The US solar industry is off to a strong start in the first quarter

But mixed trends across segments will contribute to flat growth in 2024

4 minute read

Michelle Davis

Head of Global Solar

Michelle Davis

Head of Global Solar

Michelle leads our solar research, identifying emerging industry themes and cultivating a team of solar thought leaders.

Latest articles by Michelle

-

Opinion

What could further trade actions mean for the US solar supply chain?

-

Opinion

Sunny skies ahead: the solar market and supply chain in 2024 and beyond

-

Opinion

Our top takeaways from the Solar & Energy Storage Summit 2024

-

Opinion

The US solar industry is off to a strong start in the first quarter

-

Opinion

Is the IRA paying off for the US solar supply chain?

-

Opinion

US solar shattered records in 2023, but will this continue in 2024?

Zoë Gaston

Principal Analyst, US Distributed Solar

Zoë Gaston

Principal Analyst, US Distributed Solar

Zoë's areas of focus include residential solar policy and project finance

Latest articles by Zoë

-

Opinion

The US solar industry faces a perfect storm of Federal policy and trade challenges

-

Opinion

Insights from Wood Mackenzie’s Solar & Energy Storage Summit 2025

-

Opinion

US residential solar turbulence persisted through 2024

-

Opinion

Solar surge: the US solar industry shatters records in 2024

-

Opinion

US residential solar market turmoil reached new heights this year

-

Opinion

RE+ 2024: Our 7 biggest takeaways

The US solar industry had a record-setting first quarter this year. Installations were at 11.8 gigawatts-direct current (GWdc) of capacity in the first quarter of 2024, a 79% increase from Q1 2023 and a 40% decrease from Q4 2023. Q1 2024 was the second-best quarter ever for the industry, other than the last quarter of 2023.

After achieving record installation growth in 2023, we expect the US solar industry to add a similar amount of capacity in 2024. In our US solar market insight Q2 2024 report, created in collaboration with the Solar Energy Industries Association (SEIA), we highlight the segment dynamics contributing to our expectations of flat growth and more details on the numerous trade policy developments the US solar industry is contending with.

Fill in the form at the top of the page for a complimentary copy of the 15-page executive summary. Or read on for some key highlights.

2024 installation growth will be mixed across the various solar segments

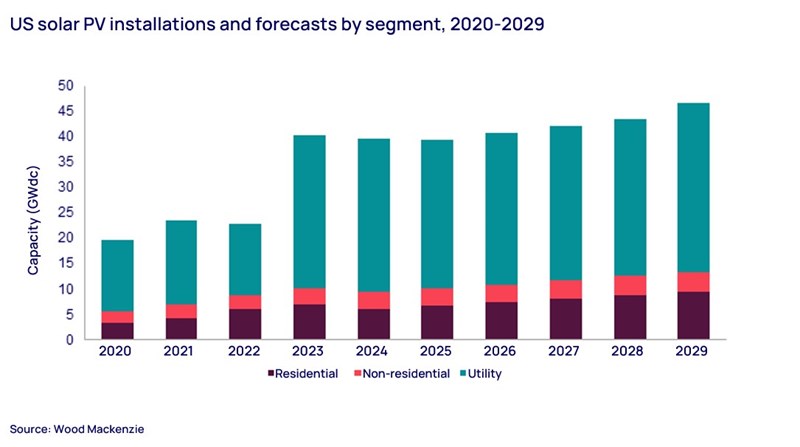

While we do not expect growth this year compared to 2023, the US solar industry will add nearly 40 GWdc of installed capacity, double the market size from just two years ago. Our 2024 outlook reflects mixed trends across segments.

The residential solar market will shrink 14% year-over-year as California residential volumes decline by nearly 40% due to the net billing transition. While solar-plus-storage installations are on the rise, this doesn’t compensate for the declines in standalone solar. Overall residential sector growth outside of California is expected to be flat as higher financing rates continue to challenge residential solar sales.

However, the total non-residential segment is forecast to grow in 2024. After 23% growth in 2023, commercial solar is expected to increase by 14% this year, primarily driven by growth in California and Illinois. While this might seem counter to the declines in residential solar installations in California, commercial solar is experiencing the same dynamics but on a delayed timeline due to longer development cycles.

Installations are currently growing thanks to the surge in NEM 2.0 projects. But installations will drop off next year after this pipeline is built out.

Community solar growth will slow to 4% this year after increasing 10% last year. While some states, such as Illinois and Virginia, are expanding, growth has slowed in more mature markets, and new state programs have been slow to form.

Utility-scale solar growth will remain flat in 2024 and 2025. The pipeline is strong, but buildout is being suppressed by a lack of labor availability, high voltage equipment constraints, and continued trade policy uncertainty, among other headwinds.

The solar industry continues to navigate tariff uncertainty

As recently as a year ago, module availability was a constraint for the industry, but the situation is quite different now. Not only has the global solar supply chain expanded, but module imports to the US have risen significantly over the last year. Plus, domestic quarterly production in the US roughly doubled in the same timeframe. Although inventory levels are high and module availability is no longer a major constraint, numerous solar tariff policy changes in the last few months could shake up the solar supply chain yet again.

First, but least impactful, is the announced increase of the Section 301 tariffs (from 25% to 50%) on imports of Chinese solar cells and modules. Given the small volume of Chinese imports compared to total imports (0.09% for modules and 0.03% for cells in 2023), the direct impact on the US solar industry is insignificant.

Second, the Biden Administration announced it will eliminate the Section 201 tariff exemption for bifacial modules after a 90-day grace period. Bifacial modules, which make up the majority of module imports, will now be subject to a 14.25% tariff (which will be reduced to 14% in February 2025) before expiring in February 2026. This will raise module costs by about $0.03-0.04/watt, according to Wood Mackenzie’s latest module pricing for the US market. While we’ve accounted for these new tariffs in our solar outlooks, the impacts are negligible as the tariff is relatively short-lived, and there is healthy module availability for projects in development.

Finally, potential new antidumping and countervailing duties (AD/CVD) are on the horizon. In late April, a group of US solar manufacturers filed petitions with the US Department of Commerce and the US International Trade Commission seeking new AD/CVD tariffs on imports of solar cells and modules from Cambodia, Malaysia, Thailand, and Vietnam. There is considerable uncertainty regarding the timeline of tariff applicability and final tariff levels. But given that there is sufficient manufacturing capacity outside of Southeast Asia to serve the US market, though, we anticipate the industry will be able to adapt quickly.

However, these new tariffs would undoubtedly raise module prices for the US market temporarily. We expect the market to absorb these higher prices since demand for solar projects remains high. But the degree to which this will impact the US solar industry remains uncertain.

Modest growth for the US solar will continue through 2029

From 2024 to 2029, the US solar industry will add more than 250 GWdc of installed capacity, roughly 40 GWdc a year. While this is certainly proof of the solar industry’s strong standing in the energy transition, it also represents a slowdown of industry growth. The growth patterns vary amongst segments, but we expect 3% average annual growth between now and 2029.

Learn more

The full report explores each segment in detail and reports on solar supply chain dynamics and solar pricing trends based on recent global solar manufacturing buildout.

Fill in the form at the top of the page for a complimentary copy of the 15-page executive summary.