Energy transition is making its mark on Asia Pacific's major energy markets

1 minute read

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin oversees our Europe, Middle East and Africa research.

Latest articles by Gavin

-

The Edge

A world first: shipping carbon exports for storage

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Nigeria’s bold strategy to double oil production

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

-

The Edge

Upside pressure mounts on US gas prices

-

The Edge

The coming geothermal age

Hello and welcome to the first edition of the APAC Energy Buzz.

As Asia Pacific's Vice Chair, I am privileged to travel the region to meet energy suppliers, traders, regulators and buyers.

Given the pace of energy demand growth and uncertainties brought by energy transition across Asia Pacific, my blog is an informal monthly reflection on what I am hearing, discussing and seeing while on the road.

Talking energy transition in India

I have always loved India. I first visited almost 30 years ago and have been returning regularly ever since. Recently I had the pleasure to host executive roundtable dinners in Delhi and Mumbai to discuss the impact of the energy transition in India. I was immediately struck by the range of companies present. From E&Ps to battery manufacturers, miners to renewable power developers, all are being impacted by the transition, and all are figuring out their response.

Adding relevance to the conversations was the soundtrack of India’s mammoth general election (the Mumbai roundtable was actually held on the Phase 1 voting day in Maharasthra – thank you to our guests who braved the traffic!). Sitting on the plane en route to India and reading the Times of India and the Hindustan Times, I was struck by two thoughts. First, just how little the rest of the world really understands about the world’s largest election; like India itself, the issues, personalities, scale and potential outcomes are overwhelmingly complex and diverse.

Second, through all the commentary one number really jumped out – India’s 84 million first-time voters . As we debated the energy transition at our roundtables that week I kept returning to this group, bigger than the entire population of Germany. In understanding the challenges (and the opportunities) presented by energy transition in India, the consumer is the critical recurring theme. Of course, today India’s population remains amongst the lowest per capita consumers (and hence per capita emitters of carbon) globally, but India is a growth story and urban air pollution in many major cities is already at crisis point. With debates around energy costs, affordability and environmental challenges prominent in the election, radical thinking is on the agenda at both government and corporate levels.

India’s renewable-led future?

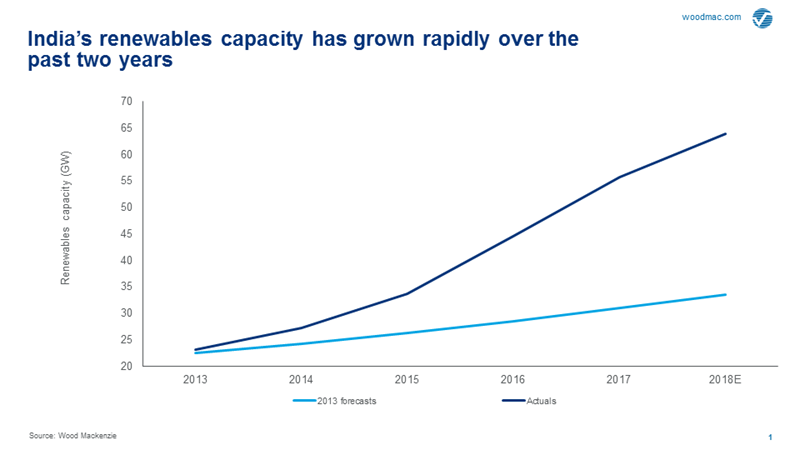

India’s incumbent BJP-led government, the first majority government in 30 years, had much freedom to roll out sweeping reforms since coming to power in 2014. Through this period, total energy consumption increased at a frantic pace, particularly power which grew at its fastest pace in three decades between 2014 and 2018. And while coal still dominates the generation mix, the share of renewables is rising (and outpacing our forecast from 2014).

Predicting voter choice is risky (Brexit anyone?), but our base case forecast for energy demand sees a BJP-led government retaining control of the Lok Sabha after May, though with more coalition partners than last time. This result could limit policy implementation. However, existing targets for renewables growth remain – and are nothing if not ambitious.

How ambitious? Try 100 GW of solar and 75 GW of wind by 2022 for size (equivalent to 35% of total generating capacity by this time). While this may sound a pipedream, progress is being made; India’s solar-park policy (target: 20 GW) is supporting rapid deployment and an easing of land acquisition red-tape is reducing installation costs. From a low base of 24 GW in 2014, utility-scale solar and wind grew to more than 60 GW by end-2018. Meanwhile, rooftop solar is now gaining traction through subsidies and favourable financing terms.

