Can LNG save China from winter gas shortages?

Prices, adequate supply and truck sourcing will be critical

1 minute read

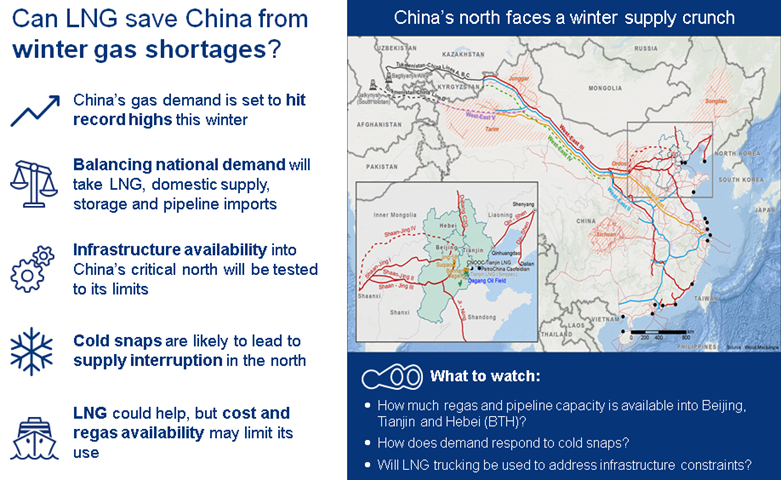

With new restrictions on the use of coal for heating in '2+26' cities and the industrial sector, China's gas demand is set to hit record highs this winter — growing by 23 bcm. The 2+26 policy alone will create 10 bcm of additional demand in Beijing-Tianjin-Hebei (BTH) and the surrounding areas, and industrial users that already switched to gas over the course of the year will continue to require gas in the winter months , increasing demand from 2016 levels. But will China have sufficient supplies?

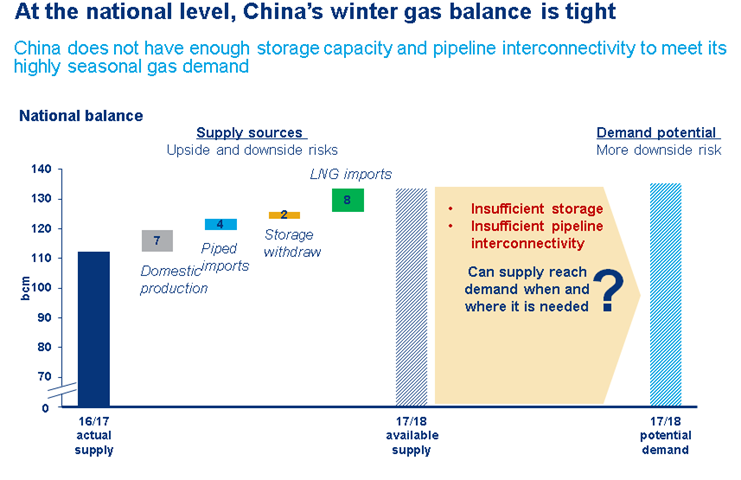

The supply and demand balance will be tight

Domestic gas production has performed well so far and is expected to grow up to around 7 bcm this winter. China's pipeline imports from Central Asia are also expected to grow 4 bcm this winter, due to new/amended supply contracts. Storage capacity also increased by 2 bcm, and LNG imports are expected to grow 8 bcm versus last winter. This raises supply by 21 bcm, very close to the anticipated 23-bcm growth in demand.

The highly seasonal north China market is at risk of shortages

The highly seasonal gas market in BTH sees demand grow at a fast pace and at massive scale. In 2017, we've already seen fairly high LNG imports in the summer months because of strong momentum in industrial switching. This means that the winter LNG demand will be even stronger as R&C heating demand will be added on top of the strong demand we've seen throughout the summer.

Will BTH be able to build up a large enough gas supply? If all goes according to plan, there should be just enough gas supply, but if the critical Shaan-Jing IV pipeline is late, other supplies fail or temperatures drop to lower-than-anticipated levels, consumers are likely to face interruption. In fact, Beijing has had a cold start to winter, and there have already been gas supply interruptions in Hebei.

LNG could step into the gap

To address shortages stemming from any number of setbacks in gas transportation and storage, China is likely to consider trucking LNG from other LNG terminals to BTH. But how competitively priced is LNG and can volume be guaranteed? LNG prices are already on the rise in Hebei ahead of expected increased demand, and we anticipate that this trend will continue. Whether price-sensitive industrial users and rural residential users choose to use expensive trucked LNG will be the big question. If more and more end users begin relying on trucked LNG, securing volume and trucks will become challenging. All those factors will limit the upside for LNG.

The uncertainties around LNG outlook will also affect LNG import prices. Regas capacity constraints in north China might limit LNG price upside in December to January. But a colder-than-normal end of the winter could further boost local LNG demand — and the global LNG price.

For more insight, purchase the full report

Can LNG save China from winter gas shortages?

In the news

- In China gas push, one-size doesn't fit all as CNOOC hires tankers

- China scales back northern gas push to avert heating crisis

China Gas & Power Service

Get unparalleled analysis on the key provinces from our Beijing-based experts. The China Gas & Power Service covers supply, demand and pricing fluctuations, as well as the outlooks for power capacity, fuels and transmission infrastructure. The service offers an in-depth China gas and power market analysis at the province level and provides detailed analysis on the key provinces driving gas demand growth, supply and price dynamics