Five trends to watch for in the electrolyser supply chain

The electrolytic hydrogen sector is rapidly expanding, with over 85 Mtpa of projects announced and cumulative factory announcements exceeding 218 gigawatts of electrolyser capacity by the end of Q3 2023

7 minute read

Nicolas Groues

Managing Consultant, Emissions and Low-carbon Fuels

Nicolas Groues

Managing Consultant, Emissions and Low-carbon Fuels

Nicolas is part of our emissions and low-carbon fuels consulting practice based in Dubai.

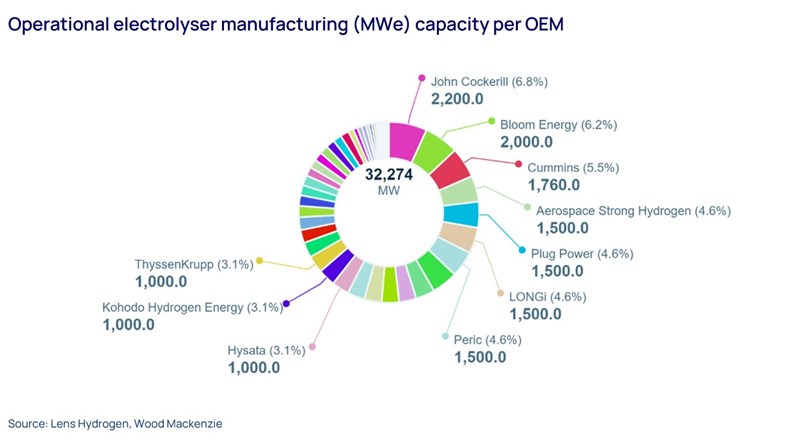

Latest articles by Nicolas

View Nicolas Groues's full profileIn the ever-evolving landscape of renewable energy, the burgeoning electrolytic (green) hydrogen sector has made remarkable strides. Over 85 Mtpa of electrolytic hydrogen projects have been announced. This surge in electrolytic hydrogen has brought focus to the electrolyser supply chain, which will need to expand at an unprecedented pace to meet anticipated demand. By the close of the third quarter in 2023, cumulative factory announcements had already surpassed 218 gigawatts of electrolyser capacity.

As this sector matures and gathers momentum, profound transformations across the electrolyser supply chain are coming. From product design and operational strategies, to enhancing overall profitability – a shift in paradigms seems inevitable – heralding an exciting era of upheaval and innovation in the electrolytic hydrogen ecosystem.

1. Consolidation of the players and the technologies

Wood Mackenzie’s Lens hydrogen product tracks 103 operational electrolyser facilities. The number of facilities extends to over 200 when counting proposed facilities in addition to those already operational This number is progressively increasing each quarter, as new entrants enter the market, and our coverage broadens to encompass emerging players. Additionally, the diversity of technologies is on the rise, with Alkaline (both Atmospheric and Pressurised) and PEM (Proton Exchange Membrane) leading the way. Additionally, an array of new technologies announced, such as AEM (Anion Exchange Membrane), MFE (Membrane-Free Electrolysis), or E-Tac (Electrochemical-Thermally Activated Cycle).

As the sector progresses towards maturity, a consolidation of key players in the mid to long-term appears likely. This natural progression is anticipated to lead to a reduced number of dominant entities in the market, especially to support large-scale projects, where achieving economies of scale will be crucial. This consolidation is poised to yield a more focused and streamlined industry, effectively optimising resources and expertise to drive down project costs.

In parallel, certain technologies will emerge as winners, surpassing the less competitive ones. A market segmentation is probable, with specific technologies gaining an edge for dedicated applications. For instance, SOEC (Solid Oxide Electrolysis Cell) may find prominence in industries generating by-product heat or steam.

2. Increased product segmentation

As major electrolyser OEMs develop their portfolios, a clear product segmentation is expected to emerge, tailoring products to specific market applications. Presently, the market primarily features two key offerings:

- Small-scale containerised solutions: Known for their rapid deployment and easy installations.

- Larger industrial electrolysers: Often installed, sometimes in consortium, by Engineering, Procurement, and Construction (EPC) companies, particularly for industrial applications.

The variety of projects being announced demonstrates varying end-use and power sourcing strategies, necessitating specialised electrolyser configurations.

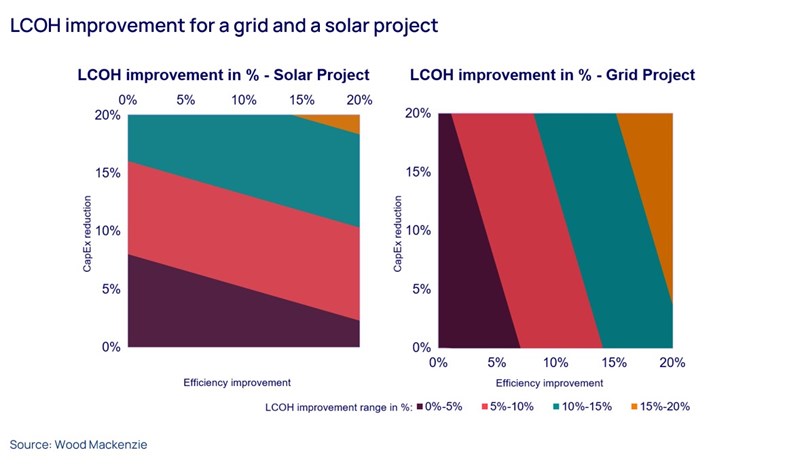

Below an illustration of the impact of the efficiency and CAPEX of electrolysers on the levelised cost of hydrogen (LCOH) for two power sourcing strategies (200MW project):

- Solar-connected: Linked to a solar farm, boasting a 2and an LCOE (Levelised Cost of Energy) of €20/MWh.

