Discuss your challenges with our solutions experts

IMO 2020's knock-on effects for Gulf Coast waterborne crude flows

Refiners around the world are gearing up for an industry-wide inflection point

1 minute read

The shipping industry faces a world of uncertainty as IMO 2020's forthcoming rule changes the makeup of marine fuels to a lower 0.5% sulphur requirement. Ship owners will lean heavily on the supplies of complex Gulf Coast refiners that can turn the heaviest crudes into valuable low-sulphur diesel.

To plan for the onslaught of demand for middle distillates that will emerge with the marine fuels transition, refiners are adjusting typical maintenance schedules. Usually, facilities undergo planned outages for upkeep during spring and autumn months. This year, refiners are scheduling a heavier cycle of downtime for maintenance in the spring.

As cited in Bloomberg, we believe refiners will front-load 2019 work in the first half of the year to capitalize on fatter margins for middle distillates in the second half of the year. Beyond 2020, more tools will be needed to analyse the future for supplies of low-sulphur marine fuels.

How will crude flow into the U.S. Gulf Coast?

On the Gulf Coast, refiners are typically set up to process heavier sour crudes into high-value middle distillates at higher margins. Two market events have sparked near-term supply concerns for those imports:

- One large source of supply, Venezuela, was cut off from US refiners in January as new sanctions were implemented to block oil trade between the two nations.

- In a blow to Canadian supply, Enbridge's planned Line 3 expansion will be delayed to the second half of next 2020.

What's the future for U.S. crude exports?

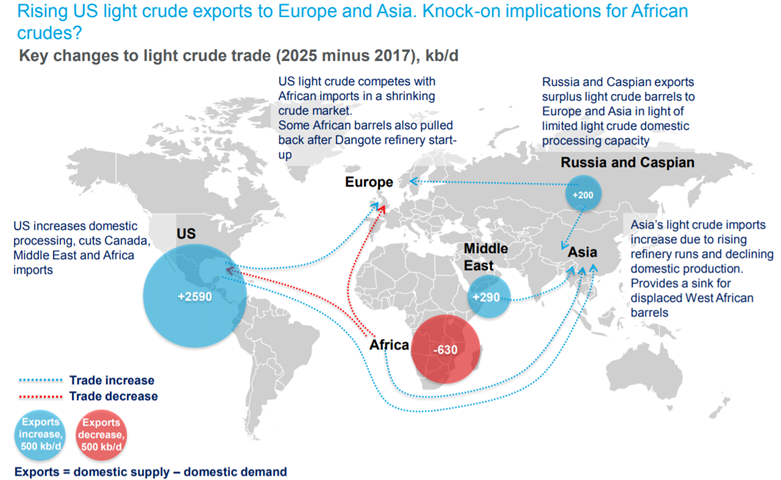

The light, sweet crude that is now exported from the Gulf Coast is another disrupter in global oil trade. How much US supply will saturate Asian and European markets is a growing concern for traders as the worldwide crude slate lightens.

Today, holding a view into the long-term outlook for crude trade flows is the key to capitalizing on IMO 2020 changes. Wood Mackenzie's Crude Trade Service offers a holistic view of how arbitrages will evolve over the years. We tie in macro oil analysis, key crude price benchmark forecasts and refinery evaluation tools to provide short- and long-term views on the next steps for crude trade flows.