Find out how our Consulting team can help you and your organisation

The challenge: Helping the world get the required mined materials for the energy transition in an innovative, cost-effective, and sustainable way

Society is engaged on an accelerated decarbonisation path globally, with net-zero pledges now covering ~88% of global emissions. On this journey, renewable energy and low-carbon technologies will play an increasing role within the evolving energy transition landscape. In parallel, mined materials will be crucial in providing the structural components needed to advance the development of all major energy transition drivers. This represents a US$ 3.2 trillion investment opportunity in the mining and metals sector, paving the way for the development of new projects, and innovative new technologies.

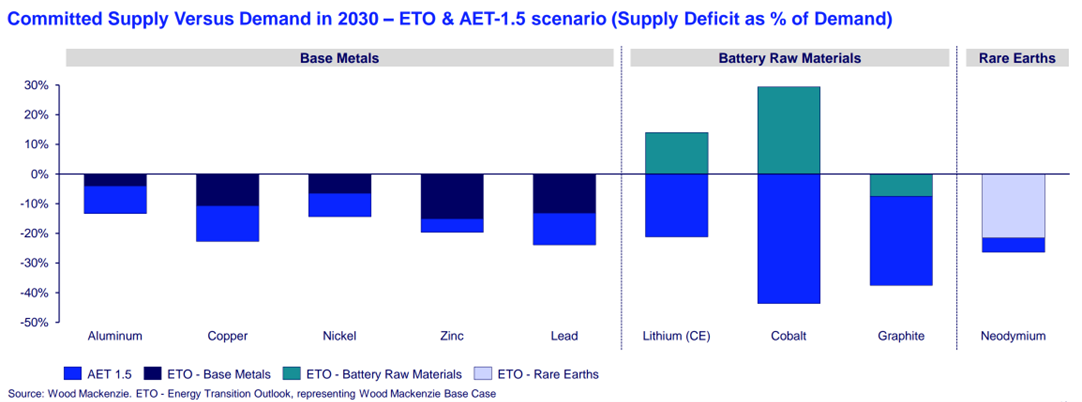

However, the path to net zero is not free of obstacles. Significant supply deficits are expected across base metals, battery raw materials and industrial minerals, unless new projects are commissioned, especially under an accelerated energy transition scenario. For example, under Wood Mackenzie’s base case scenario, by 2030 copper will undergo a theoretical deficit of ~12%, which could grow to >20% under an accelerated decarbonization scenario. This situation makes it clear that without more mining, the energy transition will not be possible. Nevertheless, mining cannot occur at any cost, with social and environmental awareness demanding more from mining companies when it comes to building and operating a mine.

The energy transition requires a dramatic increase in the production of metals like copper and nickel. However, separating minerals from the rock in which they are trapped requires tremendous amounts of energy to grind the ore into tiny particles. Globally, mineral comminution is estimated to consume around 4% of global electrical energy, which in turn has a significant emissions footprint. I-ROX proposes to replace conventional grinding equipment with an innovative process that leverages the science of plasma physics to pass electrical arcs through rock, causing it to burst from the inside using tiny amounts of energy. This disruptive new approach could drastically reduce energy consumption and associated emissions while increasing the recovery of critical minerals.

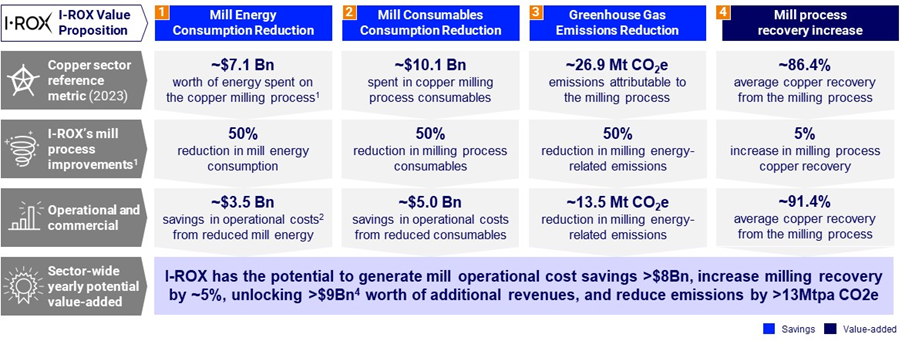

The potential value is eye-catching. Reduced energy and consumables costs with higher recoveries could generate $18 billion per year for the copper industry alone. In addition to the cost savings, the potential reduction in energy consumption has a corresponding abatement potential of nearly 500Mt CO2e, which is comparable to the emissions of a country like Canada.

In this context, I-ROX sought the guidance of a strategic advisor – with an established track record, industry expertise, and access to reliable data – to size its market opportunity and quantify its commercial value proposition.

