Discuss your challenges with our solutions experts

In the first editorial in this series, we discussed project choice for oil and gas Majors at a high level, noting that the Majors can capitalize on their competitive advantage by investing in offshore wind and ultra-large solar photovoltaics. In this piece, we draw from a second report, where we explore the path from one or two profitable investments to genuine scale in renewables.

Scaling up

Oil and gas Majors claim 15 percent of the global oil and gas market. Matching this scale in wind and solar would require investment of over US$200 billion. While achievable, this means the Majors need to either develop or buy a lot of renewable energy projects.

When thinking about scaling up, it’s useful to think of renewable investment like a swimming pool. In the shallow end, you find easier types of solar and wind investments, such as onshore wind and solar projects in developed markets. The shallow end is crowded, with many swimmers vying for space. Barriers to entry to “shallow end” projects are low – these projects are highly bankable, low risk, and have low technical complexity. They typically deliver lower returns – the shallow end is a bad place to achieve scale.

The deep end of the pool has much more room to achieve scale. This is where you find complex projects like offshore wind and ultra-large scale solar PV, often found in emerging markets. We’d also put mergers and acquisitions in the deep end; most of the developers in the shallow end don’t have M&A on their agenda.

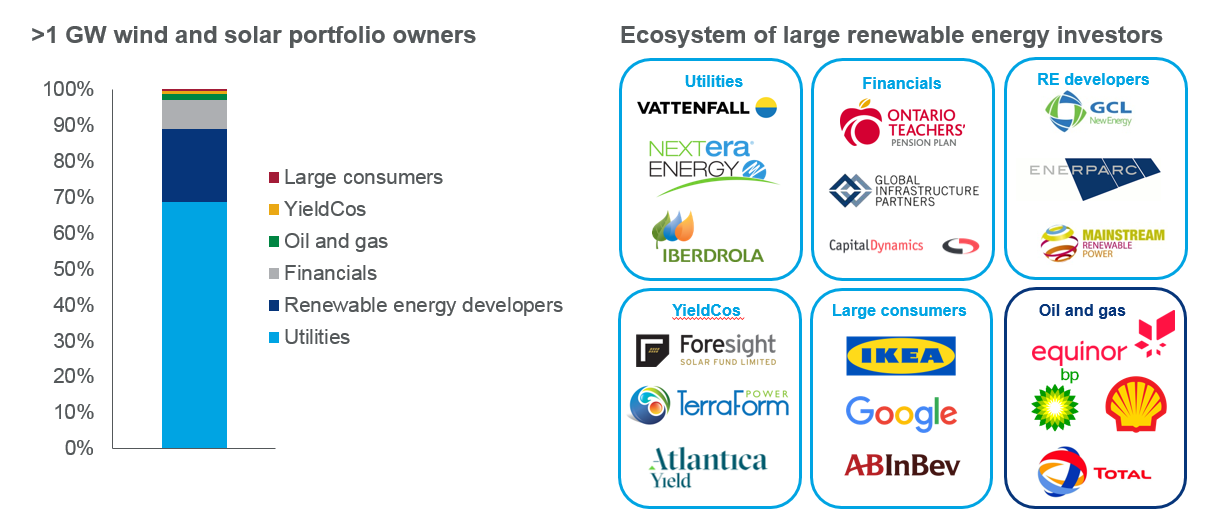

Only a few companies find it worthwhile to play in the deep end. To be competitive, you need to have one at least one of a few things: large balance sheets, tolerance for above-ground risk, existing relationships, or technical know-how.

The deep end is where oil and gas majors are most likely to achieve diversification at scale and deliver better returns. In the competitive and fragmented renewables market, oil and gas companies can achieve scale via routes that are too challenging for competitors, thereby setting themselves up for a stronger position as the renewables market matures.

Take the example of ultra-large solar PV. In renewables, scale demands scale. Large PV projects tends to be in emerging markets where land is more plentiful. A big balance sheet makes it easier to finance large projects in risky emerging markets, where project finance is harder to come by or more expensive and where higher rates of equity are required. Majors can also rapidly deploy large amounts of capital, which competitors may find challenging.

Large renewable energy procurement programs are becoming more common. 1 gigawatt is considered a “mega large” project in renewables; “ultra-large” procurements are on the horizon. India is currently considering a 10 gigawatt solar auction and procurement overall is on an upward trajectory. Winning a large tranche of such a procurement program would require several billion dollars of capital. This is the domain of the Majors.

Another route to scale is M&A. The Majors already have lots of experience with inorganic growth from their legacy operations. Three distinct types of M&A will help the Majors achieve scale and realize the best returns in renewables: acquiring power trading capabilities, purchasing operational renewables projects, and capturing new technology.

Investing in power trading and supply capabilities can help secure returns from merchant projects. Wind and solar investors are increasingly conscious of exposure to wholesale price changes. Historically, renewable energy projects have been protected from power prices under many subsidy regimes. In the future, wholesale price evolution will have a significant impact on internal rates of return. Experience with – or acquisitions in -- power trading may prove helpful to hedge some or all of a project's output in advance of production to lock in revenues.

Acquiring operational renewable energy projects is a fast-track to scale. Many oil and gas Majors have already begun to explore this route, with investments in Silicon Ranch, Lightsource, and others. The approach can be expensive, however. Smaller developers are unlikely to compete in this space, but the Majors face competition from pension funds and institutional investors.

Oil & gas Majors are just dipping their toes in the water. There is already some clarity on which companies are prepared to dive first into the deep end of the renewables pool. Return to our first report here, and stay tuned for the next editorial, which will pull from the third and final report in the series.

The Oil & Gas in Renewables series is available as part of our Global Solar Markets Service and our Global Wind Service.