1 minute read

1. US crude exports go global

US crude exports will increase by close to 3.0 million b/d from 2016 to 2023, with almost all the increase in exports moving to Europe and Asia.

2. Crude trade converges towards Asia

Crude import requirements for Asia will increase by about 4 million b/d from 2016 to 2023. No other region needs to import as much incremental crude. All crude exporters, especially those from the Middle East, Africa, Latin America and North America, will be keen to secure and increase their crude market share in Asia.

Source: Wood Mackenzie. Asia needs the largest amount of incremental crude imports, but the Middle East processes more domestic crude

3. Global crude slate lightens

We forecast light crude supply to rise quickly, offsetting declines in medium and heavy crude and becoming a major trend in future supply growth. Almost all of the incremental global crude run is expected to be from light crude and condensates.

4. Condensates market tightens

Asia will see a tightening of its condensate market amid robust petrochemical demand growth and decline in Middle East condensate exports. Read more about this in Part 3 of this series on crude trade.

5. Tightness in heavy crudes

We expect limited growth in the heavy crude market and only after 2022. Heavy crude refiners in China, India and the US will vie for the limited heavy oil supply growth.

6. IMO 2020 challenges to crude trade

We expect wider sweet-sour and light-heavy crude differentials as a result of the IMO regulation. Two groups of refiners will emerge, firstly, deep conversion refiners will strongly go after heavier and sour crudes, while simpler refiners will increase sweet crudes processing.

Source: Wood Mackenzie. Light-heavy crude differential widens as impact of IMO regulation outweighs the narrowing effect of surplus light and tighter heavy crudes

To discover more about the impact of this changing landscape, download the full insight and associated slide deck by filling in the form on this page.

Click here to read part 1 of "The changing global crude trade landscape" which looks at the global story.

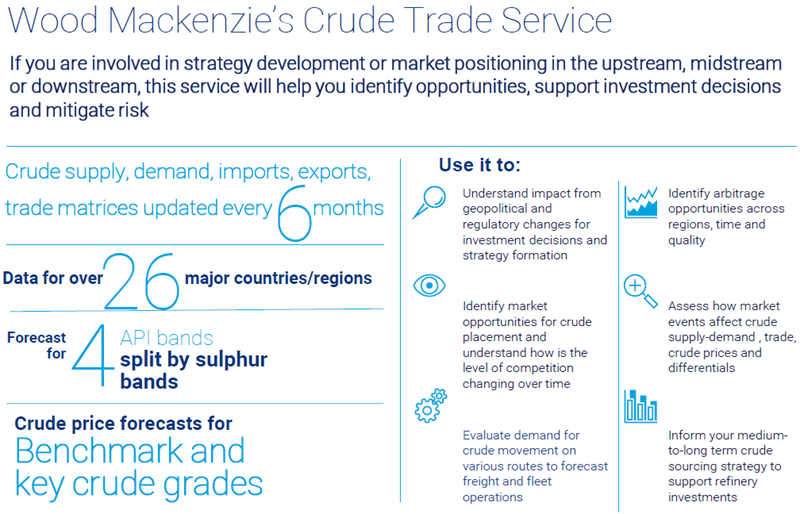

Available now: Crude Trade Service

This solution is designed to give you the data you need to address your key concerns on:

- Where are the key demand growth markets for crude and how to secure long-term supply?

- Understanding arbitrage across region, time and quality

- How will crude supply-demand changes and market events affect crude prices and arbitrage?