Carbon Intensity: not all assets are created equal

Pulling together a low-carbon portfolio will take more than looking at resource theme headlines

1 minute read

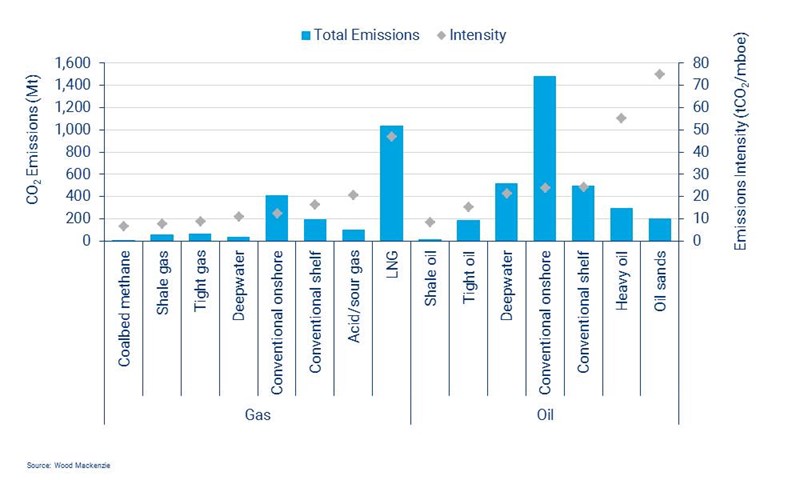

In transitioning to a low-carbon future, conventional wisdom dictates that we need to shift away from high-carbon fuels in favour of lower carbon fuels. Within the oil and gas industry it's often suggested that divesting from specific resource themes, particularly oil sands, is the way forward, but is it as simple as that?

Companies need to look beyond resource themes and review the variations in upstream emissions intensity to see how companies can reduce their CO2 footprints. Even assets of the same theme can have significantly different emissions intensity based upon maturity, location and other unique factors.

Thirty-six countries currently impose a price on carbon, and a further 78 have indicated that they would either implement or consider implementing carbon pricing. This potential financial liability will have an impact on project economics.

Get the full report

For more in-depth analysis on resource themes and the financial implications download a complimentary copy of this report, Carbon Intensity: not all assets are created equal.

Get in touch

Whether you’re interested in comparing your own carbon emissions to those of your peers, looking for carbon-related intelligence to inform your emissions strategy, or are curious about the risks to your investment portfolio containing companies with upstream assets, we are here to help.

Gavin Law, Head of Gas, LNG & Carbon Consulting