1 minute read

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin oversees our Europe, Middle East and Africa research.

Latest articles by Gavin

-

The Edge

A world first: shipping carbon exports for storage

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Nigeria’s bold strategy to double oil production

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

-

The Edge

Upside pressure mounts on US gas prices

-

The Edge

The coming geothermal age

Capital is the lifeblood of the global gas industry. The ability of companies to competitively finance new supply has supported a 26% increase in gas production over the past decade, with suppliers, lenders and shareholders benefitting from the long-life and reliable cash flow that gas projects typically provide.

Developers able to secure long-term contracts or capacity commitments with customers have found supportive lenders for non- or limited-recourse project financing. Driven by Asian demand, FIDs on new LNG projects hit record levels in 2019. At the other end of the spectrum, the deep, liquid gas markets of North West Europe and the US have attracted tens of billions of dollars in debt and equity financing to fund supply growth.

Tackling carbon emissions and urban air pollution are increasingly urgent goals, particularly across Asia. The cleaner-burning credentials of gas give it a starring role. We estimate around 200 bnboe of new gas development is needed to meet global demand growth out to 2040, including a more than doubling of LNG capacity. The price tag is a phenomenal US$2 trillion.

But the industry can’t be complacent. Two price crashes in five years, the Covid-19 pandemic and the impact of the energy transition are transforming corporate and investor attitudes towards all upstream investment, including gas. Future supply must work at acceptable hurdle rates, lower oil and gas prices and, increasingly, more robust internal carbon price assumptions. Fewer projects will make the grade.

Gas contracting is also changing. The long-term deals that for decades lured LNG project financiers are fading into history. Buyers in Asia now want far greater flexibility, not contractual straightjackets. But without these to underpin FIDs, projects are looking to equity lifting, with joint venture partners and third parties taking LNG into their portfolios – along with more price and demand risk.

Carbon is transformational. Gas may be less polluting than coal and oil, but ESG and stricter lender criteria are putting gas’ emissions intensity in the spotlight. Liquefaction, venting, flaring and fugitive emissions are the major culprits. European policymakers and investors are today at the vanguard – but others will follow, and no investment will be untouched.

The industry must now respond, doubling down on reducing costs, tackling carbon head-on and living and breathing ESG. Suppliers are embracing non-traditional sources of capital, seeking out new and more diverse partners and innovating with how gas is priced and sold. The successful gas players of the future will be as focused on trading and optimisation and partnering with customers to reduce their emissions as they will be on developing supply and building liquefaction.

The future of gas investment will depend on it.

Gas demand will double in China and India by 2040, bolstered by clean air policies, rising per capita income and gas-consuming capital stock with decades still to run.

The robust outlook for gas

Gas will play a critical role in meeting future energy demand. While some gas demand has been permanently lost to Covid-19, we expect consumption to follow a parallel growth path to our pre-pandemic view as the global economy rebuilds.

Asia is the engine room, with the region’s gas demand growing by an average of almost 3% a year over the next two decades. Gas demand will double in China and India by 2040, bolstered by clean air policies, rising per capita income and gas-consuming capital stock with decades still to run.

Current low gas prices are supporting demand growth, prompting pro-gas policies and infrastructure developments as governments and companies look to take advantage. Shifts in contracting terms are also encouraging gas use in Asia, as lower levels of oil indexation reduce gas prices through the medium term compared to historical averages.

Investments must pass greater scrutiny on long-term demand and price

Margins for gas projects can be modest, requiring only limited downside to damage profitability. Confidence in demand and pricing is therefore an important part of project evaluation and lending. And while risks vary by region, an acceleration in decarbonisation is an increasing concern.

As a result, both companies and investors are rigorously stress-testing the impact on demand and prices of an emissions trajectory more closely aligned with 2 °C global warming pathways by 2050. This is in line with outlooks such as the IEA’s Sustainable Development Scenario and Wood Mackenzie’s Accelerated Energy Transition-2 scenario. In such 2 °C scenarios, gas demand peaks earlier as electrification expands and disruptive forces – including renewables, green hydrogen and carbon removal technologies – attract capital and edge out gas.

The US$2 trillion supply opportunity

Our base case requires some 200 bnboe of new gas resource developments to meet demand through to 2040. The major contributors will be the US, Russia and China, which, together, currently account for almost half of global gas supply, and Qatar with its additional LNG mega trains. Combined, the ‘Big 4’ will meet 60% of global gas demand by 2040.

We estimate almost US$2 trillion of capital is needed to deliver this growth in supply. We identify 124 bnboe of discovered reserves and a further 44 bnboe of yet-to-find resource, requiring US$1.36 trillion of capital investment to bring onstream. Pre-FID LNG projects will supply 340 Mtpa by 2040, requiring a further US$0.6 trillion of investment.

It is worth noting that a 2 °C demand scenario dramatically alters this outlook, with future supply requiring a more modest, though still considerable, US$700 billion of new investment as global gas demand peaks earlier.

Significant further investment will also be required in both midstream and downstream infrastructure to ensure future demand is met. Ensuring access to capital in many developing markets and increasingly complex environmental hurdles in mature markets is likely to present challenges.

Gas’ carbon challenge and the “fundamental reshaping of finance”

For investors across virtually all asset classes, ESG – and, specifically, carbon – is rocketing up the agenda. This is driving what BlackRock CEO Larry Fink has called a “fundamental reshaping of finance”. Sustainable investment is booming and investor activism on carbon has gone mainstream as more fund managers embrace ESG screening.

This increasing scrutiny of gas’ carbon intensity is shaping investment decisions on future supply. Projects must have rigorous plans to avoid or offset carbon emissions to compete for capital as traditional financing models adapt to include stricter criteria. In the future, end-user emissions (Scope 3) will also feature prominently.

Without effective carbon mitigation, gas risks being seen in the same light as other hydrocarbons.

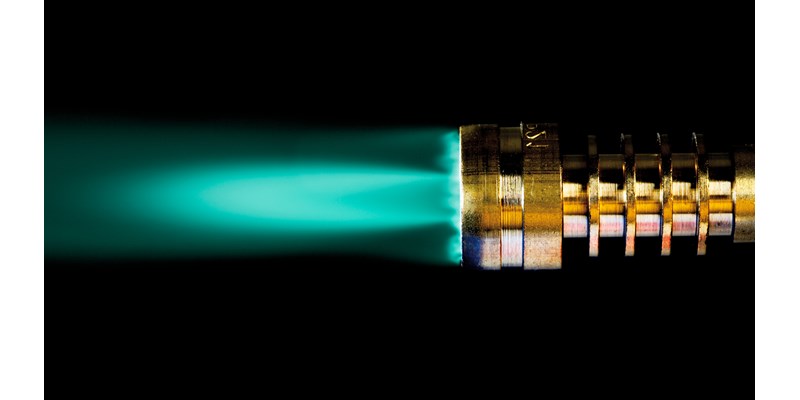

LNG and carbon emissions intensity

Its low carbon intensity on burning makes gas the cleanest hydrocarbon – but this isn’t the same as clean. Scope 1 and 2 emissions vary by project type, with liquefaction, venting, flaring and fugitive emissions in the spotlight.