Discuss your challenges with our solutions experts

1 minute read

By Rory McCarthy, Principal Analyst, and Victor Laurent, Senior Product Manager for Power at Wood Mackenzie Genscape

Coronavirus had a sudden and dramatic negative impact on power demand, which fell by 20% in the UK during the lockdown period with similar drops across Europe. Coronavirus power demand destruction has given us a glimpse into the future when variable renewable energy (VRE: wind and solar) makes up a higher proportion of power supply. At current levels, the power system lacks the flexibility to support this variability: the bigger the share of VRE in a system, the greater the challenge.

Will Covid-19 be a wake-up call to get Europe on track for its new flexibility feet build-out?

We look at the flexibility challenges faced in the UK and Germany in these unprecedented times. The UK, because as an island it lacks interconnection and needs flexibility before its European mainland counterparts. And Germany, a key power and flexibility hub for Europe with the highest share of VRE generation. Read on to find out why flexibility is critical to balancing power systems like these.

Flexible resource outlook for Europe’s big five power markets

Markets have been built on the assumption that at current levels of renewables, particularly VRE, there is enough system flexibility. The policy focus has been to deploy low-cost wind and solar. Little attention is paid to grid stability or ensuring dispatchable renewable power. There is also a glut of incumbent capacity, from coal to pump storage that can provide various levels of flexibility. These are sunk investments, which can be challenging to displace.

Power system flexibility is essential as our power networks transition to renewables. VRE levels are increasing to meet net zero emission targets, which threatens grid stability. Wood Mackenzie expects the power system flexibility asset mix in Europe’s big five markets (Germany, France, Italy, Spain and UK [GB]) to grow from 122 GW in 2020 to 205 GW by 2030 and 265 GW by 2040. This is made up of gas peakers, pump storage, interconnectors and energy storage. Energy storage is set to become the winning asset in annual deployment growth terms.

However, the market framework is still not clear for this growth. New market services will be needed to bolster the investment case for a new flexibility fleet build-out.

Record levels of renewable penetration, even before lockdown

In the UK (GB power market) the system operator has been pushed to its limits. Even before the lockdown took hold, the GB power market broke renewable penetration records. In the first three months of the year a record 47% of electricity was provided from renewables, up from 36% in first three months of 2019. This was mainly due to large wind resource availability. As we can see from the chart below, balancing costs throughout this period were relatively low.

It is easy to assume that winter months, when demand peaks, would result in more challenges and higher costs to the system operator. On the contrary, the grid can be at its most stable at these times. Supported by the large mass of synchronous turbines such as nuclear and gas, the grid is strong.

Balancing costs ramped up as lockdown commenced

As we can see from the chart below showing system operation balancing costs, the challenges really take hold when high VRE generation coincides with low demand. This was highlighted when the lockdown started on 23 March.

BSUoS is charged to generators and suppliers to pay for GB’s system balancing costs

Over this period, we have witnessed an average 20% reduction (National Grid) in demand coinciding with high renewables penetration levels.

The system operator (SO) has various tools to deal with these events. One of these is through the balancing mechanism, taking bids and making offers when the system is short or long. As we can see in the chart below, things got particularly interesting over the late May Bank holiday weekend, when negative prices occurred in the Balancing Mechanism system spot price for three consecutive days, bottoming out at negative £70. That means the SO was on average paying resources to reduce power or increase demand in the BM.

These periods of depressed peak prices due to low demand and low gas prices are bad news for gas and particularly flexible gas peakers. However, the extreme negatives can be capitalised by less conventional resources such energy storage and demand response.

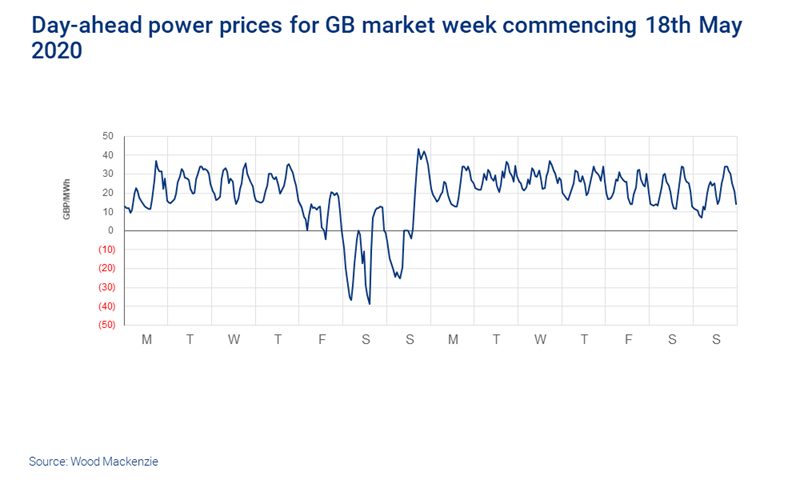

Bank holiday weekend supply-demand imbalance breaks day-ahead negative price records. The spot price is calculated to represent the energy imbalance price over each settlement period, whether the system imbalance is long or short, designed to represent the prices associated with the BM.

Taking a closer look, we can see what each generation source was up to. Over the lockdown bank holiday weekend, the abundance of solar and wind resource pushed gas out of the system and ramped up exports throughout the interconnectors.

