How will Covid-19 shape corporate strategy in energy and natural resources?

Companies in oil and gas, metals and mining, and power and renewables need to rethink long-term plans to thrive in a post-coronavirus world

1 minute read

The coronavirus pandemic has hit the world economy harder than any event since World War 2, and will have a lasting impact on energy demand. For energy companies, the emerging long-term outlook creates a critical strategic challenge. They are highly risk-averse right now, and their finances are under intense pressure. Many are cutting capital spending. But they will need to prepare for the opportunities and threats in the new world that lies ahead once the immediate crisis is past.

In a recent report, “The world after Covid-19”, we ask how corporate strategy is likely to shift in a post-pandemic world. That report also looks at Covid-19’s impact on the long-term energy outlook and lays out three scenarios for a post-pandemic future.

Read on to learn more about shifting corporate strategy or fill in the form on this page to get an extract of the report.

How will corporate strategy shift? Oil and gas

Poleaxed by the brutal combination of economic crisis and oil price collapse, the oil and gas industry’s sole focus is survival in 2020. Only ‘no-regret’ decisions will be made, mainly around cost reduction. Strategic decisions will be put on the back burner while the crisis is at its peak. But companies must also prepare for the world that lies ahead, mapping out a strategic direction to thrive post-crisis. Risk aversion will be one common theme. Another will be flexibility in execution given the higher uncertainty as to what the future looks like. Companies must be adaptable.

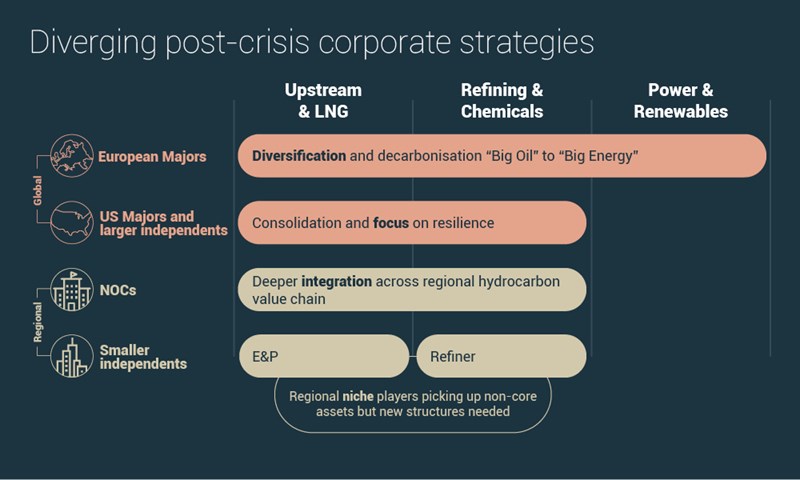

Strategic divergence is likely to accelerate

We expect an acceleration of the pre-existing trends in corporate strategies driven by investor, political and societal pressures. The US Majors and larger Independents will intensify focus on their global core businesses; European majors will diversify into zero-carbon energy. A suite of regional niche players can build positions as the Majors retreat.

Demand for gas is more resilient in each of our scenarios, and we’d expect gas to increase its share in upstream portfolios, irrespective of corporate strategy.

NOC strategies will vary by region and by country. Integration across the hydrocarbon chain, including petrochemicals, will be a central theme.

It’s easy to pigeon-hole, but each oil and gas company will position for change as it sees fit, and depending on its starting position. The challenges that lie ahead raise many questions which the companies will need to answer as they execute.

Different scenarios favour different strategies

In the ‘Full recovery’ case, both the ‘focus’ and ‘diversify’ strategies can co-exist, for a time, but inevitably one strategy will win. Significant relative underperformance by either group would force a U-turn and force them to change course.

‘Go it alone’ favours the simpler focus strategy, centred on resilience. With climate change down the agenda, we can imagine the European majors coming under greater pressure to abandon Big Energy ambitions.

