For Asia’s NOCs, it’s time to go big or stay home

Domestic investment levels remain stable, but Asia’s NOCs must also look overseas to capitalise on world-class opportunities through the crisis

1 minute read

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin oversees our Europe, Middle East and Africa research.

Latest articles by Gavin

-

The Edge

A world first: shipping carbon exports for storage

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Nigeria’s bold strategy to double oil production

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

-

The Edge

Upside pressure mounts on US gas prices

-

The Edge

The coming geothermal age

For the global upstream industry, there is no immunity from the collapse in oil prices and demand. With huge uncertainty over what a future recovery might look like, survival is the priority and costs are being cut wherever possible. As companies scramble to reduce capex, some US$62 billion in cuts have already been announced, equating to a 28% reduction on previous budgets. Buybacks have been scrapped and dividends are under increasing pressure.

Perhaps unsurprisingly, the quickest response has come from US onshore producers and the Majors. Others are now following suit.

But not all companies have been as quick to make painful changes. Indeed, many Asian national oil companies (NOCs) have emphasised that they are seeking to broadly maintain their 2020 capital budgets for domestic investment. PETRONAS, for example, has recently stated it will strive to keep its domestic investment at pre-crisis levels, and CNOOC Ltd, ONGC, PTTEP and PERTAMINA have given similar guidance. This week will give us a glimpse into what the Chinese NOCs are thinking, as they report Q1 2020 earnings and advise on their 2020 budgets.

This is understandable. Host governments are fully focused on shoring up their economies and NOCs are expected to throw their weight behind this through employment, tax revenues and dividend payments. Many Asian NOCs have robust balance sheets and access to affordable capital through state-owned banks, helping to maintain investment where others cannot. PETRONAS even raised US$6 billion on the international bond market earlier this month, with the offering six times oversubscribed. And maintaining, or even increasing, NOCs’ dividend payments will be critical as governments look to finance stimulus measures. Equinor’s decision to reduce its Q1 cash dividend by 67% will not have gone unnoticed by the management of Asia’s NOCs, but similar moves here in Asia are unlikely.

Overseas spending by the Asian NOCs is a different matter. For many, the timing and pace of investment on existing international projects is being determined by the IOC operators, with numerous projects slowed or deferred. A number have made near-term cuts to their overseas capital budgets as a result.

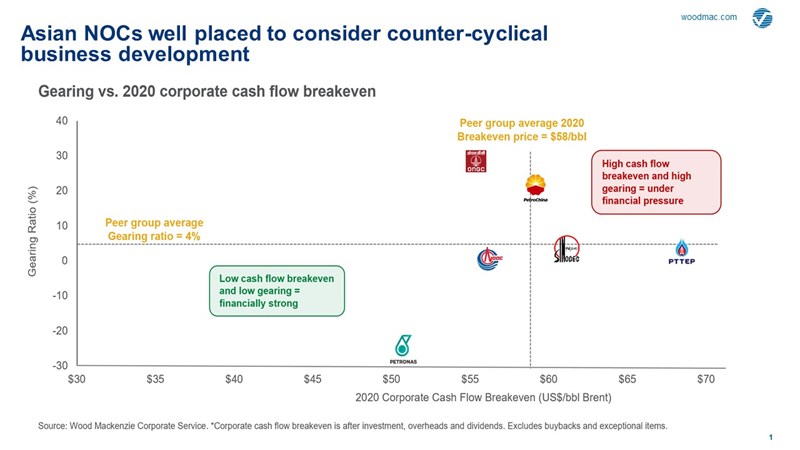

But what about overseas M&A? Having been notably cautious through the last oil price downturn, the Asian NOCs now have an outstanding opportunity to launch aggressive counter-cyclical bids to grow their international portfolios, fill strategic gaps and make decisive moves to ensure growth post-crisis.

Opportunities abound, and Asian NOCs should think big

There is no doubt Asian NOCs are now actively screening both global assets and companies. Opportunities to access some of the highest quality plays globally are plentiful. It is therefore likely that deals will be done over the coming months by Asian NOCs.

But the scale of these potential deals will be critical to both value creation and the strategic direction of the Asian NOCs’ international portfolios. For companies of the scale and financial strength of the Chinese NOCs and PETRONAS, for example, this is effectively a once-in-a-lifetime opportunity. Having maintained low profiles through the last oil price crash, few will want to do the same this time. But the world has dramatically changed over the last five years and bold acquirers also need to consider ESG implications as well as navigate a transformed geopolitical landscape.

But where to go?

In the current market, identifying attractive acquisition opportunities isn’t a major problem, but closing the best of these could be more challenging. And this isn’t just about differences in price expectations between buyers and sellers, but also about where those opportunities lie.

For Chinese NOCs in particular this could be problematic. Many US tight oil producers are financially distressed, but US upstream investment is a non-starter for China right now. Australia has opportunities, though again the current political environment may make it more challenging for Chinese NOCs to acquire. For many, Europe is largely too mature, Canada perhaps too expensive and carbon-intense. Even Brazil may be somewhat cool to new Chinese investment.

But this still leaves a raft of outstanding opportunities. Whether it be world-class deepwater plays in Latin America and West Africa, discovered resource opportunities in the Middle East, pre-FID LNG or asset divestments by the Majors, the Asian NOCs have the scope and financial firepower to think big.

And if an E&P company doesn’t work, might a service company fit the bill? Acquiring a service company would help fill NOC capability gaps and to support upstream opportunities that might otherwise have been too ambitious. Companies may also look beyond upstream altogether, with investment in international downstream supporting integration across the hydrocarbon chain, including petrochemicals. And while most Asian NOCs remain committed to the traditional oil and gas business model, there is nascent interest in renewables as low oil prices reduce upstream returns to levels similar to wind and solar projects.

There is no suggestion that Asia’s NOCs will be unrecognisable after we emerge from this current crisis. Their identity will remain as national oil and gas producers, and domestic investment will remain paramount. Nevertheless, the opportunity and timing for transformative deal making will never be better for Asian NOCs and it would be a pity to see this missed.

APAC Energy Buzz is a blog by Wood Mackenzie Asia Pacific Vice Chair, Gavin Thompson. In his blog, Gavin shares the sights and sounds of what’s trending in the region and what’s weighing on business leaders’ minds.