As part of the largest amount of funding ever provided for US highway reauthorization, America’s Transportation Infrastructure Act of 2019 earmarks capital for public EV charging infrastructure.

The bill would authorize $287 billion to finance the next five years of Highway Trust Fund operations. A proposed billion-dollar carve out for alternative fueling stations would give the opportunity for competitive grants for electric, natural gas and hydrogen stations.

“With over 1.75 million electric vehicles (EV) in North America at the end of 2018, a nearly 60% increase from 2017, the need for expanded electric vehicle charging infrastructure is greater than that of the other two fuels,” said Ben Kellison, research director at Wood Mackenzie.

EV charging stations: plugging into global infrastructure

In the rest of the world, governments and private enterprises alike are getting charged up for the switch to electric cars. To gauge the true scope of how EVs will change the landscape, consider that by 2020, 9.4 million EVs be on the road, with 7 million residential charging points in service. By 2030, those numbers climb to 74 million EVs and 30 million charging points.

Electric car charging stations: supporting EV market share growth

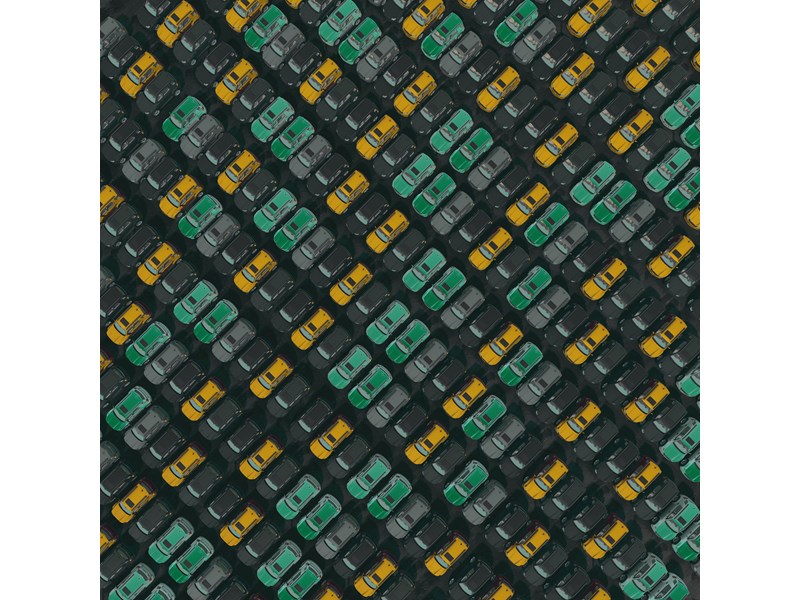

Over the next two decades, the transportation industry will grapple with several disruptive technologies, including: electromobility, car sharing, micro-mobility, and eventually autonomous vehicles. The rise of battery-based powertrains will also have major impacts on the electricity and fossil fuel value chains. This will result in increased stress for grid operators and the need for collaboration between the transport and utility sectors.

Ride-hailing companies are using digital technologies to screen and hire vast networks of at-will contractors to compete with traditional taxi services and third-party delivery services, while micro-mobility is taking trip market share from private for-hire transit operators, public services, and companies offering vehicles with fixed or variable drop-off locations available through apps. And finally, autonomous vehicles will lead to opportunities for innovation in ownership models, development of new revenue streams and a drastic reduction in costs.

EV charging station market: 3 areas of opportunity

Many governments are now actively promoting EVs. From direct investment and regulations (e.g., China), to subsidies (e.g., Europe and North America) and concerns over the environment, administrations from all over are capitalizing on the EV revolution.

- Regulatory: Energy market and utility regulations need to support EV growth by simplifying the regulatory process and promoting collaboration.

- Partnerships: Stakeholders are encouraged to support EV charging infrastructure, including public-private partnerships and industry consortia.

- Software: Interoperability, smart charging, e-roaming and the growth of new platforms will unite automakers, network and service providers, and equipment manufacturers.

Charging station infrastructure: 4 roadblocks to development

Despite a maturing market, EV charging station infrastructure also faces some critical factors that could affect is future growth:

- Vehicle range: Longer range means larger batteries. Faster public charging stations will be needed to bridge a public/private divide, with smart charging and vehicle-to-grid critical in reducing grid pressure for level II charging infrastructure.

- User behavior: Depending on adoption of smart charging, charging behavior patterns will impact the grid during specific times of day, on a particular distribution feeder, substation or transmission zone is inevitable.

- Multi-unit dwelling (MUD) penetration: Promoting EVs to apartment dwellers requires a different approach then for those in single family homes. Apartment dwellers will have to use some combination of MUD-located, workplace and public charging infrastructure creating uncertainty around where charging will be need and most profitable.

- EV ride-sharing: The time required to charge vehicles remains a major barrier to EV ride-sharing. Ride-sharing vehicles make money off of fares not time refueling, so every minute spent charging is a minute where a drive remains idol foregoing additional revenue. Longer range vehicles help reduce this concern, but still may not offer enough range to complete a full shift. This creates demand for fast chargers in high traffic locations that can reduce charging times and get drivers back on the road.

Public car charging stations are a key to EV market share growth

The availability of public charging infrastructure is a major factor in the adoption of electric vehicles. Without robust growth in EV sales, the economics of developing, owning and operating public charging infrastructure will diminish due to low utilization and thus, insufficient revenue.

This leads to a Catch-22. Without significant build-out of public charging stations, many potential EV customers will be dissuaded by range anxiety concerns, while other drivers will be resistant to “plug in.”