Black gold to green future? Incentives uncertainty clouds Pathways Alliance economic feasibility

World’s largest CCUS project up for FID in 2025, but long-term incentives in question

3 minute read

Peter Findlay

Director of CCUS Economics

Peter Findlay

Director of CCUS Economics

Peter leads the economics and project valuation function for CCUS projects globally.

View Peter Findlay's full profileCanada’s aspiration of cutting its greenhouse gas emissions by 40 to 45 per cent by 2030 from a 2005 baseline looks unrealistic given emissions have only decreased by perhaps 5 per cent, hovering still around 700 Mtpa. A boom in oil sands bitumen production, from 1 to 3.3 million barrels per day over that time, has mostly negated other emissions reduction efforts, which have been small in magnitude. What is worse, wildfires have added hundreds of Mtpa of emissions in several recent summers, that are not even included in the totals.

Everything about Canada’s oil sands seems immense. This is true for the oil sands Pathways Alliance initiative, which plans to be the largest upstream emissions reduction cluster in the world, targeting a net reduction near 80 Mtpa by 2050 (to effectively reach net-zero for scopes 1 and 2) through carbon capture and other operations and technology initiatives. In an introductory insight to Pathways, we detailed the overall aims of the multi-faceted initiative covering 94% by volume of the oil sands producers.

Although some call for a phase out of oil sands production, crude oil remains Canada’s largest export, two to three times more valuable than cars, and a pillar of the Canadian economy, which has fallen far behind the US and similarly resource-heavy Australia in productivity per capita. Canadian tax coffers rely on the oil sands profitable existence and burdening producers with cost renders them uncompetitive against lower-emitting and cheaper-to-extract global crude sources.

CCUS usually requires direct or indirect government incentive to be economic, as do most other decarbonisation initiatives. Using our Lens Carbon valuation research, we briefly discuss some of the key questions around this project.

Capture economics for the emitters: why do it?

Pathways members will be burdened with capital cost commitments for the pipeline and to a lesser extent storage facilities and injection and monitoring wells. Their own transport and storage tolls paid to Pathways will yield a return on this capital but is effectively robbing Peter to pay Paul; oil sands producers need to show a clear economic benefit beyond this to sanction their capture projects.

The Pathways rub: A game of ‘chicken’ between government and industry?

In Canada, like in most other OECD countries today, economic feasibility of CCUS projects and other long-term decarbonisation hinges on the long-term value of abating or removing CO2. The overarching question is then who between government and industry is willing to underwrite the political risk of that price over a project that will take 3 to 5 years to build after sanctioning and need to operate for 20 to 30 years.

Governments — both federal and provincial — have legislated policies that generate a value for reducing CO2 emissions but have been openly hesitant to provide any future certainty for that value, making any potential investment in decarbonisation subject to political whim. On the other hand, in a world where there will most likely be an increasing societal and economic price to emitting CO2, industry clamours for the governments to cover much of their decarbonization costs.

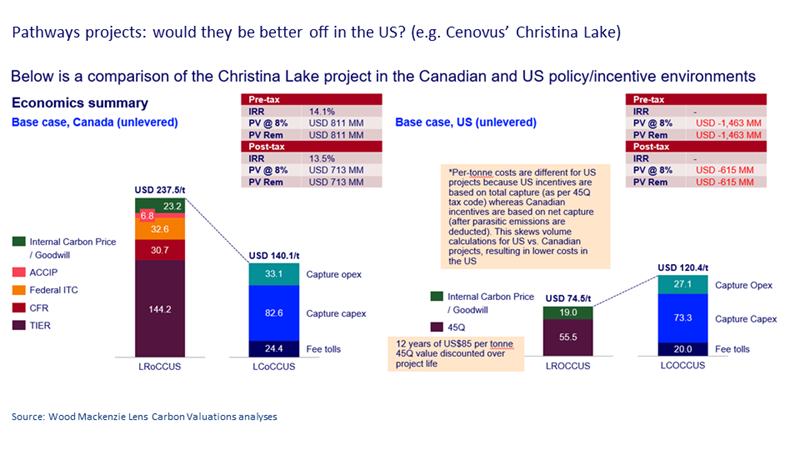

It is Wood Mackenzie’s view that CCUS incentives in Canada are in fact already much higher than in the US. In a hypothetical analysis where Cenovus’s proposed Christina Lake project was built in the US, we demonstrate that it would be much less economically attractive in our base case. Few post-combustion projects are moving forward in the US because the 12-year IRA-enhanced 45Q is simply insufficient to incentivize long-term capture. The chart below shows illustrates some of this analysis.

The future of CCUS in Canada

The real challenge for Canadian CCUS then is not insufficient incentives — they are some of the most attractive in the world— but the uncertainty of their existence throughout project life. If federal and provincial governments cannot collaborate to underpin this uncertainty, few CCUS projects will move forward and most, if not all of Pathways, will be delayed and potentially scuppered, as the industry has threatened.

Will both governments and oil sands producers constructively work together to solve this uncertainty? It is in all their best interest to do so. As Canadians wait for that to occur, sizeable economic value is lost, and millions of tonnes of CO2 are unnecessarily emitted.

Fill in the form and sign up to receive the latest CCUS insights, straight to your inbox.

Lens Carbon

Evaluation of the carbon management value chain. Lens Carbon provides the critical data and insights needed to screen, analyse and value project opportunities at speed and scale.

Explore now