Major financiers capitalise on a growing US residential solar market

Loans continue to be the backbone of residential solar deployment in the US

1 minute read

Residential solar market growth in the US is strongly linked to the availability of a wide range of financing options. Over the last couple of years, financiers and installers have broadened their financial product offerings to spur customer adoption. As a result, the residential solar market is on pace to grow by more than 20% in 2021.

Wood Mackenzie’s US residential solar finance update tracks trends in third-party ownership (leases and power purchase agreements) and customer ownership (cash and loan purchases). Fill in the form to access a complimentary extract from the H1 2021 report, and read on for an introduction.

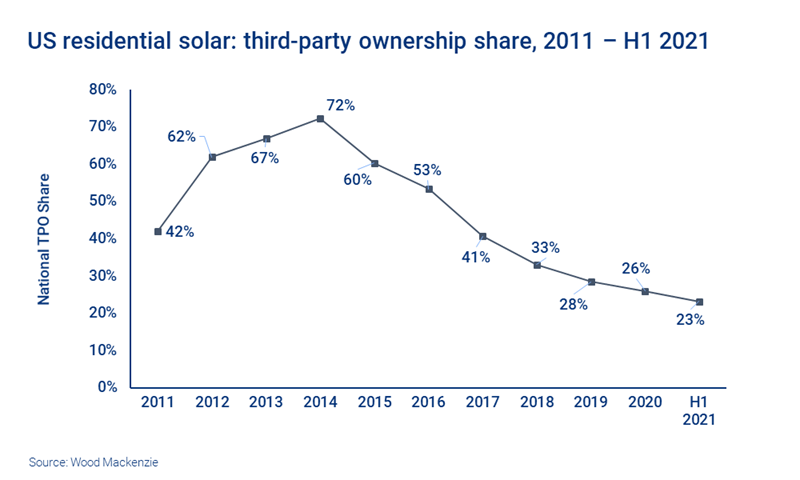

The loan segment of the US residential solar market will grow 40% year-over-year in 2021

In recent years, growth in solar loans has greatly outpaced growth in the overall residential solar market. This has led to a decrease in the share of new projects that are third-party owned (TPO). In fact, the TPO share has fallen from 26% in 2020 to 23% in 2021 through H1 – the lowest level on record. This has coincided with a loan share that increased from 55% to 60% over the same period. Longer tenor loans with low interest rates (25-year terms and interest rates of 3% or lower) continue to yield attractive monthly savings for customers and drive market growth.

We expect loans to make up 70% of residential solar installations in 2023 as the market experiences demand pull-in for customer-owned systems before the investment tax credit steps down. This will equate to 3.4 GWdc of installed capacity financed with loans and nearly US$15 billion in funded loan volume.

GoodLeap has retained its title as top financier and loan provider, capturing 23% of the entire US solar residential market and 38% loan market share

The residential financier market continues to consolidate. The top five largest players financed about 70% of the entire residential market in H1 2021, up from about 60% in 2020. The top three loan providers (GoodLeap, Sunlight Financial, and Mosaic) captured about 80% of the H1 2021 loan market, while the top two TPO providers (Sunrun and Sunnova) took nearly 90% of the TPO market.

GoodLeap, Sunlight Financial and Mosaic are competing to win business from growing regional installers that are striving for national presence. Providers compete in this space by offering exclusive access to products, custom technology integration and lower dealer fees. The major loan providers continue to win market share away from smaller banks and credit unions. Installers are giving their business to the top providers who can offer point-of-sale financing, seamless platform integration and higher customer approval rates.

Sunrun strengthened its position as the largest TPO provider with 68% TPO market share in H1 2021. This will be the case for the foreseeable future partially due to the acquisition of Vivint Solar (the former second-largest TPO provider), which closed in Q4 2020.

Record investment in the US residential solar sector has continued in 2021 with over US$3.6 billion in asset-backed securitization (ABS) transaction volume

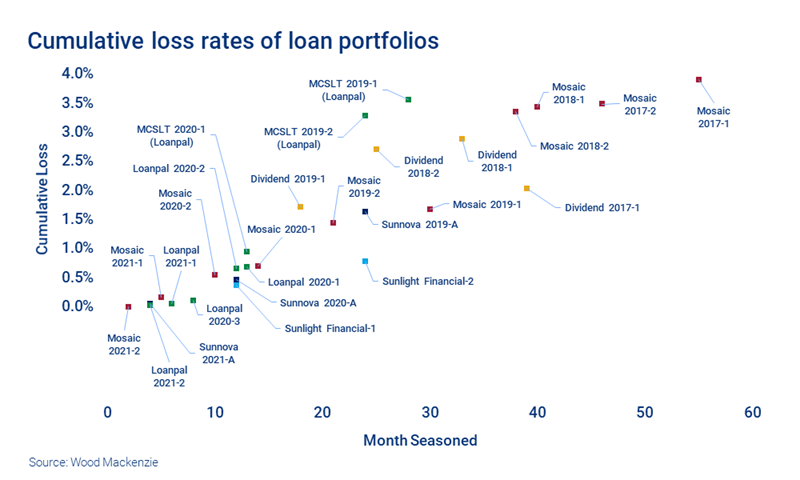

Loan ABS transactions (US$2.5 billion) continue to outpace lease and power purchase agreement (PPA) ABS transactions (US$1.1 billion) in 2021, although transaction volume has grown year-over-year for both segments. Transactions involving GoodLeap-originated loans have reached nearly US$1.4 billion this year. This activity has doubled the cumulative value of ABS deals involving GoodLeap loans. Mosaic (US$743 million), Sunrun (US$733 million), and Sunnova (US$720 million) have each completed a similar deal volume in 2021 so far.

Financiers continue to report low delinquency and loss rates across a wide range of lease, PPA, and loan portfolios. Investors now have access to almost five years of performance data for certain portfolios. Providers that have demonstrated better performance over time should be awarded with lower cost of capital in future transactions.

Demand for residential solar in the US remains strong as households look for ways to tangibly lower their carbon footprints amid the energy transition. Strong consumer demand has attracted more capital over the past few years. As investment continues to expand, we expect the residential solar market value to top US$19 billion in 2023.

Get a closer look at our US residential solar finance update. Fill in the form at the top of the page for a complimentary extract.