Over the same weekend, on 23 May, the longest day-ahead negative price spell at 17 hours occurred. This was also the first negative average day-ahead price on record at minus £10.59/MWh. This is another sign that there was oversupply, and not enough flexibility in the market.

Delving into system operators’ balancing actions data, we can see what flexibility tools were used. Constraints made up the bulk of balancing costs over these days. Out of a total of £50 million from Friday through Sunday, 69% or £30 million was spent on constraints; a chunk of that was curtailed wind output.

National Grid has also introduced a new service called Optional Downward Flexibility Management (ODFM) to deal with high VRE, low demand. This service, for small scale resources, offers payment to either turn down generation or turn up demand. As of May, they had 2.4 GW of capacity signed up from 170 small generators (National Grid).

From May to August 2019 National Grid spent £333 million on system balancing and the forecast for the same period this year is £826 million. These expenditure levels are unprecedented.

Ballooning costs and regulatory intervention point to a lack of flexibility in our system.

Intraday price volatility in Germany reflects day-ahead forecast deviations

More wind and solar in the system increases forecast deviations when the dispatch is planned for the day ahead. This results in volatile prices when the system struggles to cope, as shown in the figure below.

In Germany, intraday prices dropped below zero as soon as VRE met 75% of demand in 2019 and 65% in 2020. The threshold dropped by 10% in one year, which shows that the system is generally long. The increase in renewable capacity coupled with a decrease in demand halved average intraday prices for the month of May from 37.1 EUR/MWh in 2019 to 19 EUR/MWh in 2020.

Another market signal shows that an overnight surge in VRE (e.g.: 10 May), pushes intraday prices drop below the low of DA (DA = hourly average of Day-Ahead prices). At the grid level, the surplus of renewable pushes gas plants out of the money and peakers remain idle. The surplus of power is exported to neighbouring countries provided there is interconnector capacity or the excess is stored (via batteries and pumped storage) or curtailed.

The opposite is also true: an overnight drop in VRE results in higher intraday prices than the high of DA and gas peakers need to ramp up their production to meet the demand. At times, electricity needs to be imported from neighbouring countries or other flexible resources can be used.

Extreme market dynamics and high VRE penetration: the new norm?

Intraday and Day-Ahead prices (EUR/MWh); wind and solar generation as a percentage of demand (%); demand (MW)

The trend toward decarbonisation is well underway, which highlights the need for flexibility to provide security of supply during tightness and store cheap power during surplus. The average aggregated renewable generation (Wind and Solar) as percentage of demand increased from an average of 34.5% in May 2019 to 46% in May 2020. This is largely due to a drop in demand of 10.56%.

At the peak, 134% of demand was met by VRE in May 2020 in Germany, up 40% from a max of 93.8% in May 2019. This raises the question of interconnector capacity to export power surplus. Germany famously deals with network constraints (e.g.: north-south divide; loop flows), which will only increase unless the system operator (SO) upgrades the network or bring alternative forms of flexibility. Ultimately, grid expansion will support flexibility in Europe.

Increased intraday price volatility comes from fluctuations in the system tightness as the market comes closer to gate closure. In May 2020, the ID range (Max-Min) is 20 times higher than DA. Also, the maximum Intraday price at 2995 EUR/MWh and the minimum intraday price at -492,6 EUR/MWh are both significant compared to less volatile Day-ahead prices (min= -105,8 EUR/MWh; max=57 EUR/MWh). The sequential nature of the spot power market coupled with volatility brings more arbitrage opportunities but also increases the risk of being imbalanced.

There is a higher difference in highest demand days (i.e.: ~9% lower in May 2020 compared to May 2019) than in lowest demand days (~3.1% lower in May 2020 compared to May 2019). This shows that the elasticity of demand is skewed to the upside; there is a “bottom” to demand whereas spikes can be sharper. This shows the country’s need for gas peakers to meet spikes in demand.

Looking at the behaviour of a peaker such as Franken, shows the importance of stop-start cycles: the plant remains idle and ramps up for short period of time (15min to a few hours) a few times a month. Conversely, plants such as Bayer Dormagen and Weisweiler show the importance of ad-hoc available power when renewable generation is low or below expectations. Both plants produce sustained amounts of power during system tightness.

The big flexibility question

As we have seen in the UK or Germany, the country’s residual capacity (i.e.reserve thermal plants) need to be flexible to adapt to extreme load changes. Therefore, the need for flexibility impacts the entire system: from generators (e.g. acceleration of start time, start-stop cycles, and ramp capabilities) to storage technologies (e.g. batteries, hydrogen, hydro) and active power grids (e.g. demand-response, prosumers).

The need for flexibility is accrued by the UK’s and Germany’s thirst for green energy but can only be achieved with long-term governmental support. Admittedly when the marginal cost of production for VRE is zero, curtailment will always be a balancing option. However, when trying to increase VRE penetration to enable a net zero power system, extreme levels of curtailment seen in the UK or Germany go against the main policy need. A better option would be to have more flexibility, particularly energy storage. It can be used to move VRE to times when it is required and provide a stack of services to balance the grid.

This introduces a big question. Do European power markets need a complete rehaul in order to deliver this new breed of system flexibility? Subscribe to The Inside Track, Wood Mackenzie's weekly news digest, to get access to the latest articles on this topic.