Geothermal energy: the hottest low-carbon solution?

Beneath our feet lies an almost limitless source of low-carbon energy

4 minute read

Andrew Latham

Senior Vice President, Energy Research

Andrew Latham

Senior Vice President, Energy Research

With his extensive exploration expertise Andrew shapes portfolio development for international oil and gas companies.

View Andrew Latham's full profilePrakash Sharma

Vice President, Head of Scenarios and Technologies

Prakash Sharma

Vice President, Head of Scenarios and Technologies

Prakash leads a team of analysts designing research for the energy transition.

Latest articles by Prakash

-

The Edge

The narrowing trans-Atlantic divide on the energy transition

-

Opinion

Energy transition outlook: Asia Pacific

-

Opinion

Energy transition outlook: Africa

-

The Edge

COP29 key takeaways

-

The Edge

Is it time for a global climate bank?

-

The Edge

Artificial intelligence and the future of energy

Until now, geothermal energy has generally only been economic in regions where an abnormally hot subsurface is combined with permeability. But new technology promises to turn hot rock anywhere into an almost limitless source of low-carbon geothermal power and heat. So, could the geothermal sector be poised for trillion-dollar growth as the energy transition heats up?

In our recent insight ‘Geothermal energy: the next trillion dollar low-carbon solution’, we drilled deep into the market outlook for enhanced, advanced and co-located geothermal systems. Fill in the form to download a series of slides from the deck or read on for an overview.

Why is geothermal suddenly a hot topic?

Conventional geothermal technology exploits high-temperature resources where the permeability of the subsurface allows high water flow rates. This means traditional flash steam, dry steam and binary cycle plants are only viable in reservoirs that are both hot and permeable – attributes that are usually mutually exclusive.

In contrast, the latest enhanced geothermal systems (EGS) and advanced geothermal systems (AGS) could be used far more widely. In EGS, hot, dry rock is fractured to create permeability. AGS uses a closed-loop system drilled into the rock and is ideal to repurpose end-of-life oil and gas wells for heat and power production. EGS and AGS technology could double output per well compared to conventional geothermal. Perhaps more importantly, it creates the potential for almost limitless baseload low-carbon energy. What’s more, geothermal projects create minimal surface footprint and generate minimal waste.

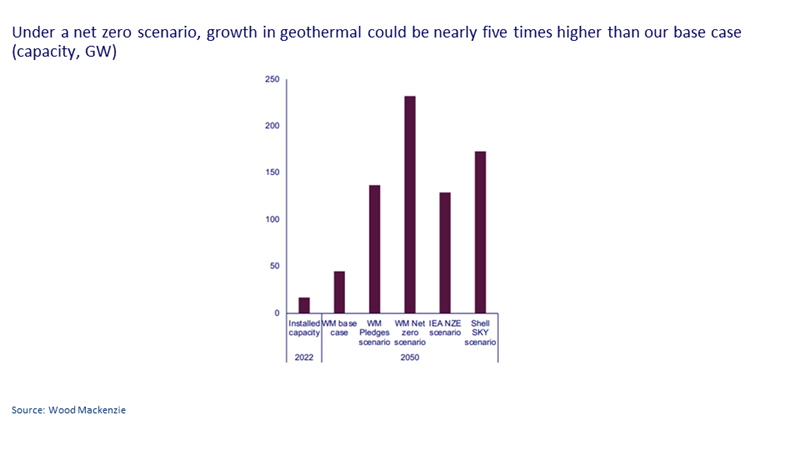

Under a net-zero 2050 scenario, geothermal power (more so than heat) would drive significant growth. We see the potential for 20,000+ producing wells, requiring an annual investment of around US$60 billion by 2050.

How does geothermal compare with other low-carbon technologies?

