Learnings from RE+: A sunny outlook for US solar and storage

The Inflation Reduction Act has given a boost to key renewables segments, and their future is looking bright. Our solar and storage experts recap some of the biggest takeaways from RE+ 2023

3 minute read

Michelle Davis

Head of Global Solar

Michelle Davis

Head of Global Solar

Michelle leads our solar research, identifying emerging industry themes and cultivating a team of solar thought leaders.

Latest articles by Michelle

-

Opinion

What could further trade actions mean for the US solar supply chain?

-

Opinion

Sunny skies ahead: the solar market and supply chain in 2024 and beyond

-

Opinion

Our top takeaways from the Solar & Energy Storage Summit 2024

-

Opinion

The US solar industry is off to a strong start in the first quarter

-

Opinion

Is the IRA paying off for the US solar supply chain?

-

Opinion

US solar shattered records in 2023, but will this continue in 2024?

Allison Weis

Global Head of Storage

Allison Weis

Global Head of Storage

Allison leads our global research into energy storage.

Latest articles by Allison

-

Featured

Energy storage 2025 outlook

-

Opinion

The state of the US energy storage market

-

Opinion

Learnings from RE+: A sunny outlook for US solar and storage

Zoë Gaston

Principal Analyst, US Distributed Solar

Zoë Gaston

Principal Analyst, US Distributed Solar

Zoë's areas of focus include residential solar policy and project finance

Latest articles by Zoë

-

Opinion

The US solar industry faces a perfect storm of Federal policy and trade challenges

-

Opinion

Insights from Wood Mackenzie’s Solar & Energy Storage Summit 2025

-

Opinion

US residential solar turbulence persisted through 2024

-

Opinion

Solar surge: the US solar industry shatters records in 2024

-

Opinion

US residential solar market turmoil reached new heights this year

-

Opinion

RE+ 2024: Our 7 biggest takeaways

With the Inflation Reduction Act (IRA), the Biden administration has sought to give the US renewables sector a much-needed boost, catalyzing the country’s energy transition. Early evidence indicates that the solar power and energy storage sectors are reaping the benefits.

At the recent RE+ event in Las Vegas, analysts from Wood Mackenzie’s Power & Renewables team presented detailed insight on the future of the US solar and storage markets. Fill out the form to download a complimentary extract with a selection of slides from their presentation, or read on for a brief look at some of the key topics.

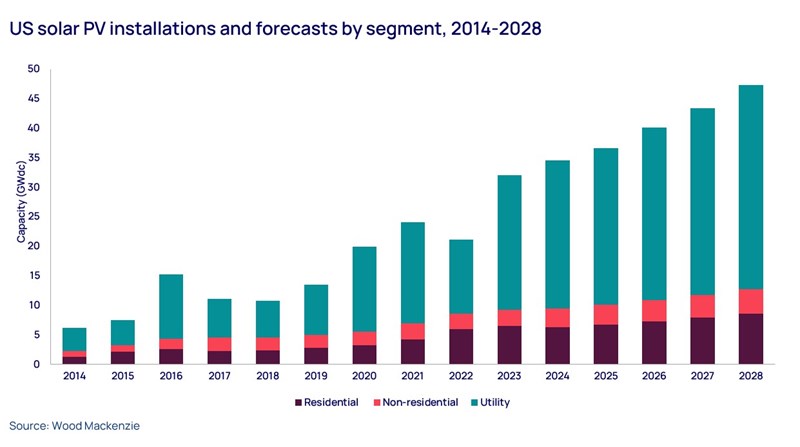

Stellar growth in solar installations in 2023, and the future outlook is sunny

We expect growth in new US solar installations in 2023 of 52%. This comes after a disappointing 2022 in which supply chain issues and uncertainty saw a year-on-year reduction (see chart below). Second quarter installation figures support our expectations for a healthy uptick in new capacity. Going forward, growth should settle into a less dramatic but still very healthy 15% average from 2023 to 2028.

Will supply chain constraints ease further?

A key factor in solar installation growth has been the slow stabilisation of supply chain conditions. President Biden’s two-year waiver on solar import tariffs instituted in June 2022 helped ease pressures in the short term, and the anti-circumvention investigation recently concluded, with five out of eight companies deemed culpable.

Manufacturers are now sending test shipments with non-Xinjiang Chinese polysilicon (the raw material use to create photovoltaic cells). However, it’s not yet clear when this equipment will be able to pass US customs. It also remains to be seen what final tariff rates will be implemented once the two-year waiver period is over.

While the news on solar equipment imports is broadly positive, the domestic solar manufacturing sector faces its own set of issues. Download the complimentary extract for more on this.

Energy storage gets a boost

With most renewables, including solar, providing intermittent rather than on-demand power generation, energy storage will be a vital element of any successful energy transition. The IRA, along with local policy, state incentive programmes, and market volatility growth are significant drivers strengthening this emerging industry.

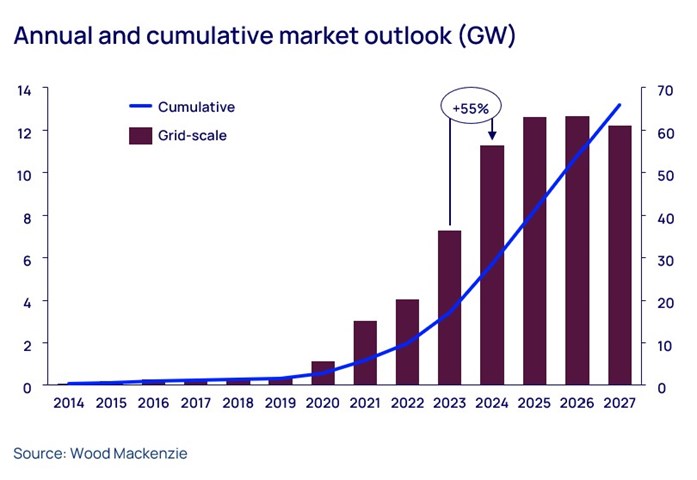

Growth in grid scale storage will be robust, with 7.3 gigawatts of new capacity expected overall in 2023 and increasing by an additional 55% to 2024, before settling into a steadier rate of increase through 2027. Q2 2023 was a record-breaking quarter for the segment, but project delays are rampant and interconnection queues with the grid are a significant headwind in most areas of the country.

Increased lithium and other battery raw material supply has led to a precipitous drop in prices since Q1 of this year, with energy storage turn-key prices following a similar decline after peaking in late 2022/early 2023. Module manufacturing supply also continues to increase through 2023, which will further drive prices down.

The interest for North American manufacturing is significant and growing, but the available capacity is not yet able to meet local demand. Skilled labour supply is tight, and engineering, procurement and construction (EPC) contract costs have increased, making strong EPC relationships key to project economics.

In the behind-the-meter storage market, the residential segment shows the most potential for growth. A lack of policy and financial incentives at the state level has hindered non-residential storage, but threats to the grid from extreme weather and a desire for backup look set to drive substantial growth in residential installations. Largely due to these factors, we expect overall behind-the-meter capacity to jump up 86% between 2023 and 2024 and continue to grow at a healthy clip through 2027.

Learn more

Don’t forget to fill in the form at the top of the page to download your complimentary extract from the report. This includes detailed analysis of global and US domestic solar equipment production capacity, and energy storage system demand, supply and pricing.