Greener LNG is vital to Asia’s sustainable development

Gas will play a vital role in Asia’s fight against air pollution, and in meeting its future energy demand. But with its environmental impact under scrutiny, could LNG get greener?

1 minute read

Asia struggles with the world’s worst air pollution. Delhi hit the headlines in November 2019 as levels spiked to such hazardous levels that a public health emergency was declared. Flights were diverted, schools were closed, and the images of streets shrouded in smog filled newsfeeds around the world.

This wasn’t an isolated incident. Air pollution is a widespread and persistent issue across the Asia Pacific region, due to a combination of dust, agricultural clearance fires and particulates from fuel and coal. A report from the Climate & Clean Air Coalition found that 92% of the population are exposed to air pollution that poses a significant risk to health, with the highest numbers living in south and east Asia.

This is, rightly, having an impact on energy policy. Coal-to-gas switching continues in China. South Korea is restricting coal use in summer, and Gujarat has mandated that the ceramics industry replace coal with gas. But while gas has earned its place as a transition fuel of choice, there is an important shift in perception underway.

Is it time for LNG to get greener?

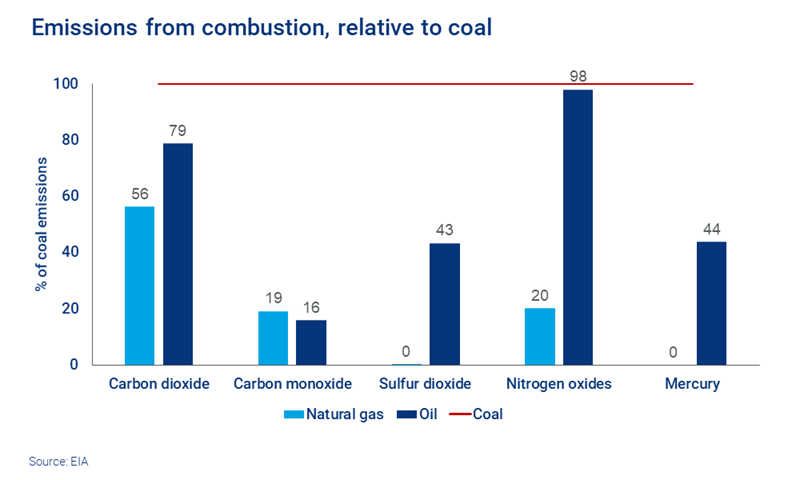

The combustion benefits of natural gas are clear

The switch from coal to gas is a significant step in the battle against air pollution. Gas burns significantly cleaner than coal and oil. Meanwhile, LNG’s full life cycle C02 emissions, from production to transportation and final consumption, are significantly lower than even highly efficient coal plants, or alternative sources of gas supply such as long-distance pipelines.

We’ve already seen what gas can do in China. It may be that coal is still king in Southeast Asia’s power market, but there have been significant steps taken in recent years to replace coal and diesel in Beijing. Efforts were stepped up in 2017 with a series of government measures that included replacing coal boilers with gas-fired CHP in Beijing, and 27 other northern Chinese cities.

My presentation at the 2019 Wood Mackenzie Energy & Commodities Summit included a chart that shows how the city’s fine particulate matter (PM2.5) readings improved, while gas demand increased. Fill in the form at the top of this page for a complimentary copy.

Increased gas usage has been a key measure against air pollution in Beijing.

Of course, meeting Asia’s expected energy demand growth is crucial to its sustainable economic development. We predict that Asia’s total gas demand will increase from around 700 billion cubic metres (bcm) in 2018 to 1,200 bcm by 2035.

LNG will meet around 60% of this growth, with demand growing by some 200 million tonnes per annum.

Gas may be good – but is it good enough?

Gas compares well against other fossil fuel options as Asia continues its journey towards decarbonisation. But complacency isn’t an option. LNG’s green credentials are under increasing scrutiny as stakeholders seek to measure and compare its environmental impact. And, given how quickly the climate debate is moving, it will almost inevitably come under increased investor pressure.

We’re seeing this pressure already. In November 2019 the European Investment Bank (EIB) launched a new energy lending policy that states: “the EIB will no longer consider new financing for unabated, fossil fuel energy projects, including gas, from the end of 2021 onwards.”

