Wood Mackenzie at Gastech 2025

Green gains: inside the rise of North American renewable natural gas

Biomethane market expands despite policy headwinds, driven by strong investment and feedstock growth

4 minute read

Natalia Patterson

Senior Research Analyst, Americas Gas and LNG Research

Natalia Patterson

Senior Research Analyst, Americas Gas and LNG Research

Latest articles by Natalia

-

Opinion

Green gains: inside the rise of North American renewable natural gas

-

Opinion

North America's RNG market set for continued growth in 2025 after historic year

-

Opinion

LFG-to-RNG: positive outlook and hidden potential

-

Opinion

North America renewable natural gas: five questions answered

Kateryna Filippenko

Research Director, Global Gas Markets

Kateryna Filippenko

Research Director, Global Gas Markets

Principal Analyst with a focus on the European gas market and the development of alternative scenarios.

Latest articles by Kateryna

-

Opinion

Biomethane price puzzle: why demand-side policy is the missing piece

-

Featured

Gas & LNG: region-by-region predictions for 2026

-

Opinion

Europe gas & LNG: 5 things to look for in 2026

-

Opinion

FuelEU Maritime: a catalyst for bio-LNG market growth

-

Opinion

Green gains: inside the rise of North American renewable natural gas

-

Opinion

Gastech 2024: Our top three takeaways

Dulles Wang

Director, Americas Gas and LNG Research

Dulles Wang

Director, Americas Gas and LNG Research

Dulles delivers analysis of all aspects of the natural gas value chain.

Latest articles by Dulles

-

Opinion

North America gas: 4 things to look for in 2026

-

Opinion

How LNG and power are shaping US gas pipeline development

-

Opinion

Green gains: inside the rise of North American renewable natural gas

-

Opinion

4 things you should know about North American gas to 2050

-

Opinion

North America's RNG market set for continued growth in 2025 after historic year

-

The Edge

US upstream gas sector poised to gain from higher Henry Hub prices

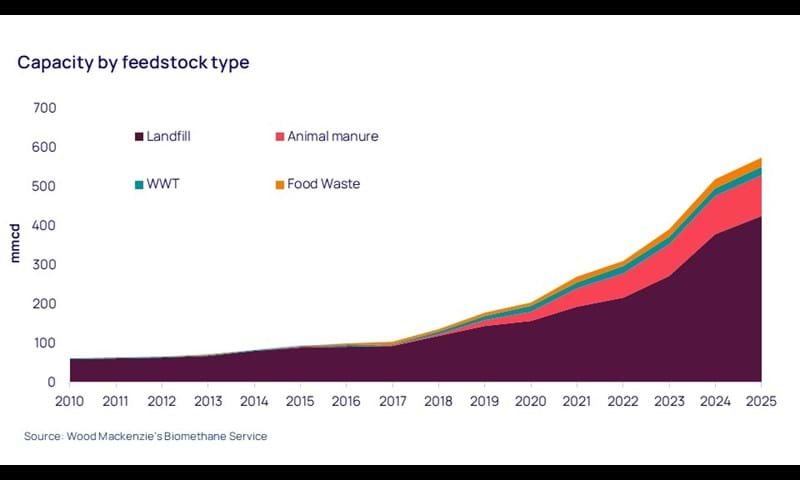

The biomethane, or renewable natural gas (RNG), market has expanded by 35% since 2023 thanks to a combination of policy support, investment momentum and feedstock diversification, with capacity increasing to 604 mmcfd in 2025 from 385 mmcfd in 2023. We expect this growth to continue and see North American RNG capacity growing by 70 mmcfd in 2025 after a record 139 mmcfd rise in 2024.

Analysts from Wood Mackenzie’s Biomethane Service recently assessed the North American biomethane market – what drives it and holds it back, the outlook for supply and demand, as well as pricing and policy development.

Read on for a brief introduction and, to learn more, fill in the form to arrange a meeting with the team at Gastech in Milan from 9 to 12 September 2025.

Embracing regulatory uncertainty

We forecast RNG production to grow across all feedstock types, with development activity spanning multiple US and Canadian regions. Continued merger and acquisition (M&A) activity signals that market participants embrace uncertainty and show their confidence in the future of biomethane. But despite the remarkable growth in the past five years, we estimate that RNG production will remain below 50% of its total resource potential by 2050.

Federal and local policies remain critical to the RNG sector’s continued development, and regulatory uncertainty, especially at the US federal level, could cast doubt on the future subsidies for the industry. More clarity on future policy development would help stabilise prices for environmental attributes (EAs) and boost confidence in the RNG sector’s long-term viability.

The US Environmental Protection Agency, for instance, published the final set of rules for the Renewable Fuel Standard (RFS) programme in 2023, establishing biofuel targets to 2025, but failed to include the electronic renewable identification numbers (eRINs) mentioned in the draft proposal. The eRINs were intended to credit renewable energy used in electric vehicles.

In January 2025, the US Department of Treasury and Internal Revenue Service issued the final rules for the Section 45V Clean Hydrogen Production Tax Credit, established by the Inflation Reduction Act, which address the production of hydrogen from biogas and RNG feedstocks. However, the Trump administration’s One Big Beautiful Bill Act eliminates the 45V credit for clean hydrogen production after this year.

States and neighbours strike back

More US states have embraced RNG as part of their decarbonisation strategy, however, acting as something of a counterweight. The California Air Resources Board (CARB), for example, approved proposed amendments to existing low-carbon fuel standard (LCFS) rules that would change pathways associated with biomethane as a transportation fuel. It also increased the state’s carbon intensity reduction target to help the LCFS credit price recover.

Michigan has substantially expanded its clean energy standard, requiring the state to produce all its energy from clean sources by 2040. Eligible technologies include landfill gas and biogas from wastewater treatment facilities, biomass and food waste. The Governor of New Mexico, meanwhile, signed into law House Bill 41 establishing the Clean Fuel Standard programme. The law requires New Mexico to implement new rules by July 2026.

Further north, the Government of Canada has proposed the new Regulations Respecting the Reduction in the Release of Methane (Waste Sector). These regulations will help owners and operators of large landfills to monitor and limit their methane emissions. Environment and Climate Change Canada is reviewing public comments before implementing the final regulation.

In Alberta, the state government has proposed the Agricultural Operation Practices Amendment Act (2025), which expands existing law and incentivises investments in animal manure digesters. Québec’s Renewable Natural Gas Production Support Program supports the development of RNG, providing up to C$12 million in financial assistance for project capital costs.

Rising costs threaten market economics

RNG pretax breakeven prices vary based on feedstock type, influenced by key drivers, such as location, technology, economies of scale and operational efficiency. High costs will remain an obstacle for new participants entering the market and extended tax incentives will be key to continued RNG development growth.

More than half of US RNG production is consumed by the transport sector, mainly due to federal and local subsidies, but unlocking latent demand in the non-transport sector will be critical to sustaining sectoral growth. The voluntary markets have seen contracting activities in recent years, driven by utility and corporate decarbonisation targets, and international buyers have procured RNG to support emissions reduction targets outside of North America through LNG exports. RNG will continue to play a crucial role in the future energy mix as the preferred drop-in fuel for low-carbon solutions.

To book a meeting with the Biomethane Service team at Gastech 2025, fill in the form at the top of the page.

Biomethane/RNG Service

Powered by Wood Mackenzie’s industry-leading cross-commodity market outlooks and deep sector expertise, the Biomethane/RNG Service delivers comprehensive insights into the fast-evolving biomethane and renewable natural gas market.

Whether you're entering the biomethane/RNG space, evaluating investment opportunities, or seeking a clearer view of critical value drivers, our service is built to help you uncover opportunities, manage risk, and advance your investment and decarbonisation goals.