Five options to address the looming lithium surplus

In part two of a series on the outlook for the lithium industry, we explore the paths available to rebalance market dynamics

4 minute read

Allan Pedersen

Research Director, Lithium

Allan Pedersen

Research Director, Lithium

Latest articles by Allan

-

Opinion

The strategic planning outlook for lithium | Video

-

Opinion

The strategic planning outlook for lithium | Video

-

Opinion

The strategic planning outlook for lithium | Video

-

Opinion

How will the lithium market rebalance?

-

Opinion

Direct lithium extraction: is the hype justified by the reality?

-

Opinion

Five options to address the looming lithium surplus

Mamta Jaswal

Senior Analyst, Lithium

Mamta Jaswal

Senior Analyst, Lithium

Mamta is responsible for analysing and tracking the developments in the lithium industry.

Latest articles by Mamta

-

Opinion

Direct lithium extraction: is the hype justified by the reality?

-

Opinion

Five options to address the looming lithium surplus

-

Opinion

A tale of a looming surplus in the lithium industry: sticky supply to stay?

With electric vehicle demand growth slower than anticipated, demand for lithium – an essential component in EV batteries – is faltering just as significant investment in new supply begins to bear fruit. So, what are the paths available for producers to address the issue?

We have just published the second in our series of insights (click here to read part one) into the outlook for the lithium industry, this time looking at how producers can manage excess supply. Fill out the form at the top of the page to download an extract from the report, or read on for a brief overview of the options.

How big is the surplus?

In our previous article, ‘A tale of a looming surplus in the lithium industry: sticky supply to stay?’, we explored the fundamentals behind current market dynamics. Our modelling suggests an unadjusted surplus of 220,000 tonnes of lithium carbonate equivalent (LCE) from base case projects in 2024; by the time surpluses peak in 2026, that figure could have almost doubled to 436,000 tonnes. Lithium producers therefore need to consider their options carefully to minimise the negative impact on project economics.

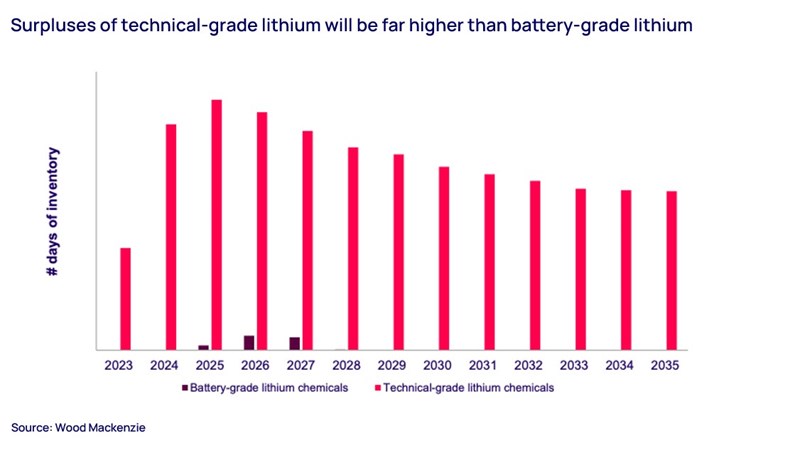

The expected 2026 surplus would equate to 97 days of demand produced for inventory – lower than the inventory level in 2020 of 103 days. However, this ignores the different product qualities involved. Battery-grade lithium is of the highest purity and so is more complex to produce; new plants therefore initially tend to produce a higher proportion of technical-grade lithium. As a result, the battery-grade lithium chemical market will only see a marginal surplus in the coming years; in contrast, the market for technical-grade lithium chemicals will see a significantly higher level of inventory days (see chart below).

Option 1: Do nothing

One possible strategy for the lithium industry is to simply sustain such extensive inventories. However, this could lower prices and reduce long-term investment, potentially provoking another disruptive cycle. What’s more, lithium chemical producers are likely to have to cover the additional costs for storing the surplus, as the offtake will not exist.

Option 2: More conversion

A more proactive option is to reprocess surplus technical-grade lithium into higher-quality, battery-grade lithium – an established process already carried out in countries including Chile, China and Japan.

Traditionally, markets prices have created an incentive for reprocessing technical-grade lithium carbonate into more expensive battery-grade lithium carbonate and lithium hydroxide. However, the looming surplus means the price gap is unlikely to be big enough to encourage this approach, especially for non-integrated producers.

Option 3: Waste products

Another possible approach is to keep lower-grade materials out of the market and treat them as waste products. From an economic perspective, this means turning the surplus from an income stream into an expense for the business, because of the cost of disposal.

It could also be disastrous from a public relations standpoint, due to the environmental concerns additional backfills and tailing ponds would create. As a result, this is likely to be the least palatable option for producers.

Option 4: Long-term inventories

A more positive strategy could be to continue producing technical-grade lithium chemicals for use, putting them into long-term storage until demand outstrips supply and prices recover. However, this would reduce cashflow while still incurring production costs, while any inventory would show up as a cost on producers’ balance sheets for a prolonged period.

Given anticipated production levels, we expect battery-grade lithium inventories to peak in 2028, with technical-grade lithium surpluses topping out in 2029. Based on our analysis, it would then take until 2033 for all inventories to be consumed for the market to fall into a supply deficit.

Option 5: Production curtailment

Finally, a not uncommon approach in industry is to curtail production, either as a considered strategy or as a tactical move when production costs exceed the current market price.

In the last super cycle, curtailment by a few major producers had a significant impact on the wider industry, reducing overall supply enough to eliminate the surplus and stabilise prices. However, since then, a large number of new assets and small players have entered the lithium landscape.

The increase in overall supply is dominated by China, where existing facilities are ramping up production at the same time as many new assets are coming online. The impact of a similar approach would therefore be more limited this time around. So far, lithium producers have announced very few curtailments, although investments and commissioning have been postponed in some cases.

Learn more

Don’t forget to fill out the form at the top of the page to access your complimentary extract from the full insight. This assesses the impact of each of the five options on supply levels and pricing and includes a full range of charts underpinning our analysis.