Discuss your challenges with our solutions experts

Chinese wind asset owners venture out on global stage

As conditions on their home ground become more challenging, Chinese asset owners are branching out abroad, investing in markets like Australia

1 minute read

Chinese wind asset owners keep grip on global top 25

Chinese asset owners hold 63% of wind projects globally. According to our latest Global Wind Asset Ownership report, 11 out of the global top 25 companies in 2017 are Chinese. A recent merger of former top-ranked power producer Guodian Group and seventh-ranked mining and energy company Shenhua into industrial titan CHN Energy is another good indicator this development shows no signs of slowing – this combined behemoth owns more than twice as much wind capacity as Iberdrola, the world’s second-largest wind asset owner.

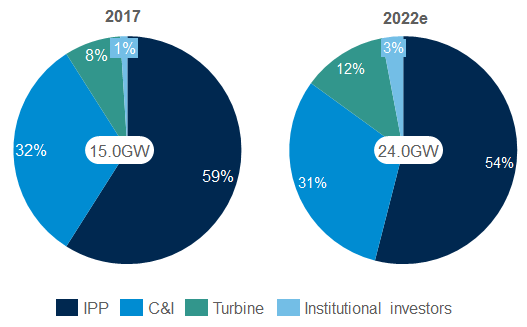

China Wind Power assets by owner type and sector 2017 and 2022e

While Chinese owners traditionally focused solely on their domestic market, tougher conditions and the central government’s Belt and Road overseas investment directive mean they are increasingly looking to invest abroad. Now more than ever before, Chinese investors are looking to invest their money in new geographies, with Australia’s open market and high project profits making it a particularly favourable destination for asset owners from heavily regulated China.

Chinese developers chase opportunities in distributed wind power market from 2022

Looking ahead to 2022, an increase in ownership share by the turbine OEMs will lead to a modest erosion of the IPP segment in China. Most Tier I and II turbine OEMs have reserved wind sites to develop internal wind projects and are looking for development opportunities in the distributed wind power market, with project sizes of less than 50MW that are connected to the power distribution network (≤110kV).

Globally, the capital-intensive offshore market is seeing rapid development in the US and Asia Pacific but remains dominated by four large European utilities who develop and sell off approximately half of the projects to a more fragmented pool of institutional investors.

The phasing out of subsidies in the US will force a market decline in the early 2020s, which will destabilise the traditional model of independent power producers. Utilities with ambitious rate-basing plans and institutional investors will gain market share in their place.

Shift to auctions drives large IPPs and utilities to invest in wind power globally

In Europe and the Middle East, the shift to competitive auctions will increasingly drive large IPPs and utilities to invest in wind power projects as they are able to leverage cost over smaller players.

Globally by the end of 2022, we expect IPPs, utilities and turbine OEMs to hold a larger share of the wind asset market. Residential owners will be at a disadvantage in the planned larger auctions.

Join our analyst team at Power & Renewables Summit in Austin on November 13th and 14th. We have panels discussing the phasedown of the PTC & ITC as well as the opportunity for offshore wind on the U.S east coast. See the full agenda and register here.