are the key drivers of market growth for renewables PPAs in APAC?

The main reason for the impressive growth in corporate PPAs for renewables in the region is the dynamic between the levelised costs of electricity (LCOE) for renewable power and end user tariffs. While costs for utility solar are falling, average industrial end-user tariffs have remained at 2022 levels. Tariffs in 2022 were at record high levels for many countries following the energy crisis.

New policy frameworks are also promoting the shift in approach, with South Korea’s Third Party PPA scheme and the Corporate Green Power Programme (CGPP) in Malaysia creating more favourable conditions for offsite corporate renewable PPAs.

Which renewable technologies are most popular in the region?

Utility-scale solar is by far the most competitive and popular corporate PPA resource in Asia Pacific. We estimate the LCOE for solar in the region to be 29% lower than the price of industrial electricity tariffs on average, although there is significant variation between countries. As a result, solar continues to dominate the market, accounting for more than half of cumulative contracted corporate PPAs for renewables in APAC as of H1 2023.

Learn more

Don’t forget to complete the form at the top of the page to download a complimentary executive summary of the full insight. This includes a selection of charts analysing the APAC corporate renewables PPA market, showing capacity by sub-region, market share for key technologies by country, involvement of RE100 companies and average contract length by region.

About Wood Mackenzie’s Power & Renewables Service

This insight is part of our Asia Pacific Power & Renewables Service, which delivers actionable insights into dynamic markets for sector stakeholders in APAC. Subscribers enjoy access to comprehensive analysis and tracking of power, solar, wind, storage, and grid edge projects, including long-term power price forecasts beyond 2050. Our aim is to empower strategic decision and facilitate the goal of a decarbonised and decentralised electricity market in the region.

2024 APAC Energy & Natural Resources Summit

9 May 2024 | Marina Bay Sands, Singapore

Book your tickets now