“To balance the scales, we need to make mining more efficient, productive, and sustainable. At I-ROX we tick all three of these boxes. Our commitment to sustainability is at the forefront of all we do. However, building new technologies is high risk and so we needed to show our investors the size of the prize, which is where Wood Mackenzie came in. Having worked with them in the past, I knew they were ideally suited to assist us in quantifying the market opportunity for I-ROX.”

Nathan Flaman, Chief Executive Officer, I-ROX

Our approach: Leveraging Wood Mackenzie’s world-class proprietary analytical tools and datasets to quantify I-ROX’s market opportunity and value proposition

As part of its fund-raising process, I-ROX approached Wood Mackenzie to help quantify its addressable market and establish the commercial value proposition of its technology in terms of cost savings (mill energy and consumables consumption), revenue generation (mill process recovery), and environmental impact (greenhouse gas emissions).

Our first step was to meet with I-ROX’s CEO to fully understand the company’s objectives, goals, and vision. This was also used as an opportunity to understand I-ROX’s disruptive technology, its differences with the conventional comminution process, and its key value levers. On this basis, Wood Mackenzie prescribed a four-step framework:

- Formulating the industry call for action

- Defining I-ROX’s addressable market

- Baselining the industry’s footprint

- Quantifying I-ROX’s commercial value proposition

The analysis spanned a wide range of commodities critical to the energy transition, with an initial focus on copper (used as a representative commodity in the following charts). To address I-ROX’s request, Wood Mackenzie leveraged its differentiated expert knowledge and capitalised on proprietary analytical tools and datasets.

The Market Service provided us with information on global demand & supply, resources & reserves, average grade & recoveries, among others. The Asset Service enabled us to conduct a thorough analysis of the operational costs broken down by year, region, country, process, and production input (labor, power, consumables, services, etc.).

This level of detail allowed us to focus our analysis on the processing stage of the value chain, where I-ROX could potentially generate the highest savings. Thereby, we could derive specific milling costs, before going in-depth to understand, for example, milling energy consumption by region / per tonne, as well as assets-specific variations.

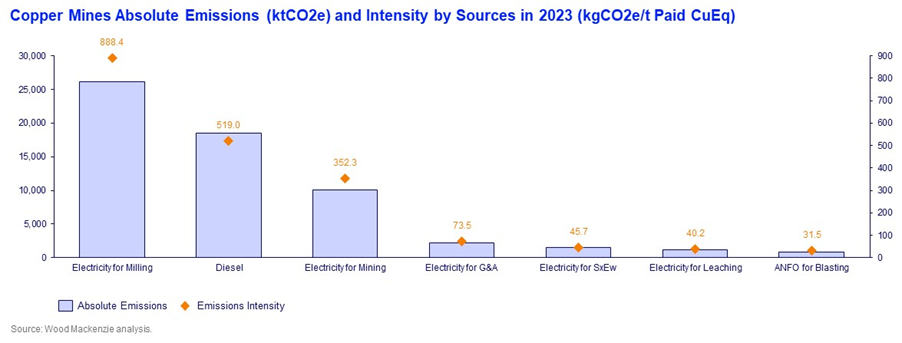

Furthermore, the Emissions Benchmarking Tool enabled us to quantify absolute emissions and emissions intensities by region and source. This was accompanied by an analysis of decarbonisation trends, and how the industry’s focus on decarbonising power generation and discovering innovative ways to minimise energy consumption, fit I-ROX’s aspirations.

The result: Determining I-ROX’s commercial value proposition in terms of cost savings, revenue generation, and environmental impact

1. Formulating the industry’s call for action

The industry’s call for action was formulated based on the increased demand for critical minerals derived from the energy transition and the theoretical supply gaps that will emerge across all key commodities.

Our base case Energy Transition Outlook (ETO), consistent with 2.5°C global warming, estimates a decrease in global copper supply at ~3.2% CAGR from 2024. The trend accelerates further in the Accelerated Energy Transition (AET) scenario, consistent with 1.5°C global warming, affecting a range of commodities and driving the market to supply deficits.

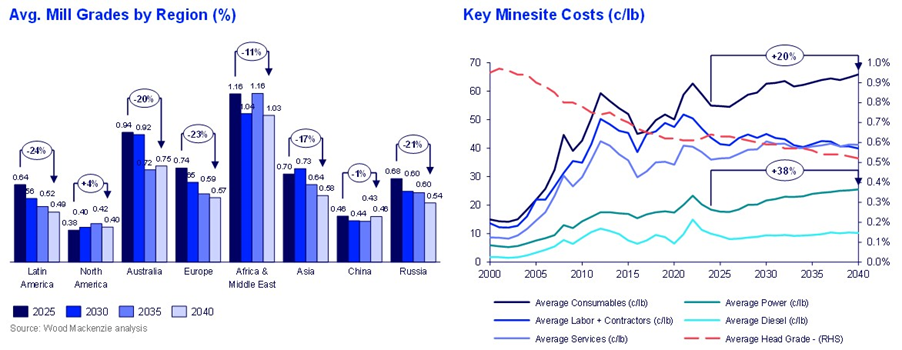

Additionally, the industry is also grappling with productivity challenges, primarily linked to a consistent decline in ore grades and an increase in ore hardness. These complexities are expected to drive costs up, compelling producers to invest in innovative ways to enhance the efficiency of their processes and reduce costs.