‘Greener growth’, in contrast, is bullish for zero-carbon diversification, offering a path to growth and could force US companies to follow their European peers towards decarbonisation. The US political landscape through the next administration will play a big part in which direction the US Majors’ strategies evolve.

Download the report to learn more about these three long-term energy demand scenarios. Fill in the form on this page.

How will corporate strategy shift? Metals and Mining

Demand recovery for metals today looks increasingly bifurcated, as China regains much of its industrial might while many other countries are only slowly relaxing restrictions. The industry unsurprisingly finds itself in margin protection mode, cutting costs and pushing out project development, but still needs to think about strategy for the long term. Scenario planning gives rise to several new directions that strategic thinking might follow.

In the ‘Full recovery’ scenario, a rising tide lifts all boats. Some will rise faster than others, though, depending on commodity exposure and operational leverage. Within each commodity, producers placed higher on the cost curve will enjoy the greatest operational leverage during the upturn.

A ‘Go it alone’ world will reignite risk-off sentiment, and pile added pressure on the mining sector. Capital flows are likely to become even more limited, and will favour lower-risk diversified companies and lower-cost pure-play producers.

The ‘Greener growth’ scenario is bullish for the pure-play miners that focus on lower-carbon energy commodities such as copper, nickel, cobalt and lithium, leading to investment in growth and M&A. The bigger, better-capitalised, diversified miners could also take advantage of this scenario to strengthen their portfolios in key commodities.

How will corporate strategy shift? Power and renewables

Unlike more global commodities, the power industry is hyperlocal, with several markets already familiar with negative price periods.

In our pre-Covid-19 outlook and the ‘Full recovery’ scenario, many mature markets reach significant (50%+) shares of non-carbon generation on the grid, although the picture is uneven.

In the ‘Go it alone’ world, the power industry faces more policy fragmentation as well as depressed demand growth from negative economic and trade policies. The economics of renewables are unlikely to backtrack, however, and their share of generation will continue to grow.

In ‘Greener growth’, the power industry will be a major beneficiary as sectors from transportation and home heating to heavy industries and oil extraction look to decarbonise via electrification. The European Commission’s desire to tie stimulus funds to “green transition” is the clearest example.

For power companies, the priorities will be:

- De-risk existing business and diversify

Even in the ‘Full recovery’ case, electric utilities in North America and Europe will still have to deal with declining coal generation. Growth will require de-risking existing business models, which may be easier for vertically integrated

- Capitalise on incumbent advantage

The ‘Go it alone’ world will further entrench incumbent regulatory structures, as utilities vie for more protection to preserve traditional business models. This case leaves the electric utilities vulnerable to an acceleration of decarbonisation when it eventually arrives.

- Adopt and innovate grid flexibility models

The most underappreciated outcome of ‘Greener growth’ will be the rise of new business models. Traditional electric utilities will need revenue streams tied to services, a far cry from the current ‘poles and wires’ model. The grids will need to be more flexible. Historically, generation has had to follow load, but a more decarbonised grid will require the load to be more dispatchable. Utilities that have flexibility products and customer-centric offerings in their DNA will benefit in this scenario, and new entrants with disruptive ideas will also proliferate.

How could the coronavirus pandemic affect your business?

The outbreak of coronavirus, the oil price crash and the impending global recession present an enormous challenge for energy and natural resources businesses like yours. Wood Mackenzie is here to help inform the decisions that will sustain your organisation through the crisis and beyond. Our team of 600+ analysts in 40+ countries continues to deliver the data and analysis you rely on; our team of consultants with expertise in your industry is on hand to support you. Wood Mackenzie is among the leading providers of commercial insight and data to the oil and gas, metals and mining and power and renewables industries.

Our research and consulting teams advise companies across these sectors on supply chain risk, performance management and cost control; portfolio management to improve resilience and maximise value; and energy transition strategies including reduction of carbon intensity in legacy fossil fuels. Find out how to become a customer.