Looking back at a year of European power: 2023 in review

In 2023, Europe's power market stabilized with a milder winter and successful demand reduction measures, while geopolitical events and gas supply restructuring influenced dynamics. Decreased power demand, a drop in commodity prices, and increased renewables contributed to a more resilient market, though challenges persisted with low and negative power prices during abnormal weather periods

2 minute read

Matthew Campbell

Senior Research Analyst, European Power Markets

Matthew Campbell

Senior Research Analyst, European Power Markets

Matthew is a senior research analyst with our Energy Transition Practice, focused on power market trends across Europe.

Latest articles by Matthew

-

Opinion

Video | Three FIDs, one day: a turning point for CCUS in the UK and Denmark

-

Opinion

The global power market outlook: can global power generation keep up with the energy transition?

-

Opinion

Looking back at a year of European power: 2023 in review

-

Opinion

European power markets emerge from the energy crisis

-

Opinion

How effective were EU emergency power demand reduction measures?

-

Opinion

Global power markets outlook: the energy transition gathers pace

In our recently published insight, ‘European Power: 2023 in Review’, a development of our monthly volumes and price tracker activities, we explored the key trends, events and market dynamics in European power over the past 12 months.

To explore these 2023 trends in detail, please download a complimentary extract from the report by filling out the form on the right of the page. Or, read on for a summary of the report’s key takeaways.

Summarising the events of 2023

Europe’s power market was in a precarious position entering 2023, and in the end, it was good fortune – the avoidance of a harsh winter – that put a halt to the surging prices of 2022. In addition, successful implementation of demand reduction measures and an increasingly robustness supply-side led to a semblance of stability, with policy dialogue reverting to the longer-term – NECPs and net-zero strategy came back into the spotlight.

While major geopolitical events continued to cast their shadow – the war in Ukraine and more recently, the Israel-Hamas conflict – but the restructuring of European gas supply arrangements has added at least a veneer of insulation from external disruptors.

The downward trend in commodity prices – the TTF gas price dropped 43% between January and December – took much of the sting out of wholesale power prices, diminishing the action and requirement for revenue caps and other redistributive measures. However, despite record gas storage inventories at the year-end, gas prices were still considerably higher than pre-crisis levels entering the current winter.

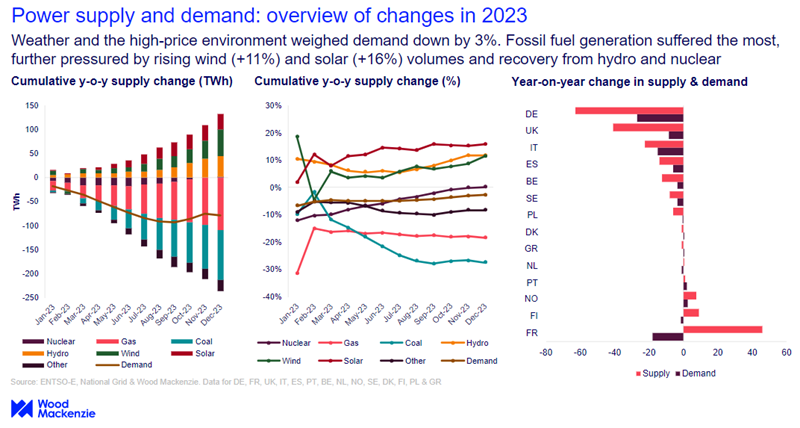

As you can see in the graph below, power demand fell by 3% in 2023, partially reflecting the success of national load reduction strategies, but also due to demand response to continued high retail prices. The industrial sector will likely take longer than others to recover from these losses, and many new demand projects will be delayed until prices come down. Germany experienced a 5% year-on-year demand reduction, the largest drop in any major market.

On the supply-side, strong hydro conditions and growth in wind and solar output eased reliance on gas (-18%) and coal (-27%), but while French nuclear performance was vastly improved and the Finnish Olkiluoto 3 reactor entered service, nuclear upside was dampened by closures in Germany (final phase-out) and Belgium.

The combination of weak demand and renewable growth increased the frequency of low and negative power prices, putting wind and solar capture prices under unprecedented pressure. System stress and price pressures – which included record negative price counts in multiple markets – were magnified in periods of abnormal weather, for instance during the summer heatwave in Southern Europe and during Storm Hans in the Nordics.

Learn more

To learn more about the key trends, events and market dynamics in European power throughout 2023, fill in the form on the top right of the page. You can also click here to find out more about our Europe Power Service.

Plus, stay tuned for our upcoming piece on the biggest European power trends for 2024.