2. Defining I-ROX’s addressable market

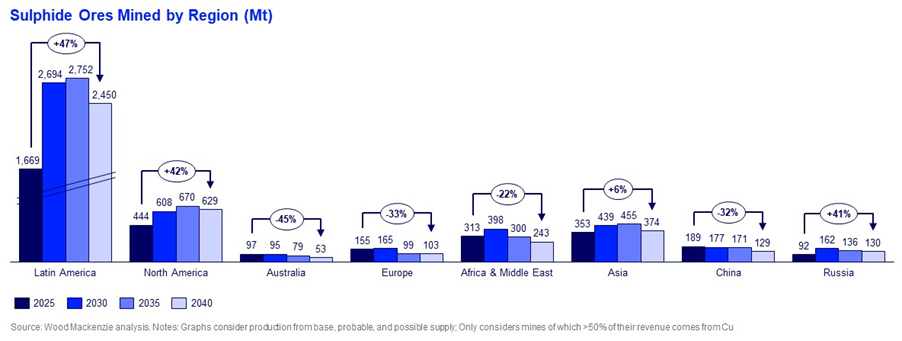

After illustrating the future landscape of the metals and mining sector, we proceeded to analyse I-ROX’s addressable market. Since I-ROX’s technology disrupts the conventional milling process, we leveraged Wood Mackenzie’s Market Service to understand the current footprint of sulfide mines, as well as quantify the pipeline of projects. In the case of I-ROX, we estimate that, in copper alone, approximately 95% of projects in the pipeline consist of sulfide ores. These projects are distributed across multiple locations, with Latin America holding the vast majority of the resources.

3. Baselining the industry’s footprint

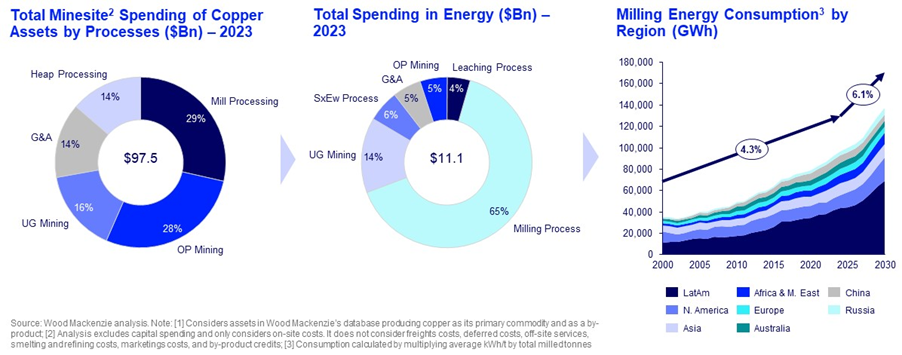

Using Wood Mackenzie’s Asset Service and Emissions Benchmarking Tool, we went on to establish an understanding of the current mine spending profile. In 2023, copper assets spent ~$97.5 bn globally, with ~42% allocated to ore processing, of which ~29% ($27.8 bn) went to the concentrator plant. Given this, the milling process is the most energy-intensive process in the mining value chain and a valuable opportunity for I-ROX’s technology, as energy consumption is expected to continue to grow to the end of the decade.

Furthermore, in copper production, the milling process accounts for ~44% of total carbon emissions, primarily due to the electricity utilised in the comminution stage. This presents a significant opportunity for I-ROX, as its technology holds the potential to reduce energy consumption in milling. This reduction not only leads to a decrease in emissions but also alleviates energy capacity and infrastructure demands.

4. Quantifying I-ROX´s commercial value proposition

As a result of the analysis, Wood Mackenzie estimates that I-ROX has the potential to unlock in excess of $17Bn worth of additional value on a yearly basis for the copper mining industry, an additional ~8% of the total yearly industry turnaround.

The incremental value-addition is expected to come mostly in the form of operational cost savings (reduced mill energy consumption and mill consumables) and increased revenue generation (increased mill process recovery).

Furthermore, I-ROX’s pulse-powered technology targets tensile weakness in rocks, substantially reducing the time and energy involved in comminution, potentially resulting in ~50% reduction in GHG emissions attributable to the milling process.

Get in touch

Whether you are a new or more experienced player and require assistance navigating the energy transition our global experts are here to help.

If you would like to set up an initial discussion, please get in touch.