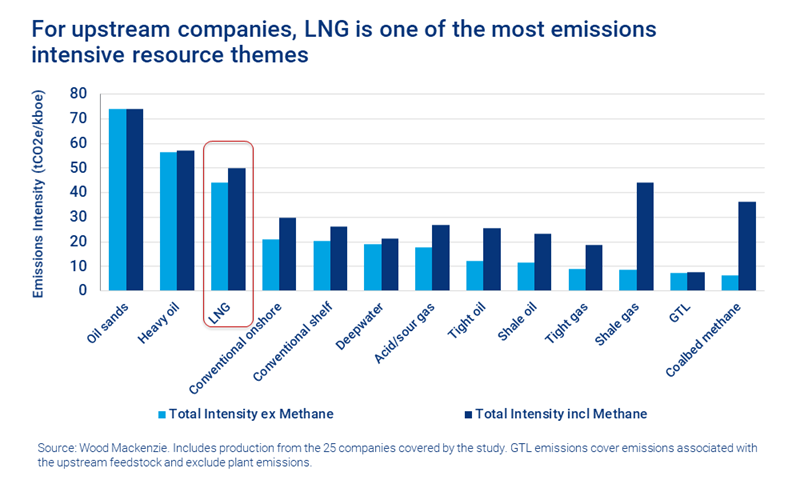

Measuring and understanding the impact of different resource themes is vital. On a full life cycle basis, LNG beats coal. But our carbon emissions study highlights that in some cases the emissions intensity of LNG is relatively high. Upstream companies may be judged on emissions up to the point of sale – so before oil is refined or consumed, and on this metric LNG can look less attractive.

LNG’s poor performance here can be partly attributed to it being further along its life cycle than oil. The liquefaction process also plays a key role. It requires that all CO2 is removed before cooling, which can result in substantial additional emissions from venting.

Three ways LNG can get greener

With investor pressure growing, companies are looking at how the emissions intensity of LNG can be reduced. Three approaches stand out.

1. Link to carbon capture and storage (CCS)

The high emissions from liquefaction projects can be partly offset by linking LNG projects with CCS. By storing rather than venting total emissions can be reduced by around 25%, but until there’s a global carbon price venting remains the cheapest option. As it stands, of the 75 LNG projects in existence or under construction, only Snohvit and Gorgon include CSS. However, Qatar is making proactive plans to take this approach – potentially getting ahead of shifting buyer sentiment.

2. Tackle the 7-9% of feedgas consumed in the liquefaction process

A variety of proposed solutions include the use of renewables for driving electric turbines in liquefaction plants.

3. Use carbon offsets and emissions trading

Shell sold the first carbon-neutral LNG cargoes this year, using offsets from land management programmes. And one buyer, Tokyo Gas, is offering consumers the option of buying carbon-neutral gas. This type of shift in buyer expectations could have a profound impact on suppliers, regardless of government policies or the lack of a global carbon price.

Where is LNG headed?

I see several likely outcomes of this fresh scrutiny on the environmental impact of LNG.

Buyers, such as European and Japanese utilities, will demand more visibility on carbon intensity. Sellers will act to provide it, either proactively or reactively, as bankers impose more stringent lending criteria.

Industry solutions for existing projects will increase. We’ll see more carbon offsets, CCS and updated turbines. We may also see more rapid decommissioning of carbon-intensive projects before backfill is considered.

New supply will come under more scrutiny and project and equity financial criteria will be toughened. High CO2 fields will be challenged, and stranded asset risk will increase for fields where LNG is the only way to monetisation.

Ultimately, all of this is likely to result in higher costs. But it will ensure that LNG plays a more sustainable role in meeting Asia’s future energy demand.

Nicholas Browne, Giles Farrer and Lucy Cullen discuss this topic in the latest episode of The Big Chill podcast. You can listen here: Can LNG improve its green credentials?

Complimentary insight: The role for LNG in Asia’s sustainable development

This article is based on a presentation at our 2019 Energy & Commodities Summit. Complete the form on this page for a free copy of the slides, including charts on:

- Life cycle emissions for power generation

- How companies are acting to reduce emissions intensity