1 minute read

The rise and globalisation of US crude exports will be the most significant change to the global crude market in the next five years, with over 4 million b/d of extra crude being produced. Most of this additional crude will come from the Permian Basin, located in West Texas and southeastern New Mexico. In addition to price implications, more US crude exports will have a knock-on effect on global crude trade flows.

Changing trade flows

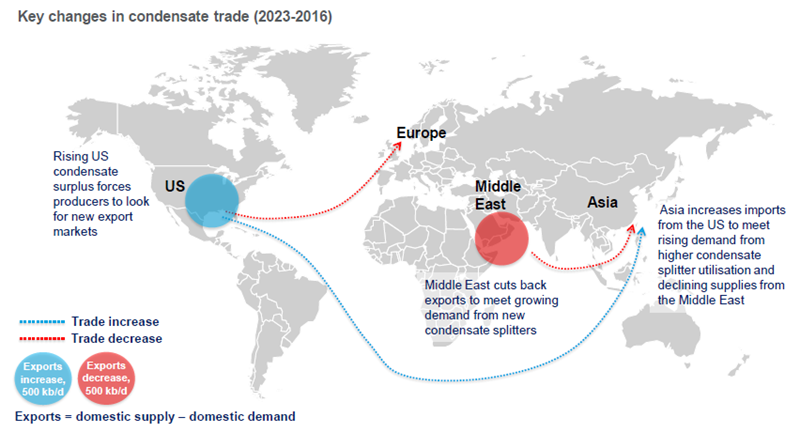

There will be changes to crude trade flows. The Middle East will cut back on condensate exports and Asia being forced to import more condensate from the US. As for light crude, rising US exports to Europe and Asia could have implications for African crudes. Heavy crude trade sees rising exports from Canada and the Middle East offset declines from Angola, Mexico and Latin America to Asia.

What do these changes in crude trade mean?

Firstly, global slate will get lighter and sweeter, but this is at odds with what the refining system, mainly in Asia, has been preparing for. And this lighter crude slate will lead to higher-distillate yields. Which in turn contributes to the global surplus of light-distillate, mainly gasoline.

So by the time the IMO 2020 regulations come into force in just over a year, the light-heavy crude differential will widen as the narrowing effect of surplus light and tighter heavy crudes will be outweighed by these new regulations.

can be obtained from the download insight and slide deck

Finally, long-haul US and Latin America trade to Asia will see the highest increase in ton-mile demand. Our insight and associated slide deck go into detail on this as well as listing the top five shipping routes with the highest increase or decrease in ton-mile demand.

Complete the form at the top of the page to download your copy.

Click here to read part 2 of "Shifting tides of global crude oil trade" which looks at the six themes emerging from changes in crude oil trade.

Available now: Crude Trade Service

This solution is designed to give you the data you need to address your key concerns on:

- Where are the key demand growth markets for crude and how to secure long-term supply?

- What is the ton-mile freight demand outlook for the various trade routes?

- How will crude supply-demand changes and market events affect crude prices and arbitrage?