Interested in one of our products?

Gas mega-projects drive BP’s growth in MENA

MENA will constitute 38% of BP’s total production by 2025, compared to 27% currently

1 minute read

As part of the transition to a lower carbon world, gas is becoming an increasingly important component of the majors' portfolios. Nowhere is this trend more visible than within BP's Middle East and North Africa (MENA) portfolio.

Using the Upstream Company Valuations (UCV) online tool, our upstream research team interrogated BP's increasing presence in MENA to analyse its production and cost profiles between 2005-2025.

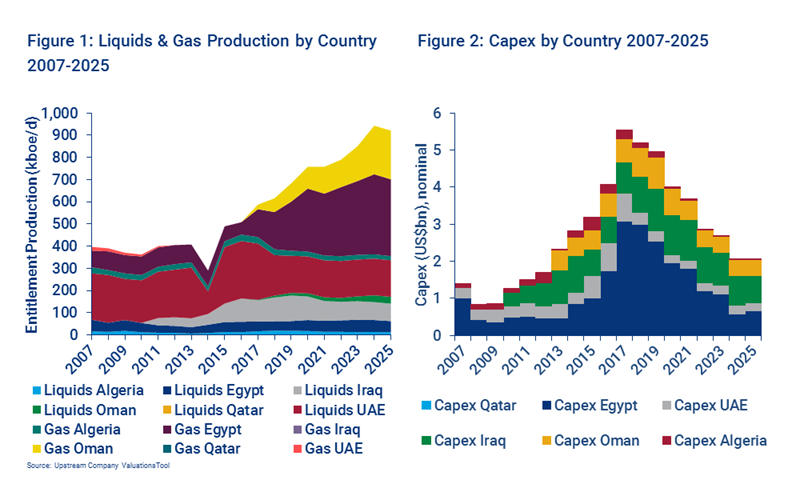

As shown in Figure 1, UCV reveals that BP's MENA gas production growth will more than triple between 2017 and 2024. At the beginning of this period, gas represents 30% of BP's total MENA output. We forecast that this will increase to 63% by 2024.

The transition is due to the start-up of a number of mega projects. The West Nile Delta fields in Egypt and the first phase of the Khazzan field in Oman have both recently come onstream, boosting BP's gas output by more than 500 mmcf/d in 2017. We expect BP's gas production to peak in 2024 while liquids production will continue to slowly decline.

Investments in Egypt and Oman drive the gas growth story

As shown in Figure 2, the capex spike in Egypt is a result of investment in the West Nile Delta, Atoll and Zohr. Capital-intensive deepwater developments will take BP's Egyptian spending to US$12 billion between 2015 and 2022. Overall, BP's capex will total US$31 billion over the next ten years, an increase of 29% over the previous decade.

MENA will become increasingly important for BP, constituting 38% of its total production by 2025, compared to 27% currently. By then, gas will make up 55% of BP's portfolio with 43% of that coming from gas fields in MENA.

UCV allows you to perform similar analysis and much more including querying company portfolios globally, running sensitivities on price, production, and costs, and filtering out assets according to bespoke criteria.

Learn how UCV can help you quickly value companies, identify growth opportunities and guide your investment strategies. Contact us to request a demo or speak to an expert.