Biden’s pause on US LNG export approvals: four questions answered

The implications of the Biden administration's pause on US LNG export approvals

6 minute read

Mark Bononi

Principal Analyst, Global Gas & LNG Assets

Mark Bononi

Principal Analyst, Global Gas & LNG Assets

Mark brings more than two decades of broad and deep experience as a global energy investor and analyst.

Latest articles by Mark

-

Opinion

Video | Lens Gas & LNG: What is Venture Global's LNG strategy?

-

Opinion

Transforming energy: 5 key questions ahead of Gastech 2024

-

Opinion

Biden’s pause on US LNG export approvals: four questions answered

On January 26th, after weeks of speculation and mounting concerted pressure from environmental activists and others, US President Joe Biden announced a temporary pause on approving new US LNG export projects by an Executive Order. Existing and under construction US LNG projects are not affected. The interruption is for granting new projects the right to export to countries that the US does not have a Free Trade Agreement (FTA) with, or non-FTA. As a result of the decision, new LNG export projects could be delayed, and new supplies threatened.

The announcement stated that the pause will allow the Department of Energy (DOE) to update its underlying analyses for authorisations, which it claims are outdated. The last review of LNG export projects was in 2018 when US LNG exports were 4 bcfd versus nearly 12 bcfd in 2023.

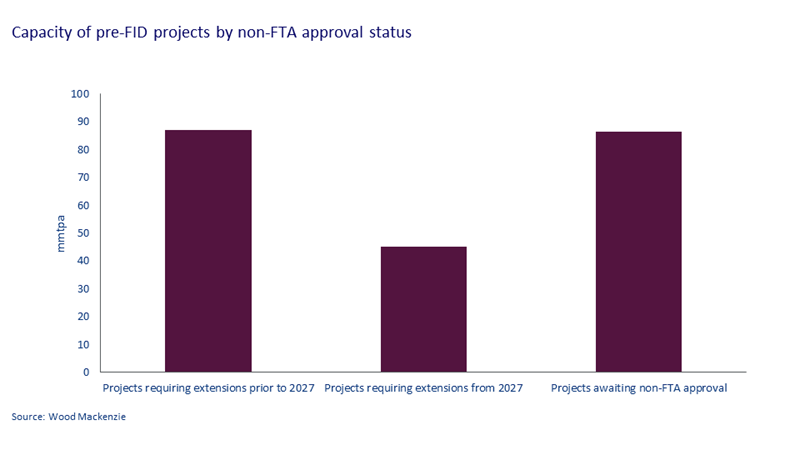

It is still not clear the extent to which all pre-FID (final investment decision) projects in the US are affected. The pause will clearly impact the 10 projects awaiting non-FTA approval, but it may also impact many of the projects which under their current DOE approval require first exports prior to 2027. These projects will require extensions to their deadline for first exports, but it is unclear if any extension of time requests will be approved under the pause.

Longer term, a hold-up in new investments in US LNG because of regulatory uncertainty has the potential to tighten the market. It could also affect how buyers perceive US LNG. While we expect existing LNG buyers to wait in the short term, these and other potential new buyers could start to look at competing projects outside of the US, such as those in Canada, Australia and particularly Qatar (if the country looks to increase capacity further), as alternative supply sources.

Both a short- and long-term pause may result in higher prices for the broader LNG market and could have long-term implications for the role that gas and LNG play in the energy transition.

We have broken our analysis on the impact of this major event for the North American Gas and LNG market into several key questions. Read on for an introduction to four of these questions answered by this analysis and fill in the form to download the full report which explores these questions in depth, plus more.

1. What does the announcement mean?

To export US LNG, or LNG produced from US-sourced natural gas to countries that the US does not have an FTA with, a liquefaction project requires non-FTA approval from the US Department of Energy (DOE).

The DOE is required to grant export authority to non-FTA countries, unless the Department finds that proposed exports will not be consistent with the public interest, or where trade is explicitly prohibited by law or policy.

FTAs are not in place with most of the key LNG importing countries in Europe and Asia, including members of the EU, the UK, Japan, and China. South Korea is the only major importer that has an FTA.

Without non-FTA approval, developers will struggle to raise financial backing to sanction projects. Consequently, the pause in approvals effectively breaks the sanctioning of any new US LNG capacity that does not currently hold non-FTA approval. Non-FTA approval is a key milestone for LNG project developers, so any delay is costly.

2. Why has Biden implemented a pause on approvals?

Rising US LNG exports have become a growing cause of concern for the Biden administration for several reasons. Despite gas producing around 50% lower emissions than coal when combusted, climate scientists have raised questions about how much methane is leaked along the LNG value chain and what this means for the emissions footprint of LNG around the world. Some have argued that increasing LNG production is at odds with Biden’s policy ambitions to reduce greenhouse gas emissions domestically and globally.

Following recent natural gas price spikes, large industrial consumers in the US have also continued to lobby against additional export approvals for fear of the impact these will have on domestic feedstock pricing.

The announcement also reflected on the pace of US LNG growth from existing and under construction facilities and an evolving understanding of the need for new LNG supply in the global market. It also offered reassurance to US allies that it would support their energy security goals via LNG.

3. Which projects are affected?

Until the DOE’s review process is fully defined, it is unclear exactly how the pause will affect different projects. The impact is mostly on US projects, but it could also affect Mexican and Canadian ones if they source feedgas from the US. With one small exception, the pause will not affect projects that are currently operational or under-construction, as well as Canadian projects sourcing local feedgas, such as LNG Canada, Woodfibre LNG and Cedar LNG.

The pause clearly impacts new projects which have applied for but do not yet have non-FTA approval. There are also many preFID projects that have already been granted non-FTA approval. However, as their approvals require first exports to commence within seven years of approval, earlier than can conceivably be possible for many, they will require extensions requests to the permits. It is unclear if the pause will affect extension requests as well as requests to increase approved volumes under the same filing.

The chart below shows there is almost 90 mmtpa of projects awaiting non-FTA approval. More analysis of this, as well as specific project details are available in full report.

4. What impact will this decision have on the market?

A long term pause on all new US LNG projects would have lasting implications on the global LNG market. Big capacity investments have been dominated by the US and Qatar in recent years. With Russia largely out of the equation for the foreseeable future and the prospect of land-based LNG developments in Mozambique still uncertain, LNG buyers will have limited optionality to diversify supply. Expectations for long-term prices will increase and the very perception that the world can access abundant and affordable gas reserves would change for good.

The consequence of this for the global gas industry could be major. European governments will push even harder to diversify away from gas. While Asian Governments may scale back strategies to use gas as a transitional fuel as they look to replace more polluting coal, as they ramp up investments in renewables, if possible. A moratorium on new US LNG development may well undermine the role that gas could have in the energy transition.

Regardless of ongoing and future events, the US LNG industry needs to accept the burden of clearly demonstrating that it is a responsible and dependable provider of a much needed and less emissions intensive energy source, that is an essential part of the solution to a smooth energy transition. It must assume a leadership role in the broader global LNG industry in this regard.