But back down to earth...

A clear consensus in Delhi and Mumbai was, even with policy support India will not meet its 2022 target. I will admit, this does not come as too much of a surprise. But let’s focus on the direction of travel rather than the destination. Listen to the many considered arguments for more favourable policies to boost renewables growth – improved conditions for manufacturing in the solar industry and policy initiatives to increase end-user tariffs while reducing technical and commercial losses on a sustainable basis (in other words, cut theft!). All are achievable goals.

Then there’s infrastructure, so often the achilles heel of energy delivery in India. Put simply, adding lots of megawatts of wind and solar will not change much without grid and transmission expansions/upgrades (it's a similar story on LNG, with terminals under-utilised as pipeline capacity growth has failed to keep pace). And with power auctions resulting in wind prices halving in 2018, lenders are now questioning the viability of wind projects.

So many challenges ahead, but the trajectory of the energy transition in India was never going to be linear.

We will be hosting India Executive Roundtables bi-annually and we look forward to welcoming guests to our Delhi and Mumbai events in October/November 2019.

You can read more about elections in Indonesia, India and Australia.

North East Asia’s LNG buyers back in the market

My visit to India was sandwiched between C-suite customer meetings in South Korea and Japan, primarily with LNG buyers showing an increasing appetite for new long-term supply deals. At the same time, my colleagues in our gas research team were in Shanghai attending LNG19 where contracting was also very much on the agenda.

Who’s afraid of Henry Hub in 2019?

Grabbing headlines at LNG19 was Novatek CFO Mark Gyetvay, who told attendees that ‘Nobody wants Henry Hub’ pricing in Europe, primarily due to hedging challenges. But what about here in Asia? Of the six new contracts inked at LNG19, and the further three agreements announced outside the conference through April, Henry Hub indexation has been notable by its absence.

Why? For China, that’s easy. Chinese deals with US projects have dried up since the ongoing trade dispute with the US, with Chinese players reportedly barred from signing contracts until a resolution is reached (at which point I believe they will be back in force – let’s see. The escalation of tariffs on US LNG to 25% by China on 13 May doesn’t bode well). But with talk of diminished appetite for US hub linkage across the region, this was a perfect time to be asking buyers in South Korea and Japan what they really want.

My sense is that while some recent deals have shown that there is appetite for creative contracting in the market (the Shell-Tokyo Gas coal-linked contract, for example), increasing hub exposure is likely to be a priority for many Pacific buyers.

Companies such as JERA, KOGAS and CNOOC need to meet their large uncontracted long-term positions and will likely look to additional Henry Hub indexation, in addition to potentially other mechanisms like JKM, to boost portfolio pricing diversity. With 100+ mmpta of proposed liquefaction projects in the US looking to Asian buyers to underpin FID, I have to believe there’s still life in Hub deals in Asia Pacific.

All eyes on China to support new project development

China is the king of global LNG demand growth. And we expect over the next two years, almost 90 mmtpa of LNG to take FID. Hail the King! But are Chinese buyers ready to be the ‘Japan of the next decade’ and underpin new supply growth through long-term contracting (and equity participation)? I think China needs to play this role. In Japan and South Korea, I continually hear concerns over uncertain gas demand. In Tokyo in particular, nobody seems able to offer a compelling story around the future of either coal or nuclear. Indeed, the announcement while I was in Japan that the refusal by the nuclear regulator to extend deadlines for completing anti-terrorism measures places all restarted plants at risk of closure from March 2020 conveniently proves my point!

The April 25 entry of CNPC and CNOOC Ltd into Novatek’s Arctic LNG-2 project came on the back of recent Chinese deals with Mozambique Area 1, LNG Canada and Cheniere. CNPC is also present in Mozambique Area 4. And in Tokyo and Seoul I picked up on a belief in both Chinese demand upside and Chinese buyers playing a more active role in pushing new supply forwards. Perhaps we really are seeing Japan Inc passing the project support baton to China.

APAC Energy Buzz is a monthly blog by Asia Pacific Vice Chair, Gavin Thompson. In his blog, Gavin shares the sights and sounds of what’s trending in the region and what’s weighing on business leaders’ minds.