- Grid-connected: Tied to the grid, with a substantial 90% Capacity Factor (CF) and a corresponding LCOE of €50/MWh.

In the case of the solar-connected project, priority would be given to a low-Capital Expenditure solution rather than to a highly efficient electrolyser. Conversely, the grid-connected project would emphasise the need for optimal energy efficiency in the electrolyser to optimise the Levelised Cost of Hydrogen. Attributes such as reliability, critical for grid-connected projects, or the ability to adapt to variable loads, will further accentuate the necessity for distinct market segmentations.

This disparity underscores the importance for OEMs to proactively address the emerging market segmentation by either diversifying their product lines or strategically focusing on specific segments of the market.

3. Standardisation and uniformisation of electrolysers for large scale projects

The momentum behind gigawatt-scale projects is driving a potential shift in the product design, with a significant portion transitioning into the hands of larger Engineering, Procurement, and Construction (EPC) companies. Presently, EPCs tend to collaborate closely with a select group of preferred electrolyser manufacturers, seamlessly integrating their modules within the hydrogen facility.

However, in an effort to diversify their sourcing strategies and mitigate product risks, project developers and investors might advocate for the standardisation of projects. This push will involve harmonising the overall design and specifications to a degree where the balance of plant permits the integration of stacks from various OEMs. In this envisioned scenario, gas separators and electrical systems may be developed by EPC companies themselves and/or electrolyser BoP players, enabling seamless integration of standard stacks from diverse manufacturers. This approach would effectively reduce both supply and technical risks, fostering a more flexible and collaborative ecosystem in the green hydrogen industry.

4. Electrode-centric value chain

At the core of an electrolyser lies its electrodes, constituting a vital component that significantly influences stack cost, efficiency, and overall flexibility. A substantial portion of innovation within the electrolyser industry is directed towards enhancing electrode performance. This entails advancements such as elevating current density, utilising cost-effective or highly efficient materials, reducing the gap between electrodes, and augmenting the reaction temperature.

Drawing a parallel with the computer industry, where the processor plays a critical role in computer performance, a similar analogy can be applied to electrodes within the electrolyser domain. There are two prevailing integration models, akin to the computer industry:

- High Vertical Integration (e.g. Apple): In this model, the OEM invests in extensive Research and Development (R&D) and in the manufacturing of the electrodes. This vertical integration strategy enhances cost-effectiveness and performance of the module. A comparable trend is currently witnessed in the Photovoltaic (PV) solar sector. Notable companies such as Nel or ThyssenKrupp and De Nora (with ThyssenKrupp Nucera) have adopted a high level of vertical integration.

- Low Vertical Integration (e.g. HP buying Intel processors): In contrast, this model involves OEMs focusing primarily on the assembly of the stacks. In the short term, it allows for swift adaptation to the best-performing electrode packages without undertaking significant R&D risks. However, over the long term, these OEMs may face margin pressures, especially when competing with companies from lower-cost countries.

Given the nascent stage of the sector, investing in electrode technologies represents a bet, and only a select few companies are expected to emerge as victors. It is highly likely that electrode manufacturers, akin to industry giants like Intel or NVIDIA, and the more vertically integrated electrolyser manufacturers, resembling the Apple model, will retain a significant portion of the value generated within the supply chain.

5. Western vs. Chinese dominance in electrolytic hydrogen technology

As the world focuses on a sustainable future, substantial investments are pouring into the electrolytic hydrogen sector, particularly in Western countries, to bolster the industry. However, amidst this fervour for progress, a pertinent question arises: will China emerge as the global leader in electrolysis technology?

Examining the renewable energy sector, we can draw valuable insights from the contrasting trajectories of the wind and solar industries, which present two distinct paradigms:

- Solar industry example: In the solar industry, China stands as an overwhelming dominator, boasting 96% of the world's wafer production capacity and 88% of the cell production capacity. China's massive capacity and production have propelled it to the forefront of solar technology on a global scale.

- Wind industry example: Conversely, the wind industry has historically seen a divide, with China capturing a significant share of its domestic market, while western OEMs lead in other global markets.

The trajectory that the electrolysis industry will take remains uncertain. On one hand, the West, particularly the USA, is actively attracting OEM investments by implementing attractive policies and offering tax credits, envisioning the establishment of a robust local competitive manufacturing industry for the future. Extensive efforts are focused on R&D to develop emerging technologies such as SOEC or AEM.

On the other hand, China currently leads in manufacturing capacity (with 19GW) and operational or under-construction projects (0.64Mtpa), predominantly deploying alkaline technology with costs significantly lower than Western alternatives. Additionally, Chinese OEMs have been actively securing partnership agreements with overseas entities to establish manufacturing facilities, particularly in Africa and the Middle East throughout 2023.

The future trajectory of the electrolysis industry might align with the solar model, where a single dominant player - perhaps China - spearheads global electrolysis technology, or the wind model, characterised by a more balanced competition between major players globally. As the industry unfolds, the interplay of policy frameworks, technological innovations, economic dynamics, and global partnerships will shape the eventual course of the electrolysis sector.

Learn more

Click here to explore Lens Hydrogen; our tool to help you maximise opportunities across the hydrogen and ammonia value chain.

Or, click here to find out more about our hydrogen consulting service, which cover the full hydrogen supply chain, from policy and incentives analysis to feedstock costs and the electrolyser supply chain.