Discuss your challenges with our solutions experts

Is there any more upside to summer Henry Hub prices?

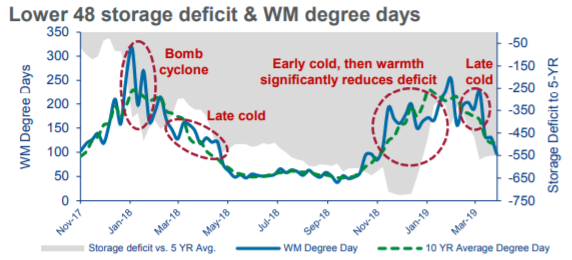

Storage levels start the shoulder season at lowest level in five years

1 minute read

North American natural gas storage levels haven't ended the season this low since the historic Polar Vortex in the winter of 2013-2014.

The shrunken inventory has kept summer Henry Hub prices supported despite choppiness in the prompt contract movement. An elevated summer strip should lead to lower gas burns as coal becomes economically competitive, and any downside risks to injections to jeopardize refill to 3.4 - 3.5 tcf by end of season could lead to even stronger gas prices for the summer and beyond.

Source: Wood Mackenzie North America Gas Service

But is the summer strip overvalued with expected production growth?

An expected resumption of production growth will be the key risk to summer prices. Gas output has floundered since reaching record-highs in November and December 2018, but supply recoveries among Rockies, Gulf Coast and Northeast promise to help replenish depleted storage levels this summer. Will they show up on time?

Wild card: LNG export demand wanes with high storage inventories in Europe and Asia

Price risk is also emerging for the Gulf Coast's growing LNG export projects. Asian LNG gas prices recently dropped below $5/mmbtu for the first time since June 2016, pressuring European prices and the arbitrage from the US. Could there be a possibly for US LNG export shut-ins this summer? We're closely watching the compressed netbacks for exports to both Asia and Europe -- and what the potential for weaker feed gas demand would mean for backed up volumes in storage fields.

For more granular details of our price outlook, see the North America Gas Service. Within this service, a monthly report is released just before Bidweek, with crucial fundamentals analysis and forecasts around power demand, LNG exports and supply. Contact us to learn more.