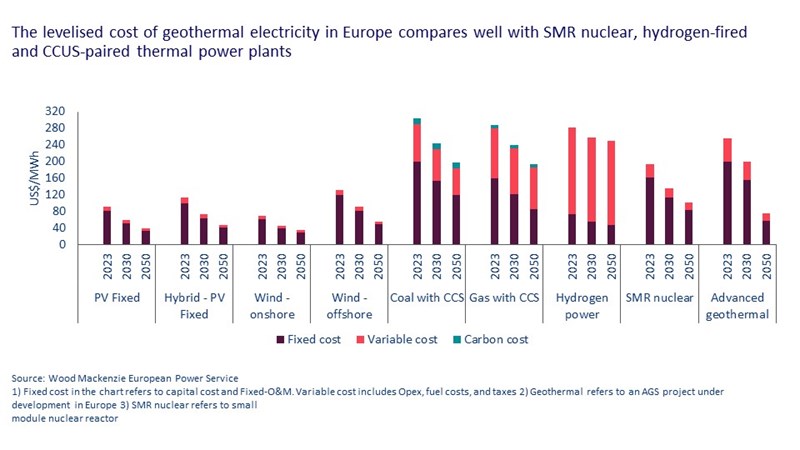

As things stand, the main barrier to growth for geothermal is cost. To compete with other flexible low-carbon power generation technologies, capex costs would need to fall by 30-60%. That would make it a compelling option in a net-zero world that relies mainly on wind and solar, helping decarbonisation alongside nuclear, hydrogen and carbon capture, utilisation and storage (CCUS). What’s more, unlike nuclear, for example, geothermal energy creates minimal issues at the point of decommissioning.

How can geothermal energy be made more economically viable?

Critical battery mineral extraction from geothermal fluids is still a nascent technology but could add to revenue streams from projects. Pilot lithium extraction plants have already been established in Germany, New Zealand, North America and the UK.

Another way to improve project economics is by co-locating geothermal plants with other low-carbon technologies, such as green hydrogen or CCUS. A pilot CCUS facility in Kenya, dubbed Project Hummingbird, is due to start operations in 2024. Meanwhile, UK-based Hydrogen Ventures plans to commence production of green hydrogen at the Reykjanes geothermal power plant in Iceland in 2025.

What about the policy and funding landscape for geothermal development?

At an international level, clean energy standards, institutional finance and carbon credits and offsets will all incentivise geothermal energy development. At the country level approaches vary, but include funding for research and development, risk insurance support for exploratory drilling, loan guarantees, tax credits, feed-in tariffs, direct incentives and offtake support.

Countries with strategies in place to encourage geothermal development include Canada, China, France, Germany, Japan, Kenya, the Netherlands, China and the US. However, funding for innovation in deep geothermal lags subsidies for renewable sources like wind and solar by orders of magnitude.

Where are the best locations for geothermal investment globally?

Currently, the regional popularity of geothermal energy is mainly dependent on the availability of subsidies, particularly research grants. For that reason, the development of next-generation geothermal technology is chiefly focused on Europe and North America. Major pilot projects include Eavor’s AGS project in Geretsried, Germany and Fervo Energy’s Project Red in Nevada, USA, both of which involve a total investment of over US$200 million. Eavor’s facility has a capacity of 8.2MW and is due to go into operation in 2026, while Project Red has a capacity of 3.5MW and is already operational.

What’s the commercial potential of geothermal energy?

Ultimately, the degree to which geothermal’s huge potential is fulfilled will depend on how the policy and technological landscape evolves, and how that impacts the viability of projects. In our base case, growth in geothermal will be dwarfed by wind and solar, remaining under 50GW. However, under a net zero scenario, installed capacity could be up to five times higher than that.

Which oil and gas operators are investing in geothermal?

Chevron has built on its previous experience with conventional geothermal power in Indonesia and the Philippines to take the lead in next-generation projects. These include the aforementioned Eavor AGS project in Germany, as well as initiatives in the US, Japan and Indonesia.

Equinor and Shell also have experience as partners in conventional geothermal projects; Equinor is involved in the next-generation Lithium de France project, but Shell has yet to venture into AGS or EGS. BP is a newcomer to geothermal energy, and is a partner in the Eavor project, as well as in the Texas Geothermal Alliance, which is evaluating EGS opportunities in the state.