Discuss your challenges with our solutions experts

DMG's 2017 Gas Indonesia Summit was held this year in Jakarta in July. We saw a good turnout from key domestic players, international LNG players and infrastructure developers including delegates from Pertamina, PGN, PLN, Medco, ExxonMobil, Total, Cheniere, Petronas, Texas LNG, AGDC, Oil Search, Osaka Gas, KBR, Wartsila, AG&P, SLNG and SNC Lavalin, among others. I chaired the Commercial stream at the Jakarta Convention Centre, where we discussed opportunities and issues in Indonesia's gas and LNG value chain.

So what did I talk about?

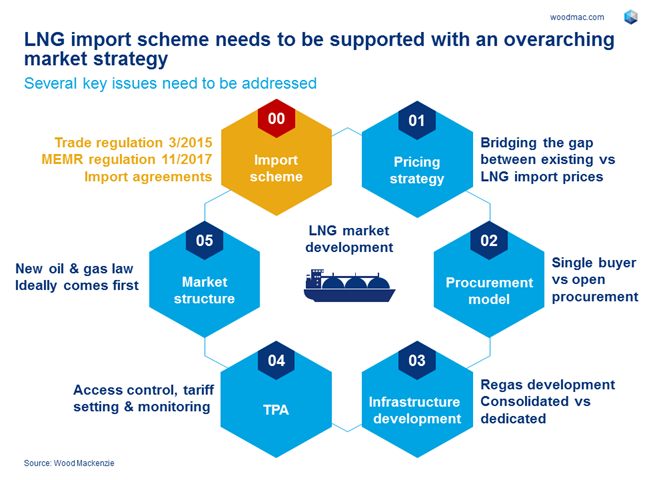

As Indonesia braces for higher LNG consumption, the country needs to address several issues. Issues that can be used as learnings across emerging LNG markets around the world.

Issue: Pricing

The price gap between existing supply and LNG imports widens

The country's existing piped gas prices are mainly based on fixed prices with annual escalation, while most LNG contracts signed by Pertamina and PLN are oil-linked. So how do we bridge the gap? By exploring alternative pricing mechanisms. The government has introduced oil-linked caps to the existing gas prices, but the feasibility of the current price ceiling is in question.

Issue: Procurement model

Integrated structure or competitive model?

Who doesn't like a little competition? So far, Pertamina has been the only company signing LNG import deals on behalf of the country. This might change with the issuance of MEMR Regulation 11 of 2017, allowing PLN and IPPs to import LNG directly. While opening the LNG import scheme gives Indonesia a healthy dose of competition and provides more options, it seems to be inconsistent with the proposed single aggregator scheme. We need clarity on policy directives, as this will greatly influence procurement strategies.

Issue: Regas development

Considering midstream consolidation regulations

Around 25 mmtpa of regas capacity will be required by 2035 to keep up with LNG demand. Several regas proposals have been proposed, and a lot of them are in the Java Island, which could lead to inefficient midstream operations due to potential overlap across different projects. For small-scale projects, cost competitiveness is the main challenge. Extending downstream beyond the power sector and integrating with the LNG trucking, mining, smelting and bunkering segments could help build much-needed scale.

Issue: Third-party access (TPA)

TPA is required for both regas and pipeline infrastructure

If midstream integration is chosen, it should be supported by a robust TPA scheme to allocate access and determine tariffs that are fair for both operators and shippers. This is required for regas as well as pipeline infrastructure. Lack of policy surrounding access to existing regas terminals for third-party users is a concern because it creates uncertainties among industry players wishing to participate in the sector.

Issue: Market structure

The new structure should be well-aligned

The government is revising the oil and gas law and has made several proposals:

• The creation of an oil and gas fund

• Changes in the regulatory bodies and the role of state-owned companies

• More support for Pertamina in expanding its domestic operations

• Gas market restructuring with the possible formation of a single gas aggregator or an energy holding company.

Whether the country opts for a competitive market structure or sticks with the current proposal toward a more integrated market, there is a need to design a robust and comprehensive strategy which is consistent across the value chain, as opposed to a set of tactical and reactive decisions. Having a consistent and well-defined policy will add stability and reduce uncertainties, which is necessary to secure the much needed investments. The market is currently waiting for such clarity from the government.