Discuss your challenges with our solutions experts

Despite the LNG industry's well-documented challenges there are reasons to be positive. The rapid increase in LNG supply is improving liquidity and security. Supply competition will help LNG along the way to becoming an exchange-traded commodity.

Positive surprises in the PNG and the US

Cost overruns and delays in Australia have been awful. But LNG supply can be delivered on budget and on-time. Papua New Guinea's first LNG project, PNG LNG — operated by ExxonMobil — is a great example of what is possible. It managed to start-up in 2014, ahead of the wave of new Australian projects. Since start-up it has been producing well above the nameplate design capacity.

The first US LNG project Sabine Pass, operated by Cheniere, is another success story. The first two trains were delivered on time. Since starting production in February 2016, US LNG has been delivered around the globe — to South America, the Middle East, Europe and Asia.

FLNG technology will make a big impact in 2017

New technology is hitting the markets as floating LNG supply becomes a reality. Look out for the world's first cargo of FLNG in 2017 when Malaysia's PFLNG Satu starts. PETRONAS will follow this in a few years with the PFLNG Dua project.

We also expect FLNG projects to be big winners when it comes to sanctioning pre-FID LNG supply. FLNG projects in Mozambique and Equatorial Guinea are the front runners to begin construction in 2017.

Where to next for LNG supply?

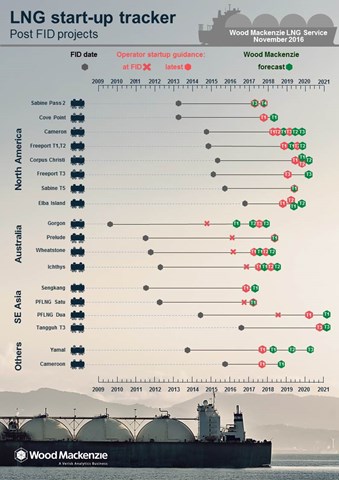

Global supply will be around 262 Mt in 2016. Since 2014, 65 Mt of new capacity has started operations and a further 110 Mt of capacity — 18 projects — are under construction. There has never been so much new supply for the market to absorb.

It's not just start-ups that we will be watching closely. Liquefaction capacity doesn't always equal LNG supply. Some projects, like PNG, will produce above nameplate in an effort to drive revenues. Several other projects will be producing below capacity.

Upstream availability and above ground events have always impacted LNG supply. But in future corporate strategies and economics will play much a bigger role in defining output. With rapid growth putting pressure on LNG prices – some players will take more strategic decisions about when to produce full tilt.

All this translates into LNG supply becoming more responsive to price than its ever been. Competition means buyers can ask for more. New markets and sources of demand are emerging in response to the softer market. The transition may not be easy, but the result will be a larger, more flexible and liquid LNG market.