Discuss your challenges with our solutions experts

How will the closure of Philadelphia Energy Solutions impact US aromatics?

Loss of 600,000-tonne-per-year cumene unit brings US market into finer balance in long term

1 minute read

Philadelphia Energy Solutions has announced its intention to shut down refinery operations permanently following a fire at the facility on June 21, 2019. Wood Mackenzie's petrochemicals experts have assessed the impact of the closure of the 600,000-tonnes-per-year cumene unit at the site.

Get the highlights of our analysis below. For a detailed analysis of global cumene and phenol markets, purchase the Global Cumene & Phenol Industry Outlook.

Cumene market responds quickly to loss of production capacity

The market has already seen a jump in US cumene prices, which is likely to attract imports of both cumene and phenol from other regions through H2 2019. The loss of cumene production at the PES unit will back out around 20 kt/month of benzene demand, assuming the unit was running at lowered operating rates of 70-80%.

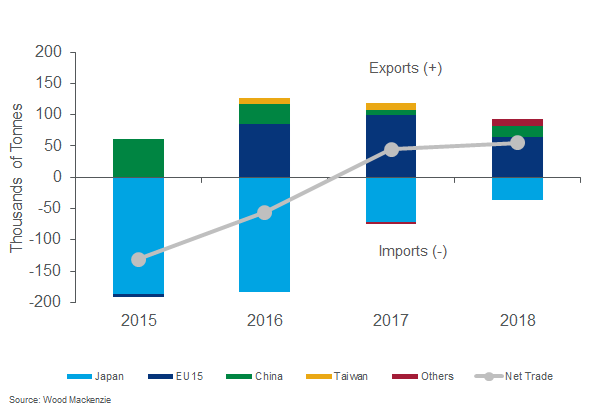

In the longer term, the closure of the cumene unit will bring the US market into a much finer balance. Some excess length in recent years, due to lower consumption into the phenol market as operating rates come down, has seen the US become a net exporter of cumene (albeit at volumes of less than 100 ktpa).

What does this mean for global cumene trade?

The chart below shows how exports into Europe have grown, with the US able to capitalise on cost-advantaged propylene. The significant export volumes from Japan into the US have shrunk over time. The closure of JX Nippon Oil & Energy Corp's 170 ktpa unit in Muroran, Japan, this year will further limit the country's export profile going forward.

Where will US phenol producers get 3 million tonnes of cumene a year?

If we take a closer look at the US cumene/phenol production landscape, the potential loss of the PES unit would bring the region into a balanced-to-tight position. On a pure nameplate-capacity basis, US phenol producers require just over 3 million tonnes/year of cumene. Without the 600 ktpa unit in Philadelphia, this leaves US cumene capacity at around this level.

US phenol producers would inevitably pull more on cumene, limiting any export volume availability. However, the potential addition of a world-scale cumene unit by INEOS Phenol to the European market would undoubtedly curtail this. Initially slated to be running by 2020, we have covered the announcement of plans around the unit at Marl, Germany, in an earlier Insight. Further news on this development is expected in the coming weeks.

US market has enough cumene to meet domestic needs... for now

In terms of capacity, the US market has enough cumene to meet existing domestic phenol needs. Even the producers that are integrated down into phenol have varying degrees of net length, although plans by INEOS Phenol to expand capacity at their Alabama site would leave them approximately 200-250 ktpa short on cumene given their existing capacity in Pasadena.

Depending on how the remaining cumene units run in the future, with growing pressure on US benzene availability in particular as more derivative MDI and potentially styrene production is slated to come online through the upcoming decade, the region may need to attract more imports or face some downstream rationalisation.