Fully loaded: the potential impact of large demand centres on US short-term power markets

How surging AI, manufacturing and crypto demands could impact US power markets

4 minute read

Rebekah Llamas

Head of Market Intelligence, Power Markets Research

Rebekah Llamas

Head of Market Intelligence, Power Markets Research

Rebekah oversees our Short-term Market Intelligence Team for North America.

Latest articles by Rebekah

-

Featured

Oil, power, gas trading 2025 outlook

-

Opinion

Fully loaded: the potential impact of large demand centres on US short-term power markets

Large centres of power demand from artificial intelligence (AI), manufacturing and crypto mining could disrupt short-term power markets in the US, with more than 25.6 gigawatts (GWs) announced since 2023 within the seven independent system operator (ISO) areas.

Wood Mackenzie analysts have run a proprietary Security Constrained Economic Dispatch (SCED) model to forecast real-time (RT) prices across the ISOs and to analyse the potential impact of large load announcements on wholesale power markets.

Fill in the form to download a complimentary copy of our brief on The impact of large demand centers on US power markets and read on for an outline.

Pushed to the limit

Our research found that on a normal market day, RT market price changes could range from US$(1) in NYISO to almost US$70 in PJM. On peak demand days, prices were pushed to market caps (our modelling only stressed additional demand on historic low, average, and high scenarios over the last year, leaving all other variables ‒ such as fuel costs, import availability and generation outages ‒ consistent).

While all of the ISOs face a similar challenge, the price and congestion implications are market specific, hinging largely on siting decisions. Many of these are centred around current demand hubs, such as Northern Virginia in PJM and the DFW metro in ERCOT.

Another critical component to the equation is whether or not these large loads will respond to market signals or if the assumption of “flat demand” will reign true. Our real-time sensor network is now monitoring several of these facilities and capturing live consumption patterns. The results show that flat demand may not always be the case moving forward.

PJM leads the large-load pack

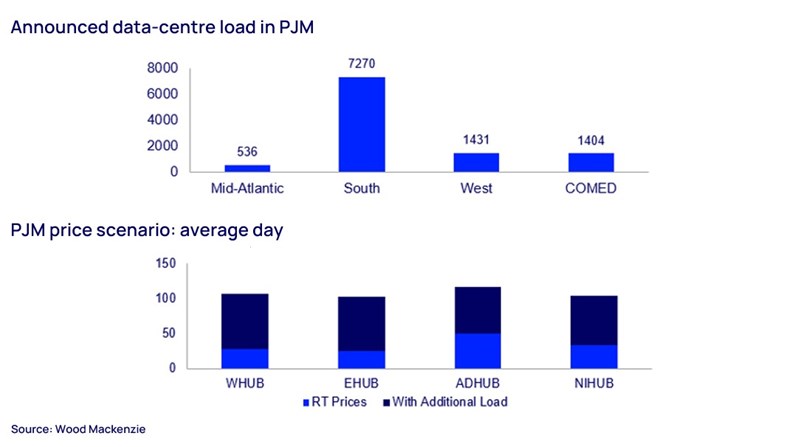

PJM currently leads the US ISOs when it comes to large loads, with 4 GWs installed in Dominion since 2019. Moreover, this trend is not expected to slow. Announcements since 2023 show an additional 11 GWs of capacity centred in the south.

Our modelling shows that on an average day (earlier in October), prices across the hubs could double or even triple. On a peak demand day, prices exceeded PJM’s cap, implying that all resources had been exhausted to meet the projected load.

While our simulations focused on potential growth, PJM has already begun to feel the impact of these heavy loads. This can be seen in recent capacity auction prices, which have exceeded US$270/MW-day, and new normal congestion patterns, which show supply flowing into data-centre alleys to meet demand.

While utilities are currently evaluating various potential solutions, regulators and large-load entities are not yet on the same page. This brings a lot of uncertainty to the market and has the potential to greatly slow the pace at which large loads are able to interconnect.

MISO coal retirements add to grid strain

MISO is an interesting case, with 13 GWs of planned coal-generation retirements in the coming years. The siting of large demand centres is focused mostly on MISO central, effectively doubling the strain on the grid from the additional load in conjunction with planned retirements.

We were unable to model the planned retirements. Taking only the additional load announcements into account, we found prices reaching the cap in the late afternoon hours on peak summer days. Emphasizing the need for emergency demand and demand response resources to ensuring grid reliability on peak days.

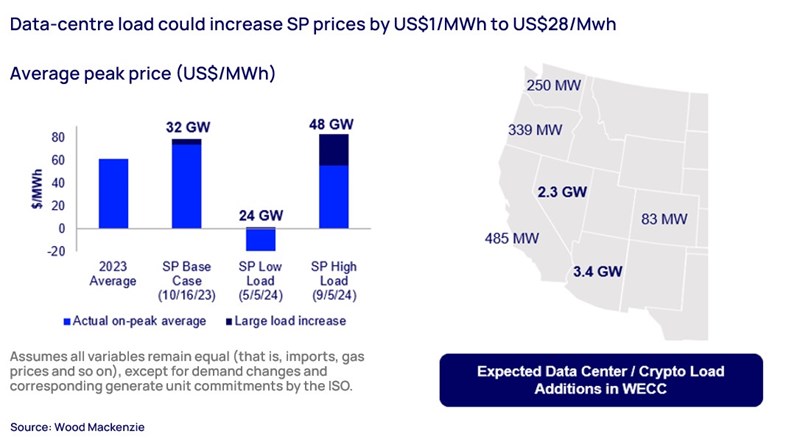

CAISO set to see an import squeeze

In CAISO, the majority of large load additions are data centres in Southern California, located close to geothermal and solar resources.

The additions within the CAISO footprint are dwarfed by bigger additions in neighbouring states. If projections materialize, import availability into the region could be reduced by almost half, which the region relies during peak days. Additional modelling will be necessary to truly understand the intricacies of limited imports.

NYISO large load queue skewed to manufacturing

The queue in New York is heavily skewed towards manufacturing load, which accounts for more than 50% of expected growth, courtesy of the Chips and Science Act 2022.

Interestingly, our models suggested a price decrease during early morning ramp hours with the additional load. This is primarily driven by generation coming online early to prepare for afternoon peaks.

ERCOT sees a turn in the trend

In ERCOT, we’re again seeing siting decisions in a major metro area rather than in resource-rich locations in the west and panhandle of the state. One of the key findings of our analysis relates to the infamous West Texas generic transmission constraint (GTC).

It is widely known that the western portions of the state have the highest installed wind and solar capacities, historically limited by transmission availability and potentially resulting in economic curtailment.

Over the last 12-18 months, however, the trend has flipped, driven by west Texas load growth of about 30% since early 2023. Prices in the west have been settling higher than in the north, which is surprising given the supply-demand dynamics. With the addition of load centres in the north, the trend could once again flip, causing Westex to bind again with higher demand in the northern and central portions of the state.

Learn more

To read more and learn whether these large loads are likely to respond to market signals, fill in the form at the top of the page for a complimentary copy of our briefing paper.