Discuss your challenges with our solutions experts

5 factors that will cushion the PTC phase-out in the US

Highlights from our latest North American Wind Power Outlook

1 minute read

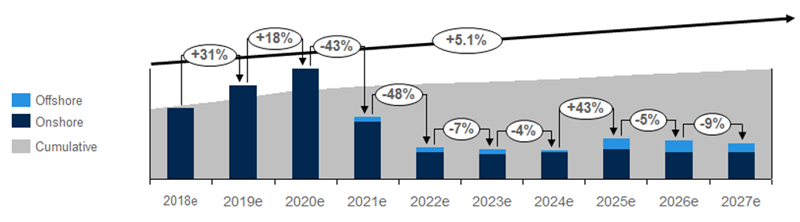

The US wind industry will face tough times post-2021 when the value of the production tax credit (PTC) drops to 60% in 2022 and 40% in 2023 before disappearing entirely in 2024. We present five drivers that will sustain demand for new wind capacity additions in the market during this time.

1. Sustained pace of coal retirements

Despite significant federal opposition under the Trump administration, economic realities will continue to underpin a robust pace of coal retirements throughout the forecast period, leading to 66GW of total retired capacity from now until 2027. As utilities retire their coal fleets, their increased willingness to rate-base wind assets regardless of state-imposed renewable portfolio mandates positions wind power to meet their growing supply gaps.

2. Supportive state renewable energy standards

Especially in markets with less optimal wind LCOE, state renewable energy standards (RES) will continue to provide critical demand after the PTC phaseout. While RES is not the driver it once was and the pace of RES policy strengthening has fallen under the Trump administration after a rash of expansions in 2016 Arizona, California, and Massachusetts are currently close to passing significant RES expansion measures. Even after accounting for banked credits, the compliance gap faced by state utilities is significant and will continue to be a major driver for new wind build regardless of whether additional states expand their RES mandates in the near term.

3. A burgeoning offshore wind sector

On August 1, Avangrid and CIP announced a stunningly low preliminary contracted price for their Vineyard Wind project off the coast of Massachusetts. While this leverages the investment tax credit to a degree that other upcoming projects will be unable to, it nonetheless represents a huge leap in US efforts to close the gap with European offshore wind pricing and underlines the viability of offshore wind in the US Northeast. With upcoming solicitations in New York and New Jersey set to contract several additional gigawatts of offshore wind capacity in the next 24 months, offshore wind will ramp up just in time to help cushion some of the blow to installation volume caused by the PTC phaseout.

4. Steady wind power cost reductions

While wind power is not expected to return to 2020’s rock-bottom, full-PTC pricing before the end of the 10-year forecast, steady cost reductions from technology improvements, the adoption of bigger turbines with larger blades and a sweeping supply chain reorganization will keep wind competitive on a pure-cost basis in much of the US “wind-belt” region during and after the PTC phaseout. Once the phaseout is compete in 2024, wind will still come in below new combined-cycle natural gas facilities on a levelized cost of energy basis in 20 states, with this figure growing to 28 states by 2027. Solar PV, however, will be a potent competitor as its cost reductions will proceed faster than wind’s own while it enjoys an extended ITC phaseout period that only begins in 2024.

5. Evolving battery storage solutions

Battery storage costs will continue to fall as technological innovations continue, supply chains mature, and regulatory changes allow proper valuation of storage attributes. As battery costs fall, especially for four- and eight-hour battery solutions, the natural gas peaking model grows increasingly ripe for a disruption that will create new opportunities for wind capacity additions.

Read more about opportunities and challenges for the sector in our latest North America Wind Power Outlook.