Discuss your challenges with our solutions experts

From digester to burner tip: navigating the fast-growing RNG industry

Why is biomethane an attractive decarbonisation solution and how can investors seize the opportunity?

3 minute read

Kateryna Filippenko

Research Director, Global Gas Markets

Kateryna Filippenko

Research Director, Global Gas Markets

Principal Analyst with a focus on the European gas market and the development of alternative scenarios.

Latest articles by Kateryna

-

Opinion

Gastech 2024: Our top three takeaways

-

The Edge

Future energy: biomethane’s time has come

-

Opinion

From digester to burner tip: navigating the fast-growing RNG industry

-

Opinion

Transforming energy: 5 key questions ahead of Gastech 2024

-

Opinion

Global gas industry in the 2050 net zero world

-

The Edge

WoodMac’s Gas, LNG & Future of Energy conference – five key takeaways

Biomethane, or Renewable Natural Gas (RNG), has been a catalyst for investments in recent years, with a marked increase in M&A deals. Oil and gas majors, in particular, are betting on biomethane as a key part of their integrated net zero solutions.

Part of the economic rationale for investing in biomethane is the recent acceleration in support from governments, which are counting on biomethane to help reduce emissions in hard-to-decarbonise sectors, build a circular economy and boost their energy security.

However, the industry is looking for ways to scale up production and identify additional revenue streams that could, over time, support the economics of biomethane without governmental mandates or subsidies.

With decarbonisation pressures rising, biomethane offers an attractive drop-in fuel and circular solution

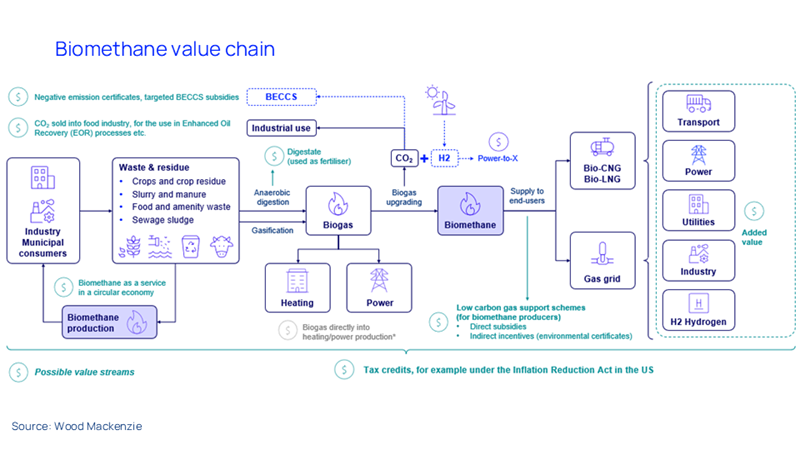

Biomethane is derived from upgraded biogas, which is mostly produced through anaerobic digestion from organic feedstock including food waste, agricultural and farming waste, crops and municipal waste. Biomethane’s properties are similar to those of traditional fossil natural gas, which allows its injection into the existing gas grid and its use in the same applications. Because of that, many refer to it as a “drop-in” fuel solution.

Biomethane is considered a low-carbon source on a net lifecycle basis. This is because, despite emitting carbon when combusted, it does not introduce new carbon into

the global system. Also, if generated from municipal or farming waste, biomethane production avoids methane emissions that would’ve occurred if waste were to degrade naturally.

This makes biomethane particularly attractive. For consumers, it offers a low-carbon drop-in energy source, potentially with additional benefits like biodiversity and circular economy. It can be a bridge until new technologies or more complex decarbonisation options scale up. Lack of upfront capital investment makes biomethane an attractive low-carbon solution with buyers prepared to pay a premium over fossil natural gas.

For energy producers, it offers a way to increase the share of low-carbon production in their portfolio while utilising existing networks and infrastructure. It is also one of the potential waste-to-energy solutions that can contribute to reducing waste and developing a circular economy at the same time. And that’s all leveraging generous government subsidies.

Biomethane offers opportunities for a variety of revenue streams – with the right approach

Biomethane’s business model differs substantially from that of fossil natural gas: it can leverage multiple elements of value creation. Revenue streams depend on local incentive structures, but alternative business models are key to creating opportunities, including leveraging innovative deal structures and broad partnerships in place of standard supply agreements.

These opportunities vary by country, as each government’s unique priorities and their visions of biomethane’s role in decarbonisation drive incentive schemes. For example, transport certificates are one of the key revenue streams in California, given the focus on decarbonising the transport sector in the US. While in Denmark, where biomethane now accounts for over a quarter of the local natural gas market, incentives are focused on decarbonising the industry sector.

But regardless of the location and available subsidies, value stacking and cross-sectoral integration are key to maximising value from a biomethane business. Most of the incentives are additive, which creates multiple value sources. Cross-sectoral integration (for example, a combination of biomethane and CCS businesses) can bring the maximum benefit, although technological and operational challenges remain. There is also potential value in non-energy externalities, for example, support of sustainable farming, local communities, and contribution to a circular economy, but the market is yet to assign a monetary value to them.

The biomethane market will grow strongly through energy transition. The fuel can be an important part of the decarbonisation puzzle, bridging the gap between fossil fuels and emerging technologies. The success of the industry will continue to rely on strong government support, but creative business approaches, development of voluntary market and cross-sectoral coordination will be key to define a path to success for investors.

Our Biomethane/RNG Service provides comprehensive insights into the expanding biomethane and renewable natural gas market

It's designed to help our customers identify opportunities, mitigate risks, and support investment and decarbonisation strategies.

Whether you're new to the biomethane/RNG market, assessing investments, or looking to better understand key value streams, get to know Wood Mackenzie's Biomethane